简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bye Digital Assets, Hi Securities?!

Abstract:On December 13, Canada's provincial and territorial securities regulators, CSA, announced that it is forbidding all Canadian-based cryptocurrency trading companies to provide margin or leveraged trading services to any Canadian clients.

On December 13, Canada's provincial and territorial securities regulators, the Canadian Securities Administrators (CSA), released a statement that it has forbidden all Canadian-based cryptocurrency trading companies to provide margin or leveraged trading services to any Canadian clients. This also applies to foreign platforms offering services to Canadians residing within the country's border.

Furthermore, the CSA requires that Canadian cryptocurrency exchanges keep their custody assets separate from the platform's proprietary company.

Additionally, the CSA considers labelling stablecoins as securities and/or derivatives as it strengthens its oversight of the crypto industry. These refer to those cryptocurrencies pegged to fiat or other fundamentally stable and reliable assets.

eToro's co-founder, Ronen Assia, also sees an evident shift within retailers' preferences on his multi-asset trading platform, wherein individuals are cashing out from cryptocurrencies and opting for securities and bonds.

Therefore, it is sufficient to say that, at the moment, regulators worldwide are striving to strengthen their oversight of this seemingly shaky and risky cryptocurrency industry. In conjunction with this, let us take a look at what exactly CSA does do.

Aiming to enhance, coordinate, and harmonise the regulation of the Canadian capital markets, the Canadian Securities Administrators (CSA) is the umbrella body for Canada's provincial and territorial securities regulators.

It seeks to reach an agreement on policy choices that have an impact on the Canadian capital market and its players. Additionally, it seeks to cooperate in the execution of regulatory initiatives across Canada, such as the evaluation of continuous disclosure and prospectus filings. While provincial or territorial authorities in each jurisdiction address all complaints relating to securities infractions, the CSA coordinates initiatives on a national level. As a result, each regulator may offer a more direct and effective service to the local investors and market participants. Each province or territory also handles its own enforcement of securities laws respectively.

