简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro, Yen and Aussie Dollar May All Find Fuel in ECB Rate Decision

Resumo:The impact of an ECB policy call setting the stage for more stimulus might reach past the Euro to broader sentiment trends, driving Yen and

TALKING POINTS – ECB, DRAGHI, EURO, YEN, AUSTRALIAN DOLLAR

All eyes on the ECB policy announcement, forecast downgrade expected

Clues on the likely stimulus expansion timing may be most market-moving

Impact to extend past Euro to broader risk trends, Yen and Aussie Dollar

The ECB monetary policy announcement headlines the economic calendar in European trading hours. A change in stance is not expected this time around, but traders seem primed for a sharp downgrade of official economic forecasts to set the stage for further easing in the months ahead. As for the likely vehicle, the consensus view appears to favor round of TLTRO liquidity injections into the banking sector.

A large downward adjustment in growth and inflation projections seems to be all but priced in at this point and may not translate into a significant response from price action by itself. Rather, traders will weigh the tone at the post-announcement presser with ECB President Draghi to gauge the likely timing of stimulus expansion. An apparent sense of urgency is likely to weigh on the Euro while hesitation may give it a bit of a lift.

The central banks disposition may also prove formative for broader sentiment trends. Worries about slowing global growth have consumed investors recently. With that in mind, the sense that the ECB will offer support relatively sooner rather than later may buoy risk appetite, boosting the cycle-linked Australian and New Zealand Dollars and punishing the Yen. Indecision may translate into the opposite result.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

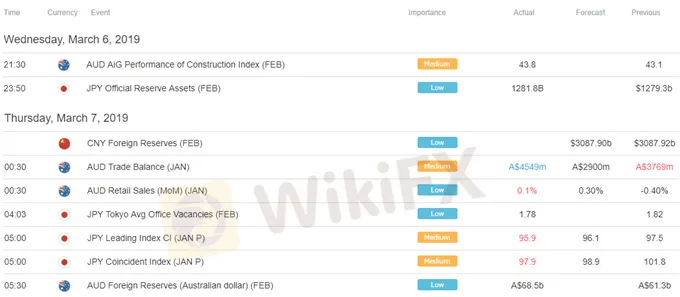

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

** All times listed in GMT. See the full economic calendar here.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Últimas notícias

Ouro Hoje (01/07/2025): Estratégias e Riscos para Traders de Forex

Warren Bowie & Smith: Trader Argentino Perde US$ 3.400 em Esquema Ponzi

RSI e RCI no Forex: Como Otimizar Suas Estratégias de Trading

STARTRADER: Vale a Pena Investir? Conheça essa Corretora Australiana Fundada em 1997!

Vantage: Avaliação dos Serviços e Benefícios de uma Corretora com Suporte em Português

Warren Bowie & Smith: Trader Colombiano Perde U$S 1.320 em Mais um Golpe

Cálculo da taxa de câmbio