简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Forecast: RSI Snaps Bullish Formation Following BoC Meeting

Абстракт:Recent developments in the Relative Strength Index (RSI) foreshadow a further decline in USDCAD as the indicator snaps the bullish formation carried over from July.

Canadian Dollar Talking Points

USDCAD trades to fresh monthly lows following the Bank of Canada (BoC) meeting, and recent developments in the Relative Strength Index (RSI) foreshadow a further decline in the exchange rate as the indicator snaps the bullish formation carried over from July.

USDCAD Forecast: RSI Snaps Bullish Formation Following BoC Meeting

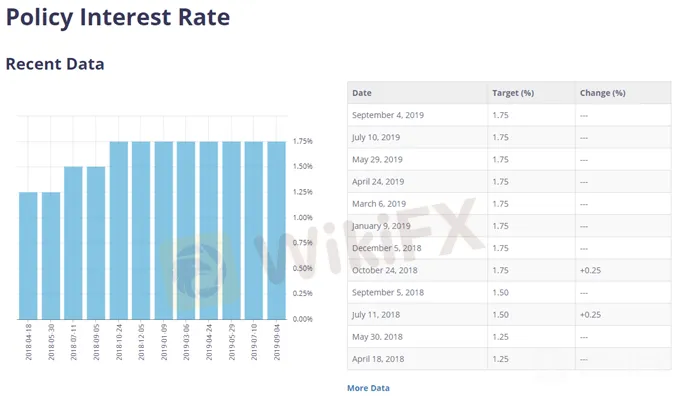

USDCAD may struggle to retain the advance from the 2019-low (1.3016) as the BoC sticks to a wait-and-see approach, and it seems as though the central bank will keep the benchmark interest rate on hold throughout the remainder of the year as “the current degree of monetary policy stimulus remains appropriate.”

The BoC appears to be in no rush to alter the forward guidance for monetary policy as “growth in the second quarter was strong and exceeded the Bank‘s July expectation,” and Governor Stephen Poloz and Co. may stick to the same script at the next meeting on October 30 as “Canada’s economy is operating close to potential.”

In contrast, the Federal Reserve appears to be on a preset course to reverse the four rate hikes from 2018 as St. Louis Fed President James Bullard, a 2019-voting member on the Federal Open Market Committee (FOMC), insists that the central bank “should have a robust debate about moving 50 basis points” at its quarterly meeting scheduled for September 18.

With that said, it remains to be seen if the fresh updates to the US Non-Farm Payrolls (NFP) will impact the monetary policy outlook even though the economy is anticipated to add another 160K jobs in August as Fed Fund futures continue to reflect overwhelming expectations for a 25bp reduction later this month.

In turn, the Canadian Dollar may outperform its US counterpart amid speculation for back-to-back Fed rate cuts, and the diverging paths for monetary policy may spur a broader shift in USDCAD behavior as the exchange rate snaps the upward trend carried over from the previous year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

Keep in mind, the broader outlook for USDCAD is no longer constructive as the exchange rate clears the February-low (1.3068), with the break of trendline support fostering a bearish outlook for Dollar Loonie.

At the same time, the rebound from the 2019-low (1.3016) appears to have stalled ahead of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), with the exchange rate at risk of extending the recent series of lower highs and lows as the Relative Strength Index (RSI) snaps the bullish formation from July.

The break/close below 1.3220 (50% retracement) brings the 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement) region on the radar, with the next area of interest coming in around 1.3030 (50% expansion).

Отказ от ответственности:

Мнения в этой статье отражают только личное мнение автора и не являются советом по инвестированию для этой платформы. Эта платформа не гарантирует точность, полноту и актуальность информации о статье, а также не несет ответственности за любые убытки, вызванные использованием или надежностью информации о статье.

WikiFX брокеры

Interactive Brokers

Exness

XM

Pepperstone

AvaTrade

OANDA

Interactive Brokers

Exness

XM

Pepperstone

AvaTrade

OANDA

WikiFX брокеры

Interactive Brokers

Exness

XM

Pepperstone

AvaTrade

OANDA

Interactive Brokers

Exness

XM

Pepperstone

AvaTrade

OANDA

Подсчет курса