简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pound May Shrug as US Dollar Gains on CPI Data, Euro at Risk

Resumo:The British Pound may shrug off UK CPI while the US Dollar gains on analogous local data. The Euro may turn lower anew after yesterdays

TALKING POINTS – CPI, POUND, US DOLLAR, EURO, SPAIN, BOND AUCTIO

UK inflation data unlikely to see strong response from British Pound

US Dollar might be sent higher as CPI data brightens Fed policy bet

Euro may fall on Spain budget vote, soft IP data and bond sale result

UK CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to tick down to 1.9 percent on-year, the lowest level since January 2017. A soft results impact on the British Pound may be relatively limited however considering near-term BOE rate hike chances already appear negligible ahead of the March 29 Brexit deadline.

US DOLLAR MAY RISE IF CPI DATA TOPS FORECAST

Analogous US CPI figures enters the spotlight later in the day. Here, the on-year price growth rate is seen cooling from 1.9 to 1.5 percent, marking the weakest reading since September 2016. US news-flow has palpably improved relative to forecasts recently, opening the door for an upside surprise. Leading PMI survey data bolsters the case for such an outcome.

An upbeat result might encourage priced-in Fed policy expectations to shift to a less-dovish setting. In fact, that process is already underway. Traders still lean against a rate hike in 2019 but the outlook now implied in Fed Funds futures puts the probability of one at the highest in a week. A higher CPI print may help this process along, boosting the US Dollar along the way.

EURO AT RISK ON INDUSTRIAL PRODUCTION DATA, BOND AUCTIONS, SPAI

The Euro may succumb to renewed selling pressure following yesterday‘s spirited recovery. Spain might trigger a snap election if the minority government of Prime Minister Pedro Sanchez comes up short in a budget vote due today. Meanwhile, soft Eurozone industrial production data and the results of bond auctions in Italy and Germany may sour investors’ appetite for EUR-denominated assets.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

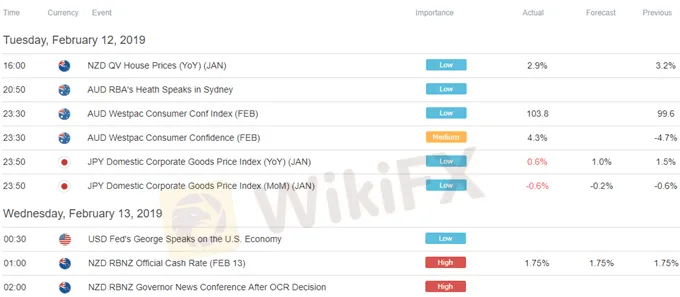

** All times listed in GMT. See the full economic calendar here.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Últimas notícias

Dólar Hoje: Moeda Opera a R$ 5,57 com Tensões Tarifárias de Trump

Prata Hoje (14/07): Ativo Atinge Máxima de 14 Anos Impulsionada por Tensões Comerciais

TradeEU Global: Trader Mexicano Perde Cerca de US$ 3.000 em Golpe Forex

MILKY WAY: Você Pode Confiar Seus Fundos a Esta Corretora?

Dólar Hoje: Moeda Americana em Queda com Inflação dos EUA e IOF em Foco

Warren Bowie & Smith: Trader Colombiana Cai no Golpe do Bônus de Depósito

Cálculo da taxa de câmbio