简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen May Rise as Euro Falls on Worried ECB, Davos Chatter, US PMI

abstrak:The Japanese Yen may rise while the Euro falls as a worried ECB, anxious chatter at the World Economic Forum in Davos and soft US

TALKING POINTS – ECB, EURO, DAVOS, YEN, US PMI, US DOLLAR

Euro may fall if a worried ECB seems to be mulling additional stimulus

Anxious Davos chatter, soft US PMIs might stoke global slowdown fears

Japanese Yen, US Dollar likely to benefit amid another risk-off sweep

The ECB rate decision headlines the economic calendar in European trading hours. A change in policy is almost certainly not in the cards. Indeed, markets are not pricing in a change through 2019. That puts the spotlight on the follow-on press conference with central bank President Mario Draghi.

Eurozone economic data has increasingly deteriorated relative to forecasts since August of last year. If Mr Draghi hints that the Governing Council has mulled counter-measures – another round of TLTRO liquidity injections, perhaps – the Euro is likely to be pressured lower.

A worried tone may also reinforce broader concerns about slowing economic growth worldwide, a subject already generating a flurry of anxious commentary at the World Economic Forum, a gathering of policymakers and financial market bigwigs still underway in Davos, Switzerland.

US PMI survey data might spook investors further. It is expected to show that manufacturing- and service-sector growth has this month. US economic news-flow has tended to underperform analysts projections recently, opening the door for disappointment.

Taken together, these developments might trigger another round of de-risking across the broad financial markets. Such a scenario probably bodes well for the perennially anti-risk Japanese Yen. A pickup in liquidity demand amid liquidation may burnish the attraction of the US Dollar also.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

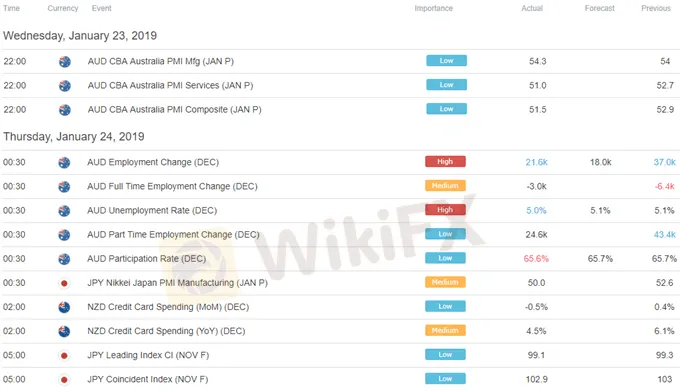

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate