简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pound May Shrug as US Dollar Gains on CPI Data, Euro at Risk

Lời nói đầu:The British Pound may shrug off UK CPI while the US Dollar gains on analogous local data. The Euro may turn lower anew after yesterdays

TALKING POINTS – CPI, POUND, US DOLLAR, EURO, SPAIN, BOND AUCTIO

UK inflation data unlikely to see strong response from British Pound

US Dollar might be sent higher as CPI data brightens Fed policy bet

Euro may fall on Spain budget vote, soft IP data and bond sale result

UK CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to tick down to 1.9 percent on-year, the lowest level since January 2017. A soft results impact on the British Pound may be relatively limited however considering near-term BOE rate hike chances already appear negligible ahead of the March 29 Brexit deadline.

US DOLLAR MAY RISE IF CPI DATA TOPS FORECAST

Analogous US CPI figures enters the spotlight later in the day. Here, the on-year price growth rate is seen cooling from 1.9 to 1.5 percent, marking the weakest reading since September 2016. US news-flow has palpably improved relative to forecasts recently, opening the door for an upside surprise. Leading PMI survey data bolsters the case for such an outcome.

An upbeat result might encourage priced-in Fed policy expectations to shift to a less-dovish setting. In fact, that process is already underway. Traders still lean against a rate hike in 2019 but the outlook now implied in Fed Funds futures puts the probability of one at the highest in a week. A higher CPI print may help this process along, boosting the US Dollar along the way.

EURO AT RISK ON INDUSTRIAL PRODUCTION DATA, BOND AUCTIONS, SPAI

The Euro may succumb to renewed selling pressure following yesterday‘s spirited recovery. Spain might trigger a snap election if the minority government of Prime Minister Pedro Sanchez comes up short in a budget vote due today. Meanwhile, soft Eurozone industrial production data and the results of bond auctions in Italy and Germany may sour investors’ appetite for EUR-denominated assets.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

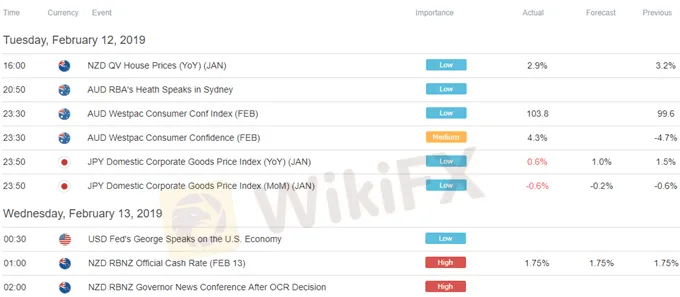

** All times listed in GMT. See the full economic calendar here.

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

STARTRADER

ATFX

GTCFX

TMGM

FXTM

Saxo

STARTRADER

ATFX

GTCFX

TMGM

FXTM

Saxo

Sàn môi giới

STARTRADER

ATFX

GTCFX

TMGM

FXTM

Saxo

STARTRADER

ATFX

GTCFX

TMGM

FXTM

Saxo

Tin HOT

EU tạm hoãn trả đũa thuế quan: Cơ hội đàm phán hay dấu hiệu cho cuộc chiến thương mại toàn diện?

Hai yếu tố quan trọng khi tra cứu và xác định một sàn Forex uy tín

Việt Nam đón làn sóng dịch chuyển chuỗi cung ứng toàn cầu

Giám đốc JPMorganChase và Chủ tịch Fed Dallas công khai ủng hộ Jerome Powell

Top 5 sàn môi giới bị tố cáo nhiều nhất tháng 06/2025

WikiFX Review sàn Forex ActivTrades 2025: Đánh giá chi tiết về uy tín và rủi ro

Việt Nam và chiến lược ứng phó sức ép thương mại đa chiều

Tin tức Forex 14/07: XM hỗ trợ giáo dục cho trẻ em tại Việt Nam

Lạm phát tháng 6 sắp lên sóng: CPI, PPI có thể phá vỡ mọi kỳ vọng và quyết định của Fed?

Chiến lược ngoại giao cây tre của Việt Nam giữa biến động toàn cầu

Tính tỷ giá hối đoái