简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is CCAM Trustworthy?

Abstract:In today’s article, WikiFX will take you on a comprehensive review of CCAM to see if this broker is worth investing in.

About CCAM

CCAM is a forex broker based in Cayman Islands. The company name of this broker is City Credit Asset Management Co. Ltd. CCAM is newly-established and have trading experience of only less than one year. On its website, this broker did not emphasize when exactly this broker was founded. But we do know that the broker from the information on the bottom of the website.

We think this broker is established in 2017. The physical address of this broker is 4th Floor, Harbour Place, 103 South Church Street, Grand Cayman KY1-1002, Cayman Islands. WikiFX has given this broker a low score of 1.02/10.

Brand Story

On 17th November 2020, CCAM claimed it has been awarded the Best Hedge Fund Manager 2020 – Cayman Islands in Worldwide Finance Award 2020 hosted by Acquisition International.

Account Type & Minimum Deposit

Due to the lack of information on its website, we cannot find enough information about the account types and minimum deposit. However, clients still need to submit the account opening request in order to invest.

Customer Service

In addition to specify its physical address, CCAM also offers Telephone number 62-21-50889715. And email address: op-enquiry@ccaml.net. Clients can fill the enquiry to get more information.

Regulation

CCAM is not a regulated broker. CCAM claimed it to be administered by Cayman Islands Monetary Authority (CIMA) under the Securities Investment Business Law in Cayman. However, this claim is not reliable as we search no information about this broker on CIMA. This is a red flag you should consider before trading with CCAM.

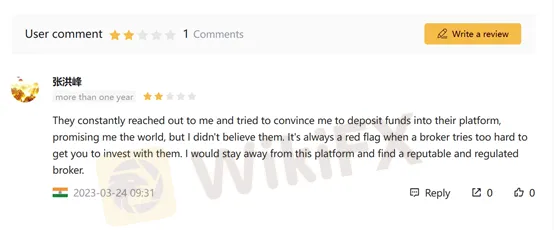

Feedback from Trader

WikiFX did not receive exposure related to this broker yet, butin the “User comment” section, one trader claims that the staffs of CCAM “constant reached out to him and tried too hard to persuade him to invest.” We think taat it is another red flag that traders need to be careful with.

Conclusion

CCAM is not a reputable broker as we consider it as an unregulated broker. And it has a fairly low score on WikiFX which makes the risk obvious. WikiFX advise traders to seek better alternatives.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Reasons Why Prime FX CFD is Not Worth Your Investment

Prime FX CFD is constantly grabbing headlines, but not for the right reasons. It has become an infamous name in the forex market, which, otherwise, has become the reason for many becoming financially independent globally. Investors have been taken for granted as scams keep happening. We have found some red flags with this scam forex broker. In this article, we will let you know about them. Keep reading!

JAFX - Where Investors Face Withdrawal Issues & Unprofessional Behavior

Are you facing withdrawal issues with JAFX? Are its executives asking you to pay a fee to get withdrawals? Accepted withdrawals failing to hit your wallet? You are virtually scammed by the company. Explore this story containing a wide range of issues investors face at JAFX.

5 Reasons Why Some Traders Choose XChief

xChief offers over 150 trading instruments, MT4/MT5 platforms, flexible account types, high leverage, fast withdrawals, and transparent offshore regulation.

What WikiFX Found When It Looked Into BingX

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BingX and its licenses.

WikiFX Broker

Latest News

Alchemy Markets: A Closer Look at Its Licenses

Wondering Why Your International Earnings Come Less Than Expected? It's Because of Forex Markup Fees

FCA to modernise rules to unlock investment

How Fake News Sites Are Fueling a Global Investment Scam Epidemic

From Novice to Pro: Why Investors Trust Land Prime?

10-year Treasury yield ticks lower after core CPI comes in slightly lightly lower than expected

Asia-Pacific markets mixed after Trump's tariffs on Indonesia

Labubu craze to drive up profit 350%, China\s Pop Mart says

PrimeXBT Launches MT5 PRO Account for Active Traders

Central banks are increasingly buying gold from local mines as prices surge

Currency Calculator