简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is an STP Forex Trading Platform?

Abstract:STP (Straight Through Processing) forex brokers allow clients to send their orders straight to the market without any human intervention for a shorter processing time and lower fees.

STP (Straight Through Processing) forex platform means that the customer's order is sent directly to its liquidity provider (bank, quotation provider or another broker) to be processed without going through the intervention of dealing desks. There is no human intervention, but an STP plays the middleman role. Banks in the interbank foreign exchange market send information about bid-ask spreads (spreads) to STP brokers, most of which are market makers and offer fixed spreads.

Some STP platforms have only one liquidity provider, while others have several liquidity providers to increase their liquidity. The greater the liquidity, the faster or smoother the client's orders will be filled, and the spreads may be lower. However, each liquidity provider offers different bid or ask prices. After receiving spread information, STP brokers have two options: either to keep spreads fixed or to choose the best bid and ask prices from several banks (the more, the better) to allow variable spreads. This way, clients trading on the STP forex platform can see the real-time market prices for themselves.

An STP Forex platform has many advantages. Firstly it offers faster trading because the STP platform passes trading information directly to the liquidity providers, thus greatly reducing the response time for trading. Secondly, an STP FX platform offers more flexible trading options because it can directly transmit trading information to multiple market providers, so traders can choose between multiple market providers and thus get better trading prices. In addition, an STP FX platform provides a more transparent trading experience where traders can directly see the market providers' quotes. Another important advantage of trading on the STP Forex platform is that an STP platform enables trading by aggregating traders' quotes, so traders can be assured of a fair and equitable trading environment, unlike traditional Forex platforms where there is no arbitrage against traders.

In short, STP is an efficient, flexible, and transparent trading platform for traders who require a faster, more flexible, and transparent trading environment, which increases trading efficiency and reduces trading risk.

STP quotes originate from the currency market, not from the platform or broker. In this case, if there is a large number of orders in a short period or if the market is suddenly facing huge fluctuations, there could be a problem with clients executing orders that are left open because the system is not loaded. This delay may cause traders to lose money.

