简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

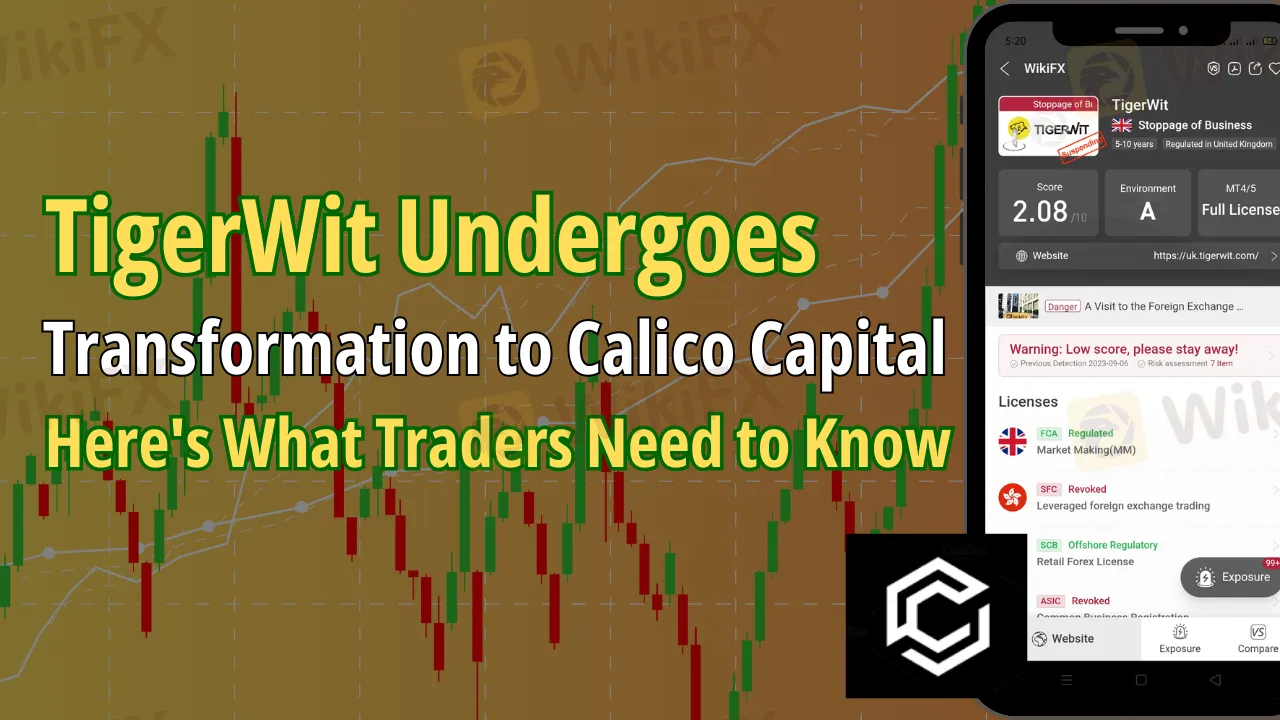

TigerWit Undergoes Transformation to Calico Capital: Here's What Traders Need to Know

Abstract:London's TigerWit rebrands to Calico Capital post FCA-licensed sale. Traders urged to stay vigilant amid offshore concerns.

London's renowned Retail FX and CFDs broker, TigerWit, is undergoing a significant transformation. The company, licensed by the Financial Conduct Authority (FCA), is gearing up for a rebranding and will soon be known as Calico Capital. This shift in identity follows a series of events, including a botched sale last year, a successful sale this year, and a falling out with its offshore partners.

A Quick Peek at TigerWits Past

About a decade ago, TigerWit was born out of the vision of Chinese entrepreneurs Summer Xu and Weilong Song. The firm mainly catered to clients in China and the Far East. Fast forward to 2016, TigerWit expanded its reach by gaining an FCA license, paving the way for its entry into the UK and European markets. Furthermore, in 2021, they secured an Electronic Money Institution authorization from the FCA.

Challenging Times and New Beginnings

Despite its ambitious start, TigerWit UK's financial performance did not reach anticipated heights. The firm's revenues saw a decline by 2022, leading the then-owner, Tim Hughes, to strike a deal with crypto exchange FTX. However, due to unforeseen circumstances, the deal crumbled.

Come 2023, a fresh opportunity knocked on TigerWit's door. Jim Manczak's investment company, Investor Limited, expressed interest in taking over. Now, with FCA's approval awaited, the company is all set to restart operations as Calico Capital. Their immediate focus will be on serving B2B and professional traders, with plans to cater to the general public by 2024.

A Word of Caution for Traders

The transition hasn't been without challenges. With the takeover, the global operations of TigerWit have ceased. However, traders need to be wary. Reports suggest that TigerWit LLC, the offshore segment previously associated with TigerWit, has been causing concerns for clients trying to withdraw their funds.

In light of this, Jim Manczak and his team have launched a warning for traders via their website, emphasizing the fact that TigerWit Group Limited and its associated entities do not offer any legitimate trading or financial services.Traders with concerns or complaints are being urged to reach out to their local regulatory bodies. Additionally, for any withdrawal requests or concerns related to funds, traders can directly get in touch with the company through support@tigerwitgroup.com.

Stay Alert, Stay Safe

This story highlights the ever-changing landscape of the financial world. As traders, staying updated and ensuring the authenticity of platforms is crucial. If you're associated with TigerWit or considering trading with its successor, Calico Capital, remember to be vigilant and informed.

For more such updates, consider downloading the WikiFX App via the provided link.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Valetax $35 No Deposit Bonus

Valetax has just upped the ante by offering a $35 no-deposit Welcome Bonus to new traders. Unlike many offers that require an initial deposit or come buried in fine print, Valetax’s bonus lets you begin trading on their MT4 platform—risk-free—immediately after verification. Here’s why this promotion stands out and how you can make the most of it.

Duhani Capital: A Scam Broker Hiding Behind Fake Promises?

Traders from the US, Pakistan, and Indonesia have notably raised complaints about Duhani Capital, a non-regulated broker. It has been proven to indulge in scammy practices, withholding traders’ funds, altering spreads without notifications and account terminations.

iFourX Scam Alert: Trapped Funds and Silent Support

Traders, including one from Japan, have raised concerns about iFourX, an unregulated broker, for their scammy tactics. The trader has witnessed blocked withdrawals, silent customer support, and restrictive account practices when dealing with the platform.

Alieus Capital Accused of Ignoring Withdrawal Requests and Cutting Off Support

A trader using Alieus Capital has raised serious concerns about the broker’s practices. They have reported an unapproved withdrawal request pending since March 18, with no live support and unanswered emails, which led to concerns about the broker’s operations.

WikiFX Broker

Latest News

OANDA Expands ETF Offerings in EU for Portfolio Diversification

FCA Introduces PASS and AI Testing to Support Financial Innovation

FCA Warns Public About 7 Unauthorised Financial Firms

Webull Canada Launches Options Trading and Advanced Tools

FTX Launches Legal Action to Reclaim Tokens from NFT Star and Delysium

Forex Traders Shift Focus: Risk Management Over High Leverage in 2025

Why High Leverage Causes Massive Losses in Forex Trading

Retiree Loses RM100,000 in Fake Investment Scheme that Promised 18% Return

USD/JPY Struggles Ahead of BoJ Decision Amid Easing Trade Tensions and Mixed Data

How the US Dollar Rules the Global Economy: Will Its Glory Continue?

Currency Calculator