简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fusion Markets Levelled Up!

Abstract:Fusion Markets levelled up its trustworthiness alongside its newly obtained Financial Commission membership.

The Financial Commission has recently welcomed Fusion Markets as its newest member, effective March 6th, 2024. This development underscores Fusion Markets' commitment to upholding high standards of dispute resolution and customer service within the forex and CFD trading industry.

The approval of Fusion Markets' membership application by the Financial Commission assures traders that they will receive services of superior quality in line with the commission's standards.

As a new member, Fusion Markets gains access to a range of benefits and services, including the potential protection of their customers for up to €20,000 per submitted complaint.

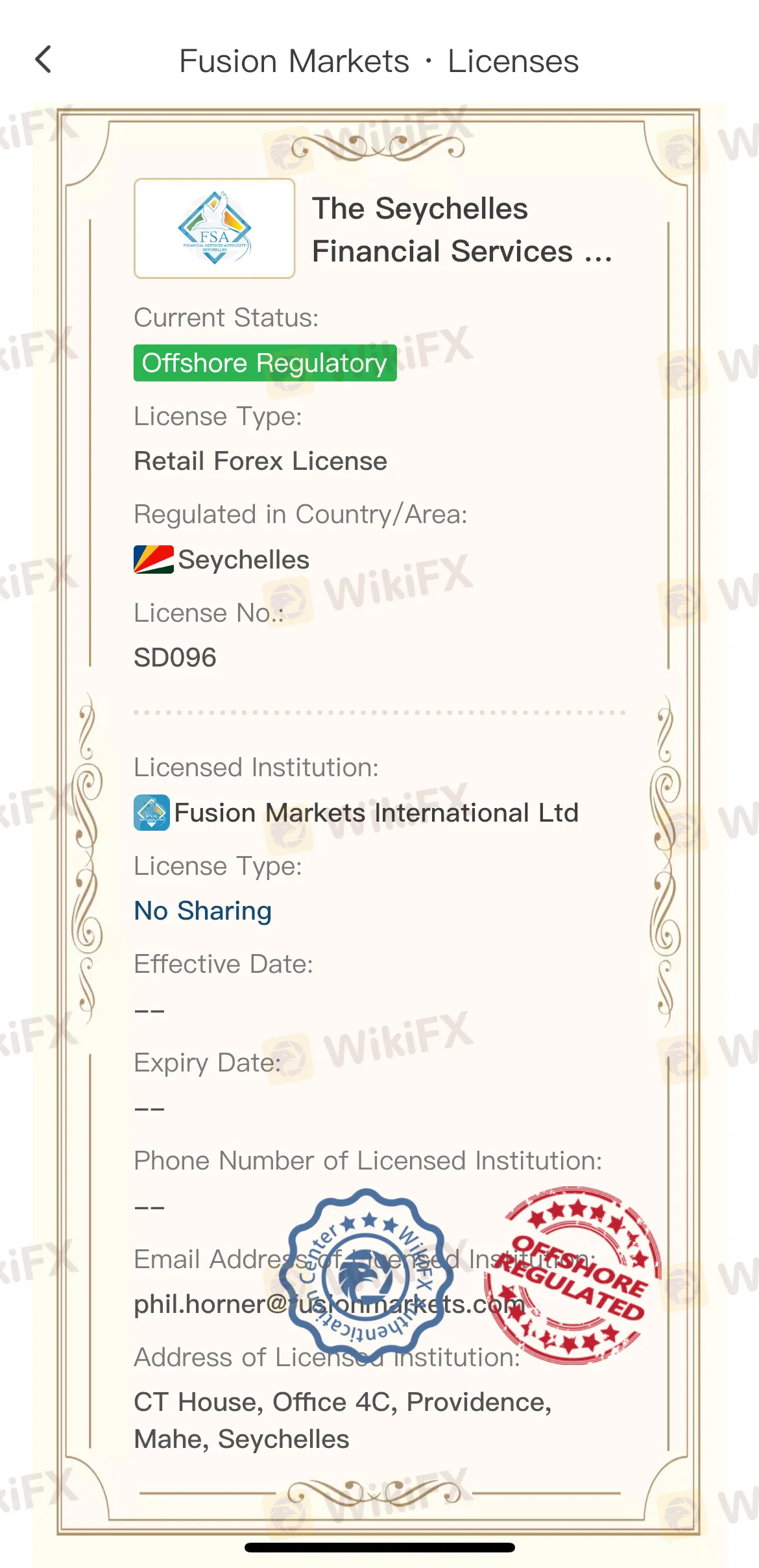

Fusion Markets was established in Melbourne, Australia, in 2017. It has become a trusted and affordable option for traders worldwide. Fusion Markets is known as a low-cost forex broker and provides services for trading in forex, commodities, indices, cryptocurrencies, and stock CFDs. It operates under FMGP Trading Group Pty Ltd, regulated by the Australian Securities and Investments Commission (ASIC) with Australian Financial Services License No. 385620. Additionally, it is also regulated by the Financial Services Authority of Seychelles with license number SD096.

View WikiFXs evaluation on Fusion Markets here: https://www.wikifx.com/en/dealer/4631413251.html

The Financial Commission operates as an independent international service, specializing in resolving trader-broker conflicts. Supported by the Dispute Resolution Committee (DRC), comprised of recognized industry professionals, it provides a streamlined resolution process compared to traditional regulatory channels like arbitration or local court systems. All clients of Financial Commission members are protected by the Compensation Fund, serving as an insurance policy. Furthermore, the Financial Commission issues execution certifications for approved brokers, with the aim of reducing the number of execution-related disputes before escalating into formal complaints.

The Financial Commission's ongoing expansion of its membership reflects the increasing demand for independent and unbiased dispute resolution in the financial trading sector. In line with this, the regulator has released case studies from 2023, providing insights into key themes and outcomes in disputes between traders and financial service providers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Funded Trader Success Rates Exposed: Much Tougher Than You Think

High profits with no risk? Funded trading programs might seem appealing, but the reality is brutal. Find out why only a tiny fraction of traders actually succeed.

Will Gold Holds Above $3,000 Despite Pressure from Rising Dollar

Gold prices dip as the dollar strengthens, but remain above $3,000 amid economic uncertainty and Trump’s tariffs. Will the rally continue?

Trade Demo, Win Real Money! Join WikiFX’s Trading Competition Now!

Tempted by the fast-paced world of online trading, new traders often jump straight into live markets, enticed by the potential for significant returns. However, for beginners, practicing on a demo trading account is an essential first step that should never be neglected before transitioning into live markets.

Thai Police Arrest Yakuza Suspect in Call-Center Scam Bust

Thai police arrest Yamaguchi, a yakuza suspect, in Bangkok for running call-center scams in Cambodia and Vietnam, seizing 30M baht in digital assets.

WikiFX Broker

Latest News

Robinhood Launches Prediction Markets Hub for Trading Events

Key Points Every Forex Beginner Must Know

Things You Need to Know About Capital88

Gold Hits New Highs: Is Now the Time to Buy?

Why US Lawmakers Urge Trump to Drop Crypto Before It Harms America

CME Group Adds Solana Futures in Both Standard and Micro Contracts

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Trade, Compete, Win: Enter the WikiFX World Elite Trading Championship

Kraken Eyes $1.5B Acquisition of NinjaTrader for Futures Trading

Dark Side of Finfluencers: They Aren’t Your Financial Friends!!

Currency Calculator