简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Surges on Dollar Weakness and Escalating Middle East Tensions

Sommario:Key Takeaways:Geopolitical risk surges after Israeli airstrikes on Iran targetsGold spikes aggressively, supported by dollar weakness and safe-haven demandMarket Summary:Gold prices spiked sharply hig

Key Takeaways:

Geopolitical risk surges after Israeli airstrikes on Iran targets

Gold spikes aggressively, supported by dollar weakness and safe-haven demand

Market Summary:

Gold prices spiked sharply higher this week, propelled by a combination of dollar depreciation and heightened geopolitical instability in the Middle East. A fresh wave of safe-haven demand emerged following Israel‘s airstrikes on Iranian nuclear-related sites early Friday morning. Prime Minister Netanyahu confirmed that the operation aimed to neutralize Iran’s nuclear threat and stated it would continue “for as many days as it takes.” Reports suggest that several senior Iranian military officials and nuclear scientists were targeted.

Although U.S. officials denied any direct involvement, Secretary of State Marco Rubio warned Iran against retaliating against U.S. personnel or assets. Meanwhile, a U.S. diplomatic team is set to meet Iranian officials in Oman for further nuclear discussions, underlining the rising urgency of stabilizing the region.

These geopolitical flashpoints, combined with the release of disappointing U.S. economic data—especially weak inflation and labor metrics—have significantly boosted investor appetite for gold as a risk-off hedge.

Technical Analysis:

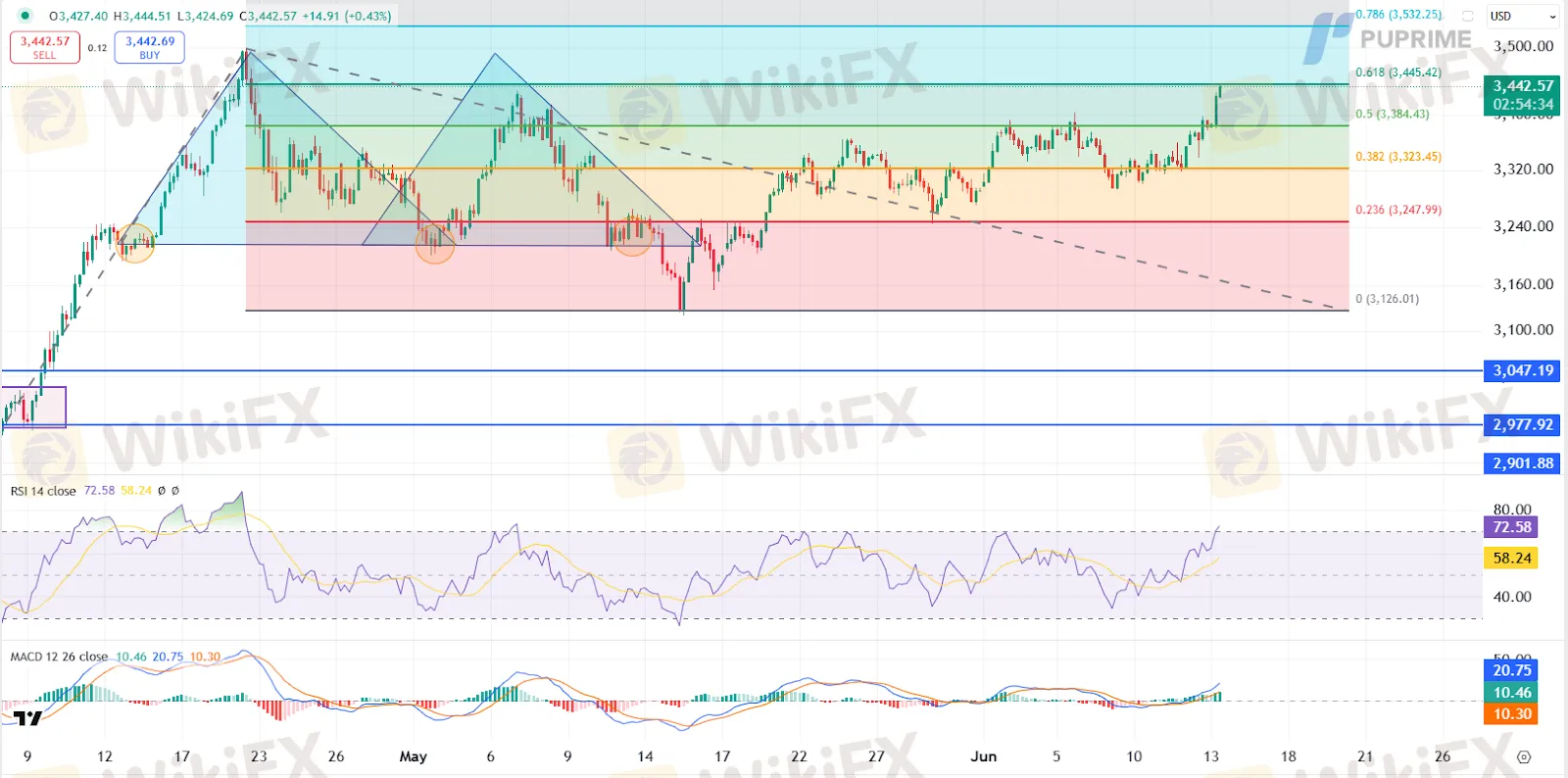

GOLD, H4:

Gold is currently testing the 3445.00 resistance level, which coincides with the 61.8% Fibonacci expansion level. A clear breakout above this level could open the door for a rally toward the next resistance at 3535.00.

Momentum indicators remain supportive—MACD shows increasing bullish pressure, and RSI has climbed to 72, signaling the asset is approaching overbought territory.

If gold fails to break above 3445.00 in the near term, we may see a mild correction or consolidation phase between 3385.00 and 3445.00 before the next directional move.

Resistance Levels: 3445.00, 3535.00

Support Levels: 3385.00, 3225.00

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

AvaTrade

KVB

GO Markets

Neex

GTCFX

Trive

AvaTrade

KVB

GO Markets

Neex

GTCFX

Trive

WikiFX Trader

AvaTrade

KVB

GO Markets

Neex

GTCFX

Trive

AvaTrade

KVB

GO Markets

Neex

GTCFX

Trive

Rate Calc