简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Eye Chart Barrier as Markets Weigh Fed, ECB Policy

Extracto:Crude oil prices have run into four-month chart resistance as markets await cues from Julys FOMC and ECB meeting minutes as well as the Jackson Hole symposium.

CRUDE OIL & GOLD TALKING POINTS:

Crude oil prices edge up in risk-on trade, but key resistance held

API inventory flow data rounds out barebones economic calendar

Gold prices retreat as markets eye FOMC minutes, Jackson Hole

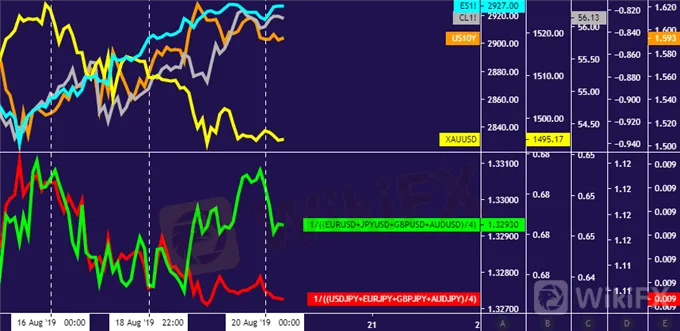

Friday‘s risk-on sentiment tilt carried through Monday’s session, with crude oil prices rising alongside stocks. A parallel rise in bond yields undermined the appeal of non-interest-bearing assets and weighed on gold. Impressively, the US Dollar recovered some lost ground despite its recently anti-risk profile.

All the same, the benchmark commodities made little progress from near-term ranges, as expected. That seems to reflect traders withholding conviction ahead of critical event risk: minutes from Julys FOMC and ECB meetings as well as the Fed-hosted economic symposium in Jackson Hole, Wyoming.

The weekly API inventory flow report rounds out the barebones data docket. It will be sized up against expectations of a 1.22-million-barrel drawdown in US stockpiles expected to be reported in official EIA statistics due Wednesday. Absent dramatic deviation, a strong response from prices seems unlikely.

GOLD TECHNICAL ANALYSIS

Gold prices edged lower toward swing low support at 1480.00. A daily close below that would bolster topping cues hinted in negative RSI divergence, exposing a more substantive barrier in the 1437.70-52.95 zone next. Swing high resistance is at 1535.03, with a weekly chart inflection level at 1563.00 lining up thereafter.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain pinned below resistance capping gains since late April, now at 58.30. A daily close above that targets the 60.04-84 zone. Alternatively, a move below the congestion area running down through 53.95 sets the stage to challenge support near the $50/bbl figure once again.

Descargo de responsabilidad:

Las opiniones de este artículo solo representan las opiniones personales del autor y no constituyen un consejo de inversión para esta plataforma. Esta plataforma no garantiza la precisión, integridad y actualidad de la información del artículo, ni es responsable de ninguna pérdida causada por el uso o la confianza en la información del artículo.

Brokers de WikiFX

últimas noticias

Construyendo Confianza, Explorando lo Mejor—WikiEXPO Hong Kong 2025 Concluye Espectacularmente

¡ALERTA! La CNMV advierte del broker Surgirux.

¿Aumentan las estafas de Warren Bowie & Smith? Inversor no puede retirar.

Interactive Brokers agrega Solana, Cardano, Ripple y Dogecoin a su lista.

Cálculo de tasa de cambio