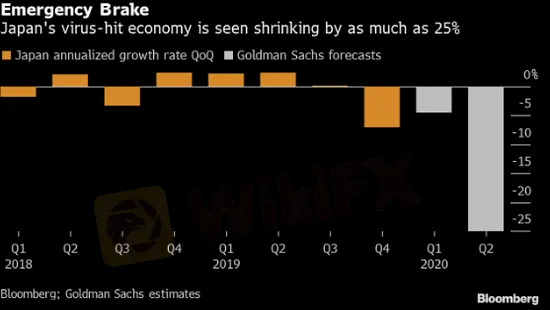

Japan’s Economy May See a Record 25% Shrinkage

摘要:JCER Senior Researcher Jun Saito recently commented that the global epidemic may be the final blow on Japan’s sluggish economy, while Goldman Sachs estimated Japan’s economy may see a record 25% shrinkage this quarter.

JCER Senior Researcher Jun Saito recently commented that the global epidemic may be the final blow on Japan’s sluggish economy, while Goldman Sachs estimated Japan’s economy may see a record 25% shrinkage this quarter.

Jun Saito repeated the point that Japan is heading towards a severe recession, attributing it to the shocks on demand and supply. In addition, the delaying of Olympics and Paralympics will “put more downward pressure” on Japan’s economy.

According to the estimation of Goldman Sachs, Japan’s economy will shrink an unprecedented 25% this quarter despite a stimulus scheme never seen in history. While coronavirus outbreak in the US and some European economies is easing, this may not be a very good news for the safe-haven yen, which has benefited from the continuous global economic slump in March. Now that the market expects a peak of global coronavirus cases, risk aversion sentiment is eventually thinning, which will definitely weigh on the yen.

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

澳洲差價合約券商 Fusion Markets 聘請 IG 前高層 Torrell Fernandes 擔任銷售主管

INFINOX 任命 Exinity/FxPro 前高層 Artem Gonov 為技術長

【Kenny平台評測】ThinkMarkets智匯受正規監管、交易環境一般,但出金流程卡關、交易糾紛不斷,具一定程度風險

Octa受塞浦路斯CYSEC監管卻交易糾紛頻傳,這家外匯券商到底是否可信?

匯率計算