简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen, US Dollar May Rise as PMI Data Stokes Global Slowdown Fears

요약:The anti-risk Japanese Yen and US Dollar may trade higher as PMI data out of the US and the Eurozone stoke worries about a downturn in global economic growth.

TALKING POINTS – YEN, US DOLLAR, PMI, STOCKS, POUND, BREXIT

Eurozone, US PMI data may stoke global slowdown worries

US Dollar and Yen may rise amid broad-based risk aversion

British Pound up as EU grants UK two-week Brexit reprieve

Global growth concerns are likely to take center stage in the final hours of the trading week as traders are treated to a first look at March Eurozone and US PMI data. The surveys are seen as a timely gauge of the global business cycle. If they disappoint – echoing a string of downbeat results relative to forecasts recently – then the already simmering fears of a downshift in the global business cycle may be amplified.

That may be a catalyst for liquidation, weighing on the sentiment-geared Australian and New Zealand Dollars while offering a lift to standby anti-risk alternatives like the Japanese Yen and the US Dollar. Worries about the upcoming round of US-China trade talks might help the risk-off move along. Bellwether stock index futures have conspicuously erased earlier losses however, warning against pre-commitment.

BRITISH POUND UP AS EU GRANTS UK 2-WEEK BREXIT REPRIEVE

The British Pound outperformed in an otherwise quiet overnight session. The currency rose against all its G10 FX counterparts after the EU agreed to grant UK Prime Minister Theresa May a two-week Brexit deadline extension. She now has until April 12 to decide whether to leave without an agreement or seek a much longer-term delay, assuming Parliament continues to reject her withdrawal proposals.

If Mrs May manages to get her scheme through the House of Commons on a third attempt next week after two crushing defeats previously, the UK will have until May 22 to put the particulars in order and withdraw. The two key dates reflect milestones ahead of the upcoming EU parliamentary elections. The UK must decide by April 12 if it will participate, and May 22 is the last day before voting starts.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

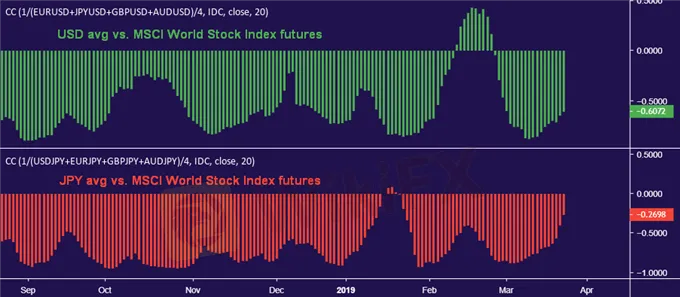

CHART OF THE DAY – WILL USD OR JPY BENEFIT MOST FROM RISK AVERSION?

USD and JPY often find support at times of risk aversion. The former benefits as its unrivaled liquidity commands a premium amid a selloff. The latter finds support as investors unwind carry trade exposure financed in the perennial low-yielder.

Near-term studies tracking the correlation between the MSCI World Stock Index – a benchmark for market-wide risk appetite – and the two currencies average values against their top peers suggest the Greenback is now more sensitive to this influence than the Japanese unit. So, it may outperform in a risk-off scenario.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

너무 간과하면 위험하다! 왜 시장은 트럼프의 관세를 가볍게 여길까? 한국 투자자들이 놓칠 수 있는 함정

[외환 거래 실전 가이드] 데모 계좌, 체험 계좌, MT4 계좌의 차이점

환율 계산기