简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

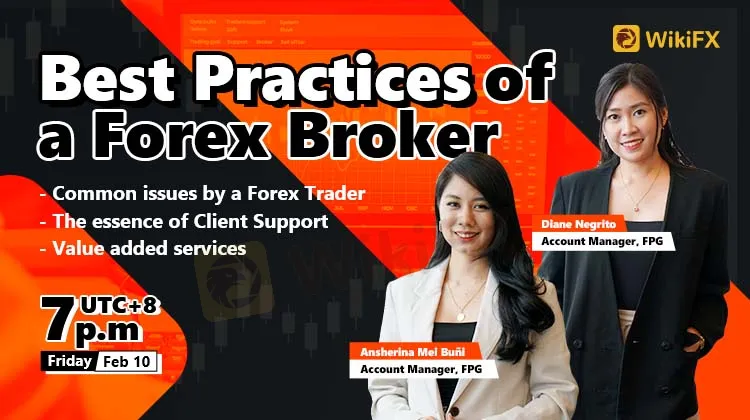

Best Practices of a Forex Broker

Abstract:Common Issue by a forex Trader, The essence of a Client Support and Value Added Services

Forex brokers play a crucial role in the foreign exchange market by providing traders with access to the currency markets. Here are some best practices that a good Forex broker should follow:

Regulation: A reputable Forex broker should be regulated by a trusted financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

Security: A good Forex broker should have strict security measures in place to protect their clients' funds and personal information. This includes SSL encryption, secure servers, and strong passwords.

Transparency: A Forex broker should be transparent in their operations and provide clear and accurate information about their services, fees, and any potential risks.

Liquidity: A Forex broker should have access to deep pools of liquidity to ensure that traders can execute their trades quickly and efficiently.

Trading Platforms: A good Forex broker should offer a range of user-friendly and reliable trading platforms, including desktop, web-based, and mobile options.

Customer Support: A Forex broker should have a responsive and knowledgeable customer support team that is available 24/7 to assist traders with any questions or concerns they may have.

Education and Research: A Forex broker should offer educational resources, such as trading tutorials, market analysis, and trading tools, to help traders make informed decisions.

By following these best practices, a Forex broker can build a strong reputation and establish trust with their clients. It is important for traders to choose a reputable and trustworthy Forex broker to ensure a safe and successful trading experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

U.S. Stocks Bounce Back for Two Consecutive Days, Is a Positive Outlook Ahead?

The U.S. stock market has rebounded for two consecutive days. Could this signal a potential turning point, or is it just a temporary uptick? Let's explore the market movements, their underlying causes, and how investors should respond.

U.S. Consumer Weakness: Is It Good or Bad?

U.S. retail data for February came in below expectations, raising concerns about slowing consumer spending. Does this signal the beginning of an economic slowdown, or is it just a temporary fluctuation? Let's dive into the analysis.

Acuity Trading and interop.io have joined forces

Acuity Trading and interop.io have joined forces to streamline financial data integration, enabling traders, brokers, and institutions to access real-time market intelligence without disrupting their existing systems. This partnership represents a significant step forward in addressing one of the financial industry’s most persistent challenges—integrating vast amounts of market data from diverse sources.

How to Avoid Risks from Scam Brokers in Forex Investment?

In recent years, the forex market has become a popular choice for global investors due to its high liquidity and 24-hour trading advantages. However, according to the recently concluded WikiFX "3·15 Forex Rights Protection Day " event, we received over 6,000 pieces of evidence exposing rights violations within a short period. This reflects that, although the forex industry is becoming more regulated, fraudulent platforms continue to emerge, causing significant suffering for many victims.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Currency Calculator