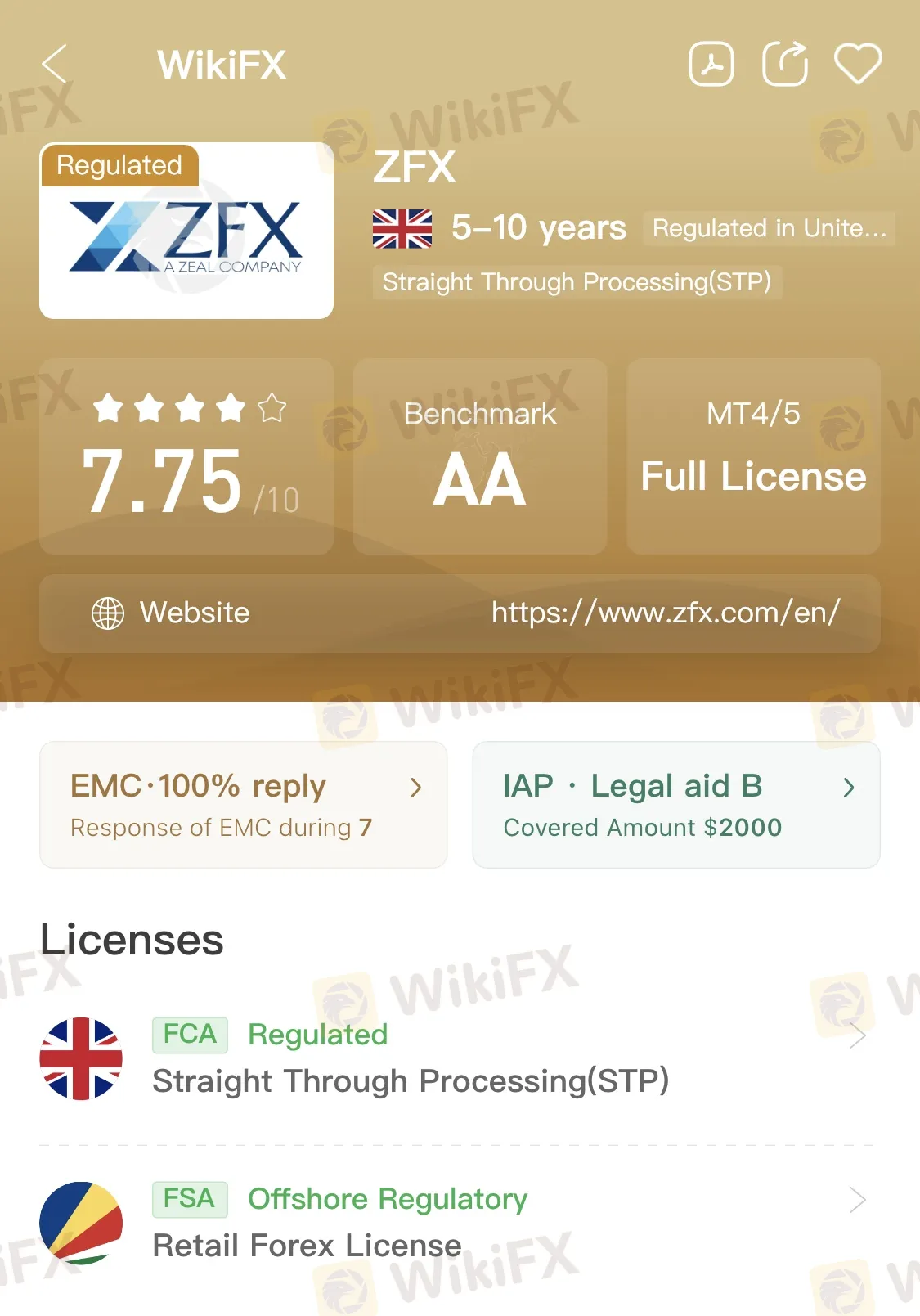

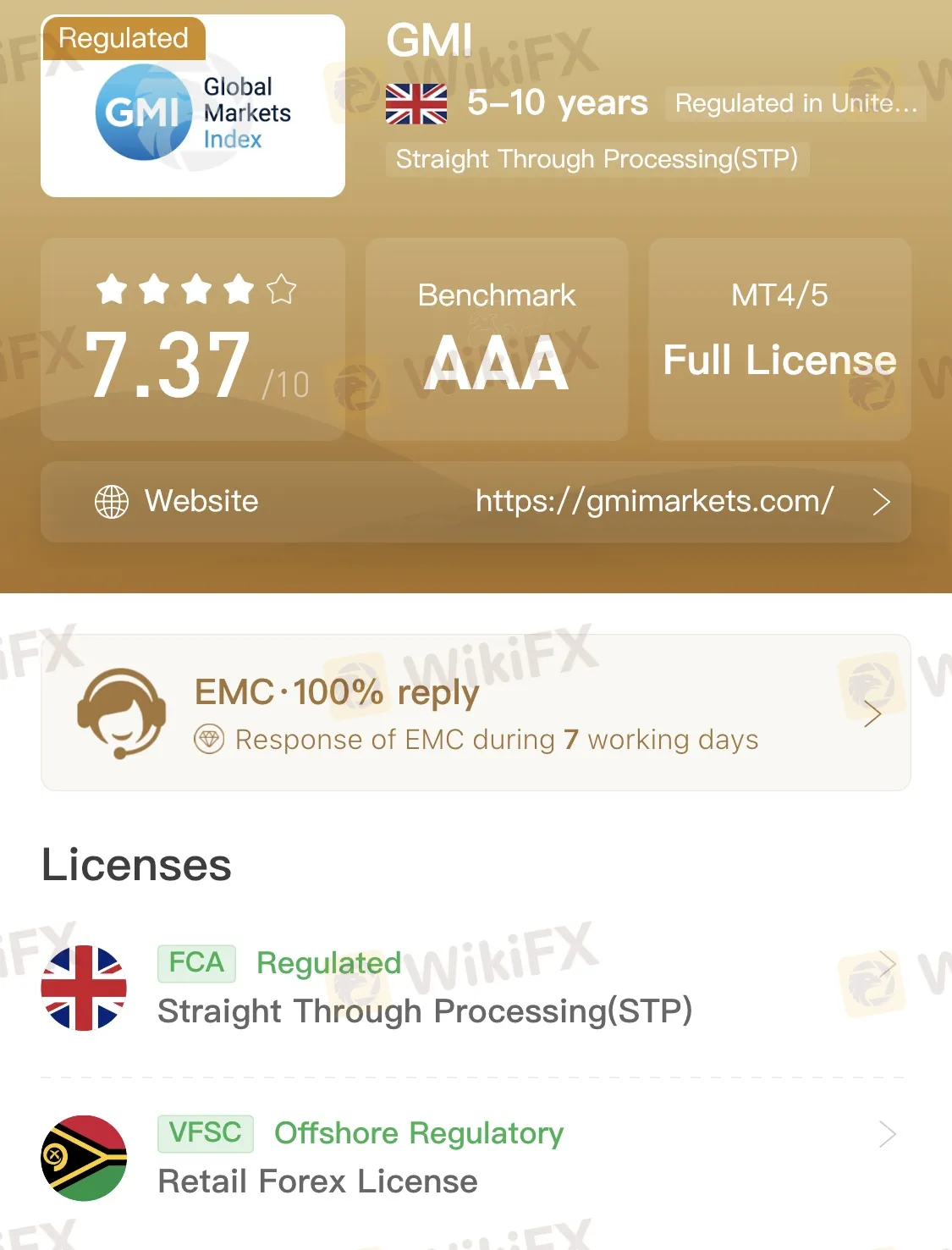

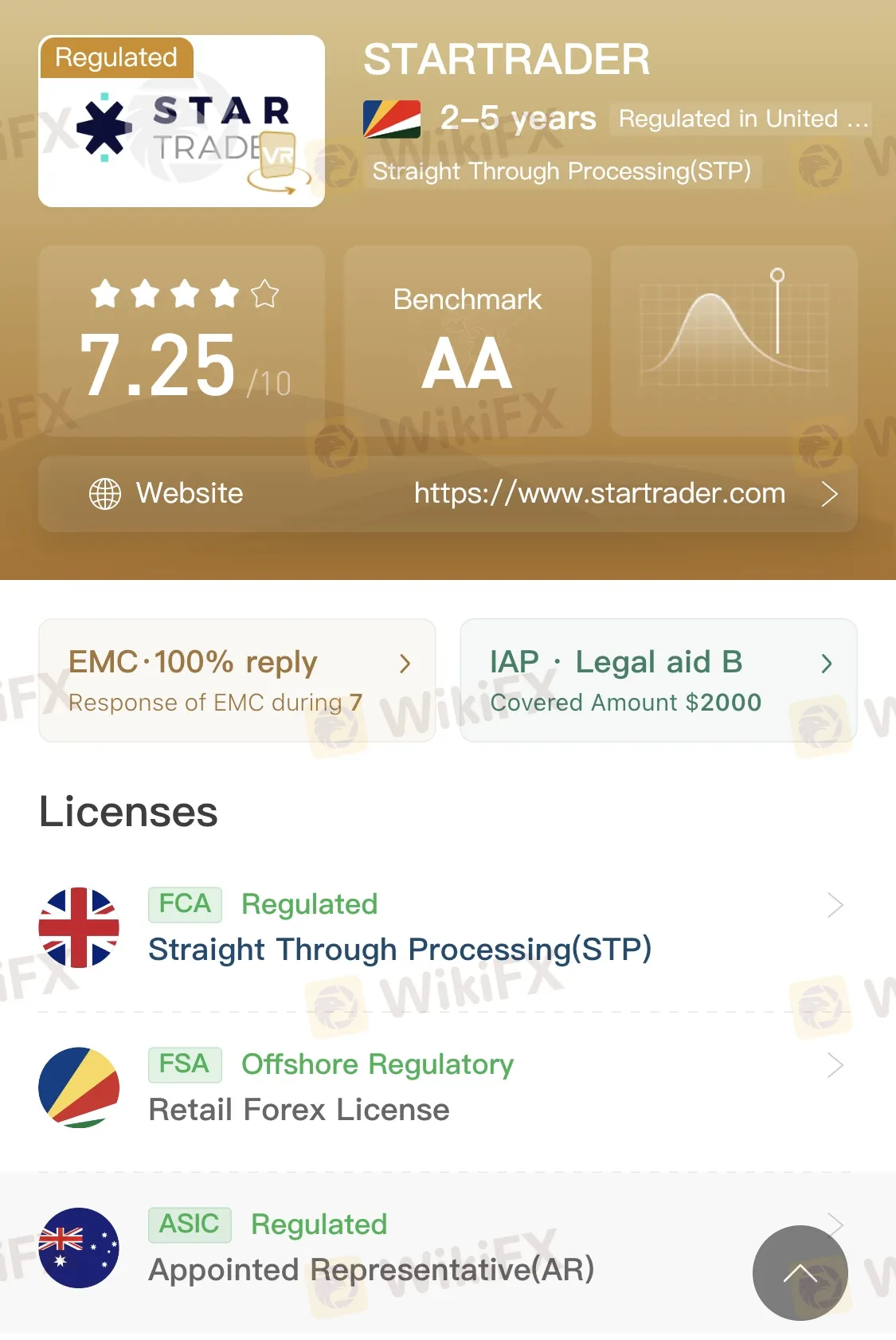

Here are a few trustworthy STP forex brokers that is approved by WikiFX:

WikiFX is a free global forex broker regulatory query platform that provides verified background information of over 40,000 forex brokers worldwide. We do your due diligence for you!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Elites Gather in Taipei to Forge a New Forex Ecosystem

On April 19, the exclusive cocktail party hosted by WikiFX Elites Club concluded successfully in Taipei. The event brought together local forex industry leaders, seasoned experts, and elite practitioners to discuss industry trends and share cutting-edge insights. It fully demonstrated WikiFX’s irreplaceable value as a globally leading forex investment ecosystem platform in gathering industry wisdom and driving sector development.

Beware of Gold Bar Investment Scams: Rising Threats

Gold bar scams surge in 2025 as gold prices hit $3,000/oz, targeting seniors. Learn how scammers exploit trust in gold and tips to avoid these frauds.

Why Trade Agreements Matter to Nations

In today’s interconnected world, trade agreements serve as the foundation for stable and predictable international commerce.

Trade Fights Are Heating Up—What Happens Next?

Global financial markets have become increasingly reactive to even minor developments in international trade talks.

WikiFX Broker

Latest News

eXch Exchange to Shut Down on May 1 Following Laundering Allegations

Think Scams Won’t Happen to You? That’s Exactly What Scammers Count On

Beware of Gold Bar Investment Scams: Rising Threats

Kraken Launches Forex Perpetual Futures on Kraken Pro Platform

Elites Gather in Taipei to Forge a New Forex Ecosystem

Over $4 Billion Laundered Through Crypto Scams in Paraguay

Currency Calculator