简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading with Exness: Understanding the UK FTSE's Impressive Surge

Abstract:Explore the UK's FTSE surge with Exness. Learn about its impact on trading and how Autochartist and Tickmill tools can help strategize your trades.

A remarkable increase in the UK's FTSE (UK100) has caught the attention of market observers worldwide. Over the past two weeks, the FTSE has seen an impressive 5.92% surge, skyrocketing from $7,224 to $7,652. This upward trend seems relentless, and some media outlets suggest that this UK index has the potential for even more growth. However, the question that remains is whether there's any foundation for this optimistic outlook. In this article, we delve into the UK's economic situation and what it means for trading.

Forecasting the trajectory of a nation's economy is far from an exact science. And if a country's economic pillars appear to be weakening, a buoyant viewpoint could turn out to be a precarious strategy. This scenario became a reality for the UK when it voted to leave the European Union in 2016. This decision resulted in a decade of economic challenges, which were, at the time, deemed manageable by the Bank of England and the UK Treasury.

Estimations of the exact cost of EU membership for the UK vary, but figures frequently hover around £7-£8 billion. The Centre for Economics and Business Research (CEBR) released a report indicating that post-Brexit, the UK is now losing approximately £9.5 billion per year. Additionally, the citizens' dissatisfaction with shouldering specific EU-related costs hasn't eased. Brexit dealt a hefty blow to the British economy, the ripple effects of which are still being felt across the nation.

The UK's economic woes were further exacerbated by the global COVID pandemic and the ongoing energy crisis. Any progress the UK had made was swiftly erased, pushing the nation towards a state of economic hardship. An alarming 14.5 million Brits are currently living in poverty – that equates to more than a fifth of the population. The UK economy now teeters on the precipice of recession, burdened by stubbornly high inflation rates, and disrupted by pay strikes affecting railways, schools, and even hospitals.

Despite these challenging circumstances, no concrete plans or definitive strategies have been proposed to reverse this downturn. This lack of action might suggest a bearish trend in the coming months. However, it's crucial not to jump to conclusions just yet. Investors and traders interested in UK-based assets should familiarize themselves with the latest insights from Barrons and other trusted financial sources before making their moves.

About Exness

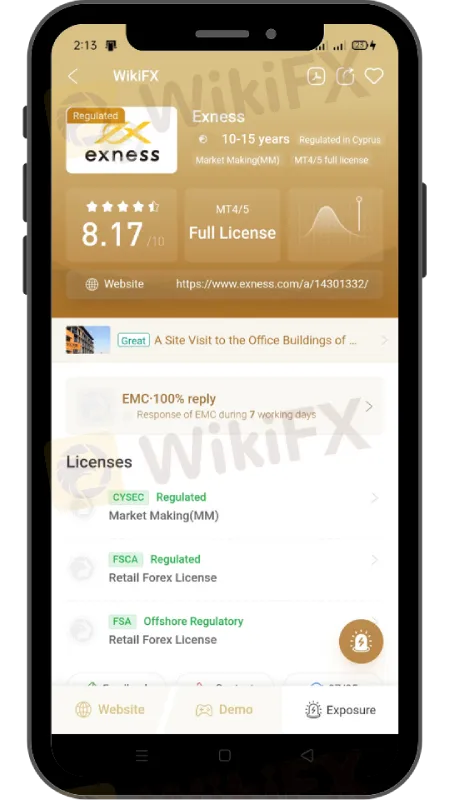

Exness is a leading international online trading platform offering a broad range of financial markets, including forex, stocks, indices, and commodities. Regulated by several financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, Exness provides clients with a safe and transparent trading environment. They are also recognized for their commitment to delivering excellent customer service and advanced trading tools to assist their clients in making informed trading decisions.

To stay updated on the latest financial news and trends, consider downloading and installing the WikiFX App on your smartphone. This handy tool provides up-to-date news that can significantly affect your trading decisions. Download the App here: https://www.wikifx.com/en/download.html.

Remember, in trading, knowledge is power. Arm yourself with the most accurate and timely information, and let tools such as the technical Exness platform guide you in navigating the financial markets. Always trade wisely and responsibly.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX "3·15 Forex Rights Protection Day" – Official Release of the Blacklist

WikiFX, as a globally leading forex investment ecosystem service platform, has always been committed to providing fair and authoritative broker verification services for forex investors, while offering solid rights protection support for every victim of forex investment. On February 26, 2025, WikiFX once again launched its annual "3·15 Forex Rights Protection Day" event, aiming to empower forex investors to speak out and defend their rights through open, transparent, and robust means.

Nigeria’s Oil and Gas Sector Gains Momentum

Nigeria’s oil and gas industry is experiencing a surge in investment, fueled by policy reforms and international collaboration, paving the way for continued energy expansion.

The Global Tariff War Escalates: Who Suffers the Most?

The global trade war is intensifying as countries continue to raise tariffs, aiming to protect their own economies while creating greater market uncertainty. In this tit-for-tat game, who is truly bearing the brunt?

Immediate Edge Review 2025: Is it safe?

Launched in 2019, Immediate Edge claims to be an automated cryptocurrency trading platform using AI technology for crypto trading services. The platform requires a minimum deposit of $250 to begin trading, which is relatively expensive for many investors. During its short operation, Immediate Edge failed to establish a positive reputation. The platform has undergone frequent domain changes and has repositioned itself as an intermediary connecting users with investment firms—a move that appears designed to obscure its actual operations. Immediate Edge restricts services to investors from the United States; it remains accessible to users in other regions.

WikiFX Broker

Latest News

Trump vs. Powell: The Showdown That Will Shape Global Markets

FINRA Panel Orders Stifel to Pay $132.5M for Misleading Investors

The Future of Trading is Here: How AI is Reshaping the Market Landscape

Nigeria’s Oil and Gas Sector Gains Momentum

Gold Price Hits Record High Amid Economic Uncertainty and Policy Shifts

Could DeepSeek Be Linked to a $390 Million Fraudulent U.S. Server Deal?

Ripple Secures Dubai License: First Blockchain Payments Provider in DIFC

BSP Restricting Offshore Forex Trades to Control Peso Volatility

Retiree Loses RM2.33 Million in Investment Scam – Could You Be Next?

SEC Charges Ronald A. Pallek in $1.54 Million Fraudulent Investment Scheme

Currency Calculator