简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Holds Gloomy Outlook amid Price Crash

الملخص:On Monday, gold prices continued retreating in Asian markets while trimming early losses below $1,900 to $1,882 in U.S. markets.

WikiFX News (22 Sept.) - On Monday, gold prices continued retreating in Asian markets while trimming early losses below $1,900 to $1,882 in U.S. markets. The yellow metal may be hampered by the massive selling for its price is recently more sensitive to bad news than good news.

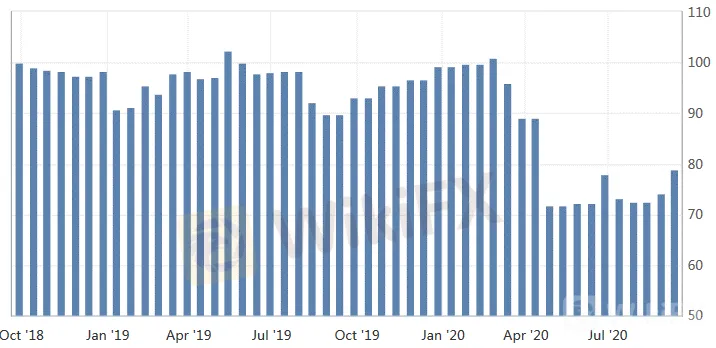

The University of Michigan said its U.S. consumer sentiment index in September rose to 78.9, the best level since March. The data indicates that consumers hold positive expectations about the country's economic prospects.

Kaplan, president of the Dallas Fed, predicted the U.S. will see an economic recovery next year and the unemployment will likely approach 3.5% by 2023. These hawkish words catalyzed the DXY up above $93.50.

Pressed by the strengthening greenback, the intraday price of gold kept declining after a rally to $1,955. Moreover, the Trump administration has softened its stance on Tiktok, which also weakened the markets' safe-haven demand for gold.

The Fed Chair Powell will testify before Congress this Wednesday and Thursday. He is generally considered to reiterate the views that economic prospects will rally and fiscal policy is of vital importance, which could further strengthen the U.S. dollar and send gold prices lower.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: Consumer Sentiment Index

عدم اعطاء رأي:

الآراء الواردة في هذه المقالة تمثل فقط الآراء الشخصية للمؤلف ولا تشكل نصيحة استثمارية لهذه المنصة. لا تضمن هذه المنصة دقة معلومات المقالة واكتمالها وتوقيتها ، كما أنها ليست مسؤولة عن أي خسارة ناتجة عن استخدام معلومات المقالة أو الاعتماد عليها.

وسيط WikiFX

أحدث الأخبار

شركة SmartFX المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة VENTEZO المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

كيف خسر 6,000 شخص أكثر من 35 مليون دولار؟

حساب النسبة