简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

There are 9 US states with no income tax, but 2 of them still tax investment earnings - Business Insider

abstrak:The states with no income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

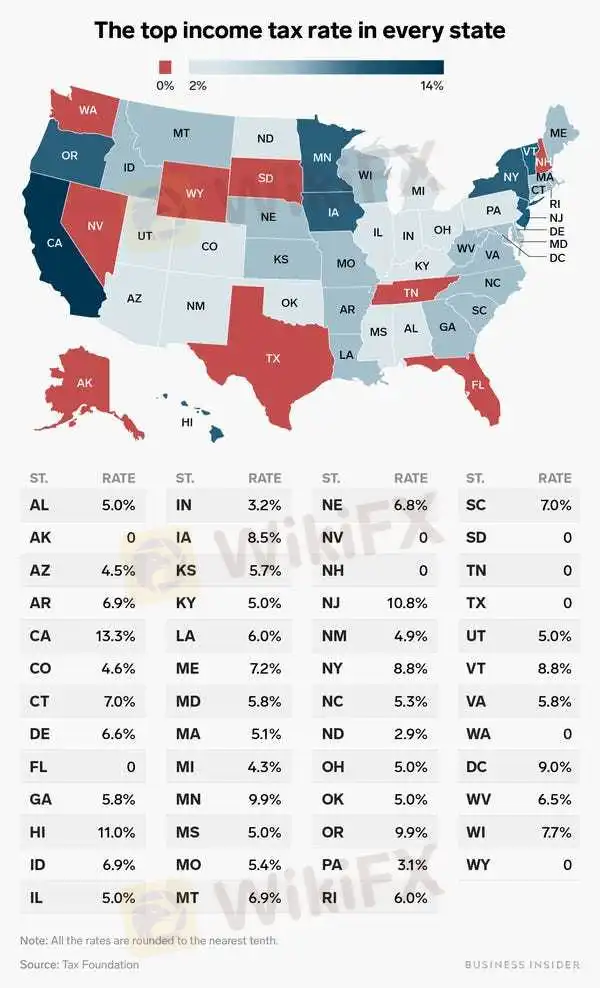

Taxes are due for income earned in 2019 by April 15.Most Americans file a state income tax return and a federal income tax return.If you live in one of nine states with no income tax, you may not need to file a state return.Read more personal finance coverage.Taxes are due Wednesday, April 15.If you owe at least $5 in federal income taxes, you have to file a federal tax return. Some people, however, are off the hook when it comes to filing a state tax return.That's because seven US states don't impose state income tax — Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.New Hampshire and Tennessee don't tax earned income either, but they do tax investment income — in the form of interest and dividends — at 5% and 2%, respectively, for the 2019 tax year. If you live in either state and received income from your investments, you may need to file a state return.The other 41 states have either a flat income tax — meaning everyone, regardless of how much they earn, pays the same percentage of their income to the government — or a progressive income tax, which means your tax rate is determined by your income. The chart below lists the top tax rate in every state for the 2019 tax year.

Ruobing Su/Business Insider

But living in a state with no income tax doesn't necessarily mean you're getting off scot-free. Texas and New Hampshire, for instance, may not tax your earnings, but they do have some of the highest property tax rates in the country, which could ding you if you're a property owner.Likewise, Tennessee doesn't tax your paycheck, but it will get you in the checkout line. The state has one of the highest sales tax rates in the country at 7%.Still, everyone is subject to federal income taxes regardless of where you live. How much you pay depends on how much you earn, also known as your tax bracket. In 2018, about 76 million Americans didn't owe federal income tax because their earnings were too low.After you file your taxes, you may get a state tax refund or a federal tax refund — or both if you live in a state that taxes income. The IRS says the fastest way to get your tax refund is the method already used by most taxpayers: filing electronically and selecting direct deposit as the method for receiving your refund.More tax day coverage:When are taxes due?How to file taxes for 2019What is a tax credit?H&R Block vs. TurboTax

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate