简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUDUSD Rate at Risk Ahead of Aussie Jobs Data, RBA Cut Bets

Resumo:AUDUSD price action hinges on upcoming employment data out of Australia as the report is anticipated to dictate whether or not the RBA will slash its policy interest rate at upcoming meetings.

AUDUSD CURRENCY VOLATILITY – TALKING POINTS

AUDUSD overnight implied volatility explodes to 12.25 percent

Australia employment data expected Thursday is in focus

Aussie jobs report will likely move odds that the RBA will cut interest rates

The Australian Dollar has recorded a steady decline since mid-April which intensified after US President Trumps tariff tweets sent currency volatility surging. Spot AUDUSD now trades near the 0.6926 mark – its lowest level since the Yen flash crash on January 2. Fears over escalating trade tensions negatively impacted risk assets as uncertainty surrounding slowing global growth quickly resurfaced.

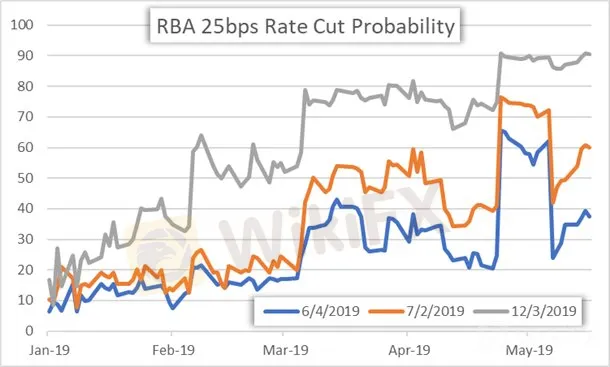

RBA INTEREST RATE CUT PROBABILITY PRICE CHART: DAILY TIME FRAME (JANUARY 01, 2019 TO MAY 15, 2019)

Since the last RBA meeting minutes were released, the odds that Australias central bank will lower its policy interest rate by 0.25 percent has climbed steadily. In fact, the probability that the RBA cuts its Overnight Cash Rate at its meeting on June 4 has jumped to 37.5 percent ahead of tomorrow's job data.

With the RBA noting that a rate cut would likely be warranted if “inflation did not move any higher and unemployment trended up,” markets are now placing extra emphasis on Thursday‘s job report due for release at 1:30 GMT. Bloomberg’s median consensus lists an expectation of 15K job additions with the unemployment rate holding steady at 5.0 percent.

AUDUSD PRICE CHART: DAILY TIME FRAME (DECEMBER 21, 2018 TO MAY 15, 2019)

According to overnight implied volatility of 12.25 percent, currency traders might anticipate spot AUDUSD to trade between 0.6881 and 0.6969 with a 68 percent statistical probability. With spot prices beneath the 61.8 percent Fibonacci retracement level shown above and sharp bearish downtrend serving as near-side technical resistance, upside in AUDUSD could be limited.

Although, a stellar jobs report tomorrow could crush the market‘s rate cut expectations and shoot AUDUSD towards the 0.7000 handle. Conversely, a disappointing reading on Australia’s labor market has potential to send the Aussie plunging towards the 76.4 Fibonacci retracement level.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Corretora WikiFX

Últimas notícias

Alta da Selic para 14,25%: Impactos e Estratégias para Traders

Inflação, Selic e o Dólar: O Mercado Forex Brasileiro Hoje

GO MARKETS: Uma Corretora Regulamentada com Forte Presença Global

TradingView Expande Suas Criptos com Mais 16 Exchanges Descentralizadas

Warren Bowie & Smith: Argentino Perde US$ 4.800 em Menos de Um Mês

Bancos Centrais em Ação: Impactos no Mercado Forex

Dólar Hoje: O Que Esperar para os Próximos Dias?

QUOTEX: Colombiano Não Consegue Sacar e Perde Parte do Investimento

Otimismo Empresarial na Alemanha Impulsiona Bolsas Europeias

Cálculo da taxa de câmbio