简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Extends Bullish Series as FOMC Defends Larger Balance Sheet

Ikhtisar:Gold prices may continue to catch a bid following the Fed meeting as the precious metal extends the series of higher highs & lows from

Gold has finally cleared the range-bound price action from December, with the price for bullion climbing to a fresh yearly-high ($1316) following the Federal Reserve meeting, and the precious metal may continue to catch a bid as it carves a series of higher highs & lows.

Gold prices appear to be on track to test the May-high ($1326) as the Federal Open Market Committee (FOMC) drops the hawkish forward-guidance for monetary policy, and it seems as though the central bank will continue to change its tune over the coming months as ‘the case for raising rates has weakened somewhat.’

The sudden shift in central bank rhetoric suggests the FOMC will adopt a more cautious tone over the coming months as ‘cross-currents’ cloud the economic outlook, and the committee may continue to tame bets for higher interest rates as ‘inflation readings have been muted.’

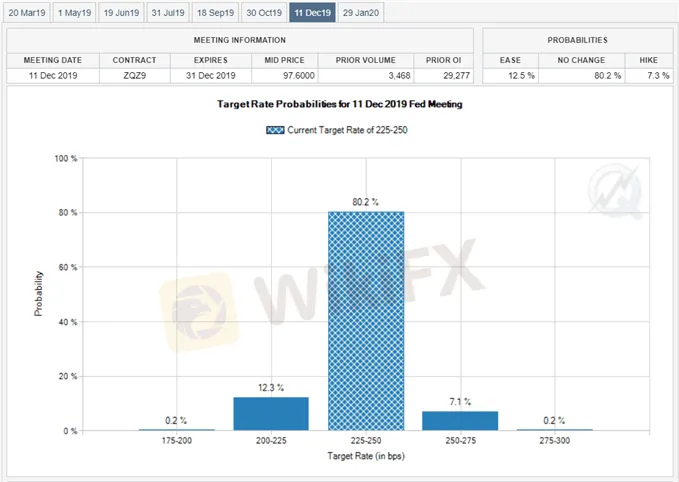

In turn, Fed Fund Futures may persistently show Chairman Jerome Powell and Co. on hold throughout 2019, and it seems as though the Fed will ultimately taper the $50B/month in quantitative tightening (QT) as officials note that ‘the normalization of the size of the portfolio will be completed sooner, and with a larger balance sheet, than in previous estimates.’

Waning expectations for higher U.S. interest rates should continue to heighten the appeal of bullion especially as the FOMC emphasizes that ‘growth has slowed in some major foreign economies,’ and gold may exhibit a more bullish behavior over the near-term as it extends the upward trend carried over from late-2018.

Gold Daily Chart

The May-high ($1326) sits on the radar for gold as it extends the series of higher highs & lows from earlier this week, with the Relative Strength Index (RSI) also highlighting a constructive outlook as oscillator snaps the bearish formation and pushes into overbought territory.

Close above the $1315 (23.6% retracement) to $1316 (38.2% expansion) region opens up the Fibonacci overlap around $1328 (50% expansion) to $1329 (50% expansion), with the next hurdle coming in around $1340 (61.8% expansion).

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

WikiFX Broker

Berita Terhangat

WikiFX Mengucapkan Selamat Hari Raya Idul Fitri 1446 H, Mohon Maaf Lahir dan Batin

Broker StoneX Meningkatkan Investasi Perbankan dan Perdagangan Dengan Akuisisi Benchmark

Nilai Tukar