简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar May Extend Drop as Yen Gains on OECD Outlook

abstrak:The Australian Dollar may continue to fall after a bruising Asia Pacific trading session as a downbeat OECD economic forecast update spooks risk appetite.

AUD, NZD, RBA, LOWE, RBNZ, US-CHINA TRADE WAR, OECD, USD – TALKING POINTS:

Australian Dollar down after RBA meeting minutes, Lowe speech

New Zealand Dollar dragged lower alongside Aussie counterpart

US Dollar to rise with Yen if markets risk appetite deteriorates

The Australian Dollar underperformed in Asia Pacific trade after minutes from Mays RBA policy meeting signaled that the central bank may be ready for a rate cut as soon as next month. A subsequent speech from the central banks Governor Philip Lowe seemed to make the case for easing even more explicit. He went so far as to confirm that policymakers have an “easing bias”.

The New Zealand Dollar followed its Aussie cousin downward. That might have reflected investors extrapolating the two economies‘ broadly analogous profiles to mean that the RBA’s defensive stance might portend RBNZ rate cuts too. Both countries are cycle-sensitive commodity exporters on the front lines of a slowdown in global growth and an escalating US-China trade war.

AUD, NZD MAY EXTEND DROP AS YEN GAINS ON OECD OUTLOOK

Looking ahead, commodity bloc currencies might face further pressure as the OECD issues an updated set of economic forecasts. A raft of downgrades seems likely. Timely PMI survey data puts the pace of worldwide manufacturing- and service-sector growth near a three-year low. Meanwhile, a measure of overall macro data flow reveals it has tended to undershoot baseline forecasts by meaningful margin.

A downbeat revision might weigh on market-wide risk appetite, inspiring another round of systemic de-risking. The Yen is likely to gain in this scenario as carry trades funded in terms of the perennially low-yielding Japanese unit are unwound. Meanwhile, the US Dollar might rise as liquidation puts a premium on the benchmark currencys unmatched liquidity.

Did we get it right with our latest FX market forecasts? Get them free to find out!

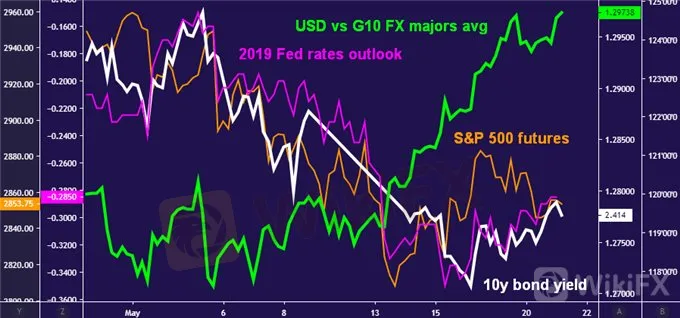

CHART OF THE DAY – US DOLLAR GAINS REFLECT HAVEN DEMAND

Currencies are typically expected to fall when their central banks are seen pivoting to a more dovish policy stance. The US Dollar has marked a clear exception to the rule. It has jumped to a seven-year high against an average of its major counterparts even as the priced-in policy outlook implied in Fed Funds futures flounders alongside benchmark 10-year Treasury bond yields.

The bellwether S&P 500 fell in tandem, implying a backdrop of risk aversion. In this scenario, it is not unusual to see lending rates decline as haven flows lift Treasuries while tightening prospects – such as they are – fizzle. That the Greenback has managed to thrive in this environment seems to clearly mark it out as a haven asset. If investors mood counties to sour, it may have scope to probe headier highsstill.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate