简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Forecast: Has XAU/USD Price Action Officially Bottomed?

Zusammenfassung:GOLD PRICE OUTLOOK: XAU/USD PERKING UP AS REAL YIELDS WILT - Gold bulls push the precious metal to its highest level in eight-weeks - Gold outlook has improved largely thanks to a pullback in real yields - XAU/USD price action now challenges a key technical resistance zone

Gold Forecast: Has XAU/USD Price Action Officially Bottomed?GOLD PRICE OUTLOOK: XAU/USD PERKING UP AS REAL YIELDS WILT

· Gold bulls push the precious metal to its highest level in eight-weeks

· Gold outlook has improved largely thanks to a pullback in real yields

· XAU/USD price action now challenges a key technical resistance zone

Gold prices have been ripping higher recently since putting in a potential double-bottom pattern around $1,680/oz. In fact, the precious metal now trades at an eight-week high following a 7% climb off its 30 March swing low. A pullback in the US Dollar and real yields seem to be benefiting gold outlook and motivating the rebound being staged by XAU/USD price action.

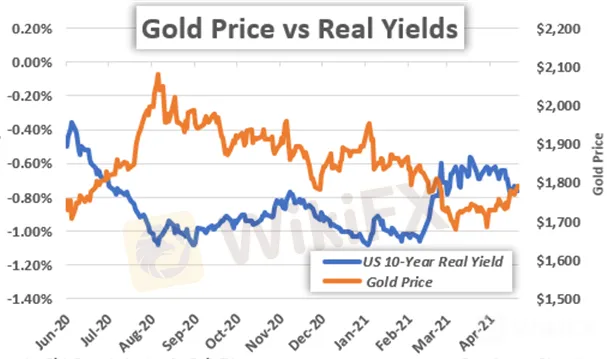

GOLD PRICE CHART WITH US TEN-YEAR REAL YIELD OVERLAID: DAILY TIME FRAME (02 JUNE 2020 TO 21 APRIL 2021)

As shown on the chart above, the price of gold tends to mirror (i.e. move in the opposite direction) of real yields. Due to this strong inverse relationship, the broader direction of real yields continues to stand out as one of the dominant fundamental catalysts weighing on gold prices. Correspondingly, if real yields struggle to regain upward momentum, there could be potential for XAU/USD to extend its rebound.

GOLD PRICE CHART: WEEKLY TIME FRAME (01 JULY 2019 TO 21 APRIL 2021)

Shifting focus to a technical perspective, how the precious metal finishes the week could prove quite telling of where gold prices trend next. A close above the 20-week simple moving average, which just so happens to underpin a big area of technical confluence around the $1,790-price level, might be followed by continuation higher and a bullish MACD crossover. The 38.2% Fibonacci retracement of its August 2020 to March 2021 trading range likely comes into focus under this scenario.

Surmounting this technical barrier has potential to motivate a larger rebound toward the upper descending trendline of golds eight-month long bull flag pattern. On the other hand, if gold bulls fail to maintain their upper hand and this technical barrier near the psychologically-significant $1,800-handle is rejected, the precious metal might recoil back toward its bottom Bollinger Band and year-to-date lows.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

ZEW-Index für die Konjunktur springt hoch: Ausgabenpläne von Union und SPD wecken in deutscher Wirtschaft große Hoffnungen

5 Gründe, warum das Tief an der Wall Street vorbei sein könnte, laut Analysten

Neuer Tarifvertrag: Die 135.000 Beschäftigten bei den Volksbanken bekommen elf Prozent mehr Gehalt

Sie ist die reichste Frau der Welt – durch Trumps Zölle verlor sie jetzt 20 Milliarden Dollar

Wechselkursberechnung