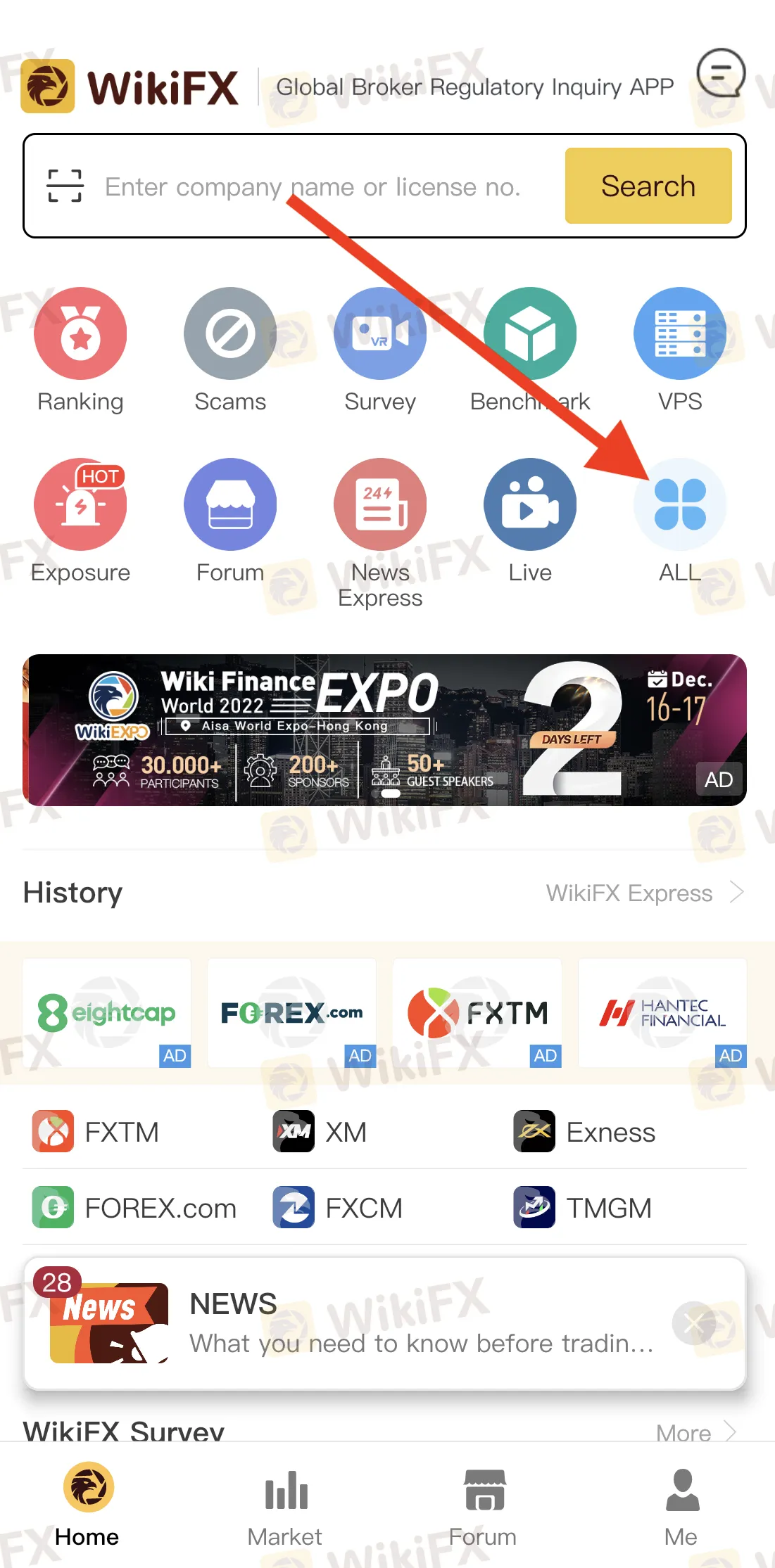

Here's a useful tip to utilise the free WikiFX app to the fullest. There is a function named “Regulatory Disclosure” where you can stay informed about the warnings and sanctions imposed by national regulators throughout the globe on concerning (forex) brokers.

WikiFX is a global forex broker regulatory query platform that holds verified information of over 40,000 forex brokers in collaboration with more than 30 national regulators, including CSA, ASIC, FCA and more.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Kraken Eyes $1.5B Acquisition of NinjaTrader for Futures Trading

Kraken is negotiating to acquire NinjaTrader for $1.5B, expanding its crypto and futures trading offerings while strengthening its market position globally.

Crypto.com Faces Backlash Over Reversal of 70 Billion CRO Token Burn

Crypto.com’s controversial decision to re-issue 70 billion CRO tokens sparks outrage, raising concerns about vote manipulation and decentralization.

Trade, Compete, Win: Enter the WikiFX World Elite Trading Championship

The global forex market is an arena where skill, strategy, and market intuition determine success. Now, traders worldwide have the chance to put their expertise to the test in the WikiFX World Elite Trading Championship, that is a premier demo trading competition that merges competitive spirit with the opportunity to claim a share of an enticing 2,000 USDT prize pool.

Thailand-Myanmar Scam Centers: 100,000 Still Operating Despite Crackdown

Despite multinational efforts, 100,000 workers remain in Thailand-Myanmar scam centers. Learn about the ongoing crackdown, trafficking, and regional coordination to dismantle these illegal hubs.

WikiFX Broker

Latest News

Investor Alert: FCA Exposes 9 Unregistered Financial Companies

Do Tariffs Refueling Inflation? Understanding the Connection

U.S. Stocks Bounce Back for Two Consecutive Days, Is a Positive Outlook Ahead?

U.S. Consumer Weakness: Is It Good or Bad?

Robinhood Launches Prediction Markets Hub for Trading Events

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Gold Hits New Highs: Is Now the Time to Buy?

Key Points Every Forex Beginner Must Know

Why US Lawmakers Urge Trump to Drop Crypto Before It Harms America

CME Group Adds Solana Futures in Both Standard and Micro Contracts

Currency Calculator