简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: March Canadian Jobs Report & USDCAD Price Outlook

Lời nói đầu:Markets are expecting the Canadian labor market to cool off after exceptionally strong gains in January and February.

The first two months of the year have produced strong labor market reports for the Canadian economy, and as a result, markets are anticipating a quieter March. The January employment change was 66.8K jobs, while the topline February reading came in at 55.9K.Even though the Bloomberg consensus calls for the March report to only show 10K jobs added,the unemployment rate is due to stay on hold at 5.8%. With energy markets continuing their rebound since the start of the year – nearly 11% of the Canadian economy is tied to oil – it‘s likely that jobs growth remained positive in Canada through the end of Q1’19.

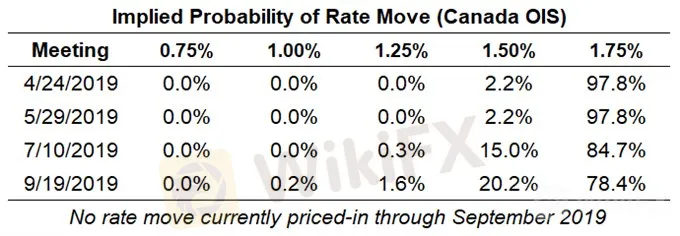

The ongoing improvement in Canadian economic data has given traders pause over dragging forward rate expectations any further. Two weeks ago, the odds of a 25-bps rate cut were priced-in at 28%; currently, they reside at 20.2%.

Pairs to Watch: CADJPY, EURCAD, USDCAD

USDCAD Price Chart: Daily Timeframe (December 2018 to April 2019)

The better than expected January Canadian GDP report has helped keep USDCAD in check, despite broad advances by the DXY Index overall. In turn, the path of least resistance pointing to the topside proved false. As such, if there is one currency on the ready to take advantage of US Dollar weakness, it may be the Canadian Dollar – particularly as oil prices stay elevated.

A double top pattern may be forming with respect to the two March swing highs, and there is evidence that momentum is shifting to the downside. Not only have both daily MACD and Slow Stochastics turned lower, USDCAD price is now below its daily 8-, 13-, and 21-EMA envelope. A move down towards the March low near 1.3251 appears increasingly likely.

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

Sàn môi giới

Tin HOT

Giá vàng hôm nay 24/3: Thế trận giằng co căng thẳng

Tin tức Forex 24/03: Một sàn Forex Việt Nam ra mắt công ty prop trading

SuperNode của Pi Network: Lời hứa suông về câu chuyện phi tập trung?

WikiFX Review sàn Forex ETO Markets 2025: Có đủ uy tín để cân nhắc?

Phỏng vấn chuyên gia cùng WikiEXPO: Tương lai của giao dịch Forex

Khám phá các phương pháp giao dịch Forex đơn giản nhất 2025

Cảnh báo về vụ việc TikToker nổi tiếng Happi.mommi lừa đảo: Bối cảnh và thủ đoạn

Lật tẩy thủ thuật lùa gà đầu tư tại Việt Nam của TikToker nổi tiếng

WikiFX 3.6.4: Nâng tầm trải nghiệm giao dịch Forex với 3 tính năng đột phá

Giảm về dưới 1 USD, Pi Network kỳ vọng vào 2 nhân tố mới

Tính tỷ giá hối đoái