简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD Soft on Rising Fed Rate Cut Bets, AUDUSD Eyes RBA Rate Cut - US Market Open

abstrak:USD Soft on Rising Fed Rate Cut Bets, AUDUSD Eyes RBA Rate Cut - US Market Open

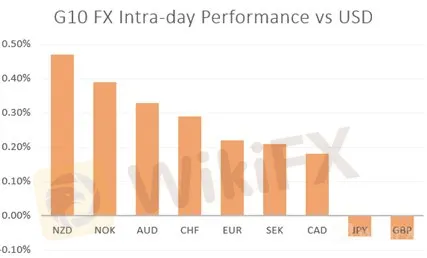

AUD: Notable outperformance in high beta currencies despite the cautious market tone. The AUD is now hovering at 2-week highs against the USD, ahead of the likely RBA rate cut. However, given that markets remain very bearish on the currency, there is a risk of a short vulnerable if the RBA fail to live up to the aggressive dovish pricing. Of note, money markets are pricing in three RBA rate cuts by the year-end.

GBP: The Pound remains soft across the board with EURGBP edging back towards its recent peak (0.8870). Todays Mfg. PMI surprised to the downside with the headline figure dropping to the lowest level since July 2016 amid the unwind of Brexit related stockpiling. Going forward, the Pound is likely to take its cue from the Conservative Party leadership contest throughout the next few weeks.

Source: DailyFX, Thomson Reuters

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Sterling (GBP) Week Ahead: Risk, Brexit, NFPs and Flashing Signals” by Nick Cawley, Market Analyst

“Crude Oil Bulls Exit, Copper and Silver Downtrend Persist - COT Report” by Justin McQueen, Market Analyst

“S&P 500 and Dow Jones Weakness Failing to Result In a VIX ‘Event’” by Paul Robinson, Currency Strategist

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

{13}

Follow Justin on Twitter @JMcQueenFX

{13}

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate