简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Outlook Grim on Yield Curve as Jobs Data Looms

摘要:The Australian Dollar outlook is grim on rising fears of a US recession, yield curve inversion. AUD/USD may shrug off rosy jobs data ahead on fears of slowing global growth.

Asia Pacific Market Open Talking Points

Australian Dollar at risk as sentiment sours on rising US recession worries

Aussie gains on jobs report could dwindle as global growth prospects fade

AUD/USD downside momentum fading but positioning offers bearish bias

Find out what the #1 mistake that traders make is and how you can fix it!

Australian Dollar at Risk as US Yield Curve Inversion Sinks Sentiment

The sentiment-linked Australian and New Zealand Dollars underperformed over the past 24 hours as rising fears of a US recession roiled financial markets. The Dow Jones Industrial dropped over 3 percent in its worst day on Wall Street this year as the S&P 500 fell by almost as much. Meanwhile, the anti-risk Japanese Yen and similarly-behaving Swiss Franc soared.

The source of panic likely stemmed from the inversion of the spread between US 10-year and 2-year government bond yields. The higher premium for near-term Treasuries compared to those maturing at a later date is historically seen as an acute signal of a looming recession. The more closely watched 10-year and 3-month spread has already been inverted since the end of May.

Thursdays Asia Pacific Trading Session

Ahead, this leaves the sentiment-linked Australian Dollar at risk as it awaits an upcoming local employment report. Australia is anticipated to add 14.0k jobs in July and it may very well beat estimates. Relative to economists expectations, data has been tending to surprise to the upside in Australia as of late. While this may bode well for AUD/USD in the near-term, down the road it may fall flat on its face if global risk aversion escalates.

Join me as I cover AUD/USD and the Australian jobs report beginning at 1:15 GMT as I discuss the Aussie outlook

Taking a look at S&P 500 futures, they are pointing notably lower heading into Thursdays Asia Pacific trading session. This may lead local benchmark stock indexes, such as the Nikkei 225 and ASX 200, to the downside. As such, this poses a threat to the Aussie while potentially benefiting the anti-risk Japanese Yen if the turmoil in markets continues.

AUD/USD Technical Analysis

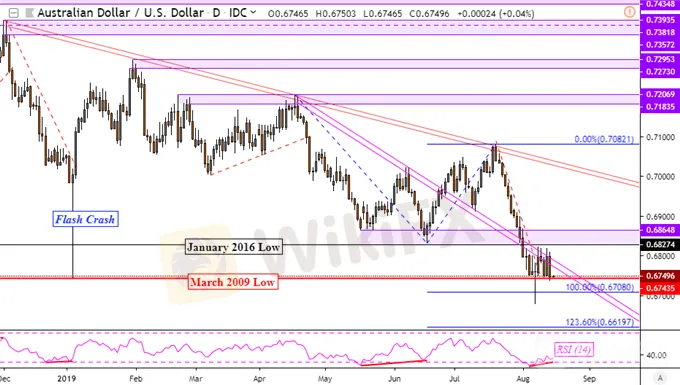

Positive RSI divergence in AUD/USD does warn of ebbing momentum to the downside, offering bears a sign of caution. This may precede a turn higher or translate into further consolidation. The latter has been more of the case as of late as prices hover above March 2009 lows. Near-term resistance appears to be well-solidified as a range between 0.6827 and 0.6865. These are the former 2019 lows.

AUD/USD Daily Chart

Chart Created in TradingView

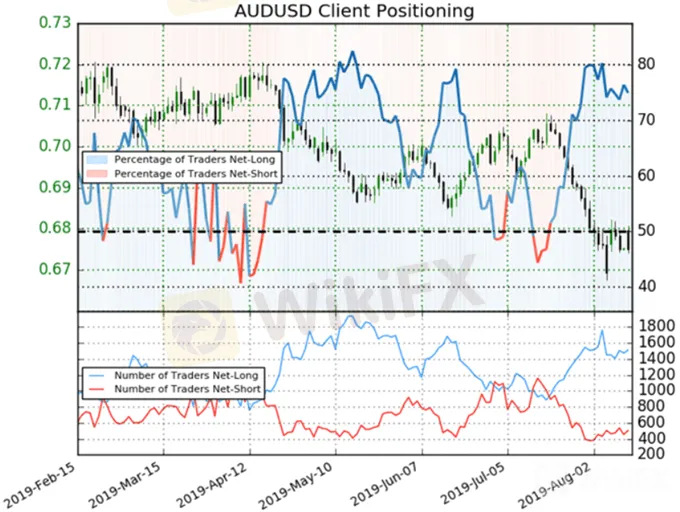

AUD/USD IG Client Sentiment

Meanwhile, IG Client Positioning is offering a stronger AUD/USD bearish contrarian trading bias. The number of net-short Aussie trading is unwinding quicker than net-long positioning. If this continues, we may see the downtrend in the Australian Dollar pick up pace. If you would like to learn more about using this tool in your trading strategy, join me every week on Wednesdays at 00:00 GMT to see how!

FX Trading Resources

See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

See our free guide to learn what are the long-term forces driving Crude Oil prices

See our study on the history of trade wars to learn how it might influence financial markets!

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

马来西亚公司经理坠入黄金投资骗局,损失高达17.3万!高回报陷阱再次浮出水面!

UBS瑞银集团被黑的最惨的一次 如何一眼识别诈骗网站

MetaTrader 5 iOS应用迎来重大更新:便捷入金成亮点,外汇交易体验再升级!

倒计时开启!WikiEXPO Hong Kong 2025即将隆重开幕!

周末复盘,洞见先机:下周外汇财富密码在这里

监管变动预警:一大批香港平台被撤销牌照

汇率计算