简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Bears Rule But May Not Turn Up Heat This Week

요약:The Australian Dollar remains close to notable lows against its US counterpart and the market is still betting on aggressive rate cuts from the RBA

Fundamental Australian Dollar Forecast: Neutral

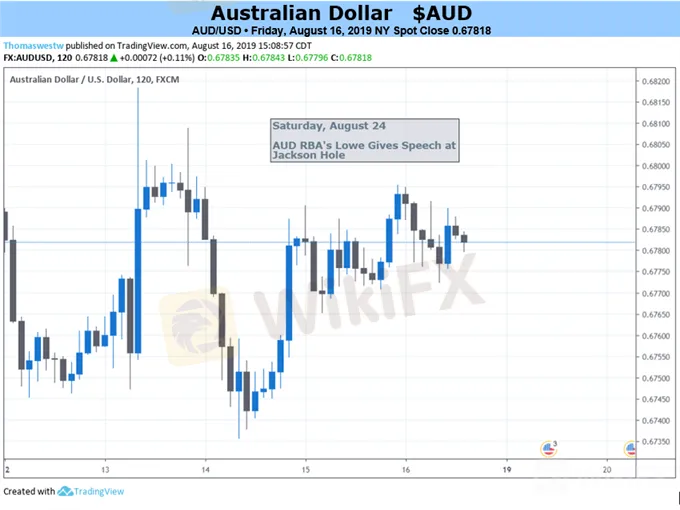

AUDUSD remains close to 11-year lows

Two further interest rate cuts are now fully priced

Still, the market may lack cause to hammer the Aussie much harder in the week ahead

Find out what retail foreign exchange traders make of the Australian Dollars prospects right now, in real time, at the DailyFX Sentiment Page

The Australian Dollar remains close to this months eleven-year lows against its US cousin with overall global risk appetite continuing to drive sentiment towards this most pro-cyclical currency.

Strong Labor Numbers Havent Changed Interest Rate Forecasts

On the domestic front, it was clear that Australias extraordinary job-creation record remained unblemished. Julys official labor-market figures made a mockery of forecasters with 41,00 new jobs on the books rather than the 14,000 expected. There was a solid rise in full-time employment to boot.

However, it is notable that those strong labor numbers did absolutely nothing to market expectations that the record-low 1% Official Cash Rate will slide to just 0.5% by the start of next year. That was the futures curves position before the data, it remained so after.

That surprise half-point rate cut from the Reserve Bank of New Zealand this month has seen a solid re-pricing lower of OCR expectations that it is clearly going to take a lot to shift.

No such shift is likely this week, which is a quiet one for economic data. Central bank meeting minutes are due from both the RBA and the US Federal Reserve, but they are unlikely to alter the overwhelming view that rates are headed down in both countries. Australian Purchasing Managers Index figures are coming up too. They‘ll attract plenty of investor attention but, again, won’t change the backdrop.

Keep an Eye on Jackson Hole

The Australian Dollar will be left as usual then to the ebb and flow of the risk trade. The risk trade in turn will depend on hard-to-predict headline news. There will also no doubt be plenty of focus on the Kansas City Fed‘s annual Jackson Hole central bankers’ fest. That kicks off on Thursday with RBA Governor Philip Lowe saving his speech until Saturday.

In short then it‘s hard to get bullish about an Australian Dollar so bereft of domestic monetary policy support, but the risk trade could yet lend it some support for as long as there are clear signs that Beijing and Washington intend to keep talking on trade. Therefore, it’s a neutral call this week.

Resources for Traders

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

미래를 위한 필수 전략, 자산 포트폴리오

WikiEXPO 글로벌 전문가 인터뷰: 진다오 타이(JinDao Tai) — 외환 거래의 미래

환율 계산기