Euro (EUR) Battles Record Low Euro-Zone Inflation Expectations

摘要:The single currency remains under downside pressure as 5-yr/5-yr Euro-Zone inflation expectations hit another record low, leaving the ECB in a precarious situation.

EURUSD Price, Chart and Analysis:

EURUSD价格,图表与分析:

Euro-Zone inflation expectations continue to make fresh lows.

欧元区通胀预期继续创下新低。

EURUSD price being kept afloat by a weak US dollar.

保持欧元兑美元价格由于美元疲软而浮出水面。

Q2 2019 EUR Forecast and USD Top Trading Opportunities

2019年第二季度欧元预测和美元最大交易机会

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

通过DailyFX经济日历了解所有关键经济数据和事件发布日期

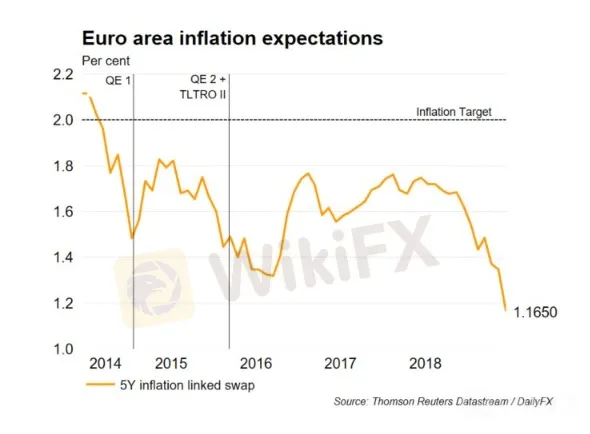

The latest market indicator of Euro-Zone inflation expectations – the 5-yr/5-yr inflation-linked swap rate – today printed a new all-time low at 1.165%. The indicator measures inflation expectation over a five-year period starting five years from now. This will be a major headache for the ECB whose remit is to maintain inflation rates below, but close to, 2% over the medium-term.

欧元区通胀预期的最新市场指标 - 5年/ 5年通胀相关掉期利率 - 今日创下历史新低1.165%。该指标衡量了从现在起五年后的五年期间的通胀预期。对于欧洲央行来说,这将是一个令人头疼的问题,其中的职责是在中期内保持通货膨胀率低于但接近2%。

This reading is closely monitored by the ECB and the recent fall in expectations will only increase pressure on the central bank to loosen monetary conditions further – rate cuts, more quantitative easing – to boost price pressures in the single-block. The ECB halted the QE 2 at the end of 2018, apart from coupon and repayment reinvestments, and the central bank is likely in the months ahead to admit that more QE is necessary. The Euro-Zone benchmark (10-yr German Bund) currently trades at -0.265%, while the 20-year Bund offers a paltry 12.5 basis points of yield, highlighting the view that interest rates are going to stay very low for a long time.

此读数受欧洲央行密切监控,近期预期下降只会增加央行进一步放松货币政策的压力 - 降息,更多量化宽松 - 以刺激单一区块的价格压力。除了优惠券和还款再投资之外,欧洲央行在2018年底停止了QE 2,而央行可能在未来几个月承认需要更多量化宽松政策。欧元区基准(10年期德国外滩)目前的交易价格为-0.265%,而20年期外滩的收益率仅为12.5个基点,突显了利率将长期保持在低位的观点。 。

EURUSD Price Looking Shaky - Lower for Longer?

欧元兑美元价格看跌 - 持续走低?

EURUSD remains around 1.5 cents away from making a fresh two-year low if it breaks the May 23 nadir at 1.1107. The pairs upside is currently being halted by the 200-day moving average which has held firm over the last week with the level broken but not closed above. EURUSD downside is being tempered by a weak US dollar with markets fully expecting at least two 0.25% interest rate cuts this year, cutting the attractiveness of the US dollar.

欧元兑美元维持在两年新低的1.5美分左右如果它在1.1107打破5月23日的最低点。这对货币上行目前正在被200日移动平均线所阻止,该移动平均线在过去一周保持坚挺,但水平已经突破但尚未收盘。欧元兑美元由于美元疲软,市场充满期待今年至少降息0.25%,从而削弱了美元的吸引力,因此nside正在受到抑制。

EURUSD Price Outlook Cloudy – ECBs Rehn Talks Rate Cuts and More QE

欧元兑美元价格展望多云 - 欧洲央行雷恩会谈减息及更多QE

EURUSD Daily Price Chart (September 2018 – June 14, 2019)

欧元兑美元每日价格走势图(2018年9月 - 2019年6月14日)

Retail traders are 45.8% net-long EURUSD according to the latest IG Client Sentiment Data, a bullish contrarian indicator. However recent daily and weekly positional changes give us a mixed trading bias.

根据最新的IG客户情绪数据,零售交易商的净多头欧元兑美元为45.8%,这是一个看涨的逆势指标。然而,最近的每日和每周位置变化给我们带来了混合交易偏见。

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

小心高風險平台Tyrell Markets:無監管牌照、網站註冊日期短,極具投資疑慮

你能分清趨勢與波動嗎?告訴你如何理解並利用趨勢!

【蔡菲特平台評測】Tickmill使用心得:開戶簡單、入金迅速、交易體驗穩定

XTB延長高層任期三年,原班人馬持續領軍

在交易中什麼時候可以自信,什麼時候不能自信?

YCHpro優惠活動贈金3000美元?平台缺乏有效監管,慎防非法吸金詐騙陷阱

匯率計算