简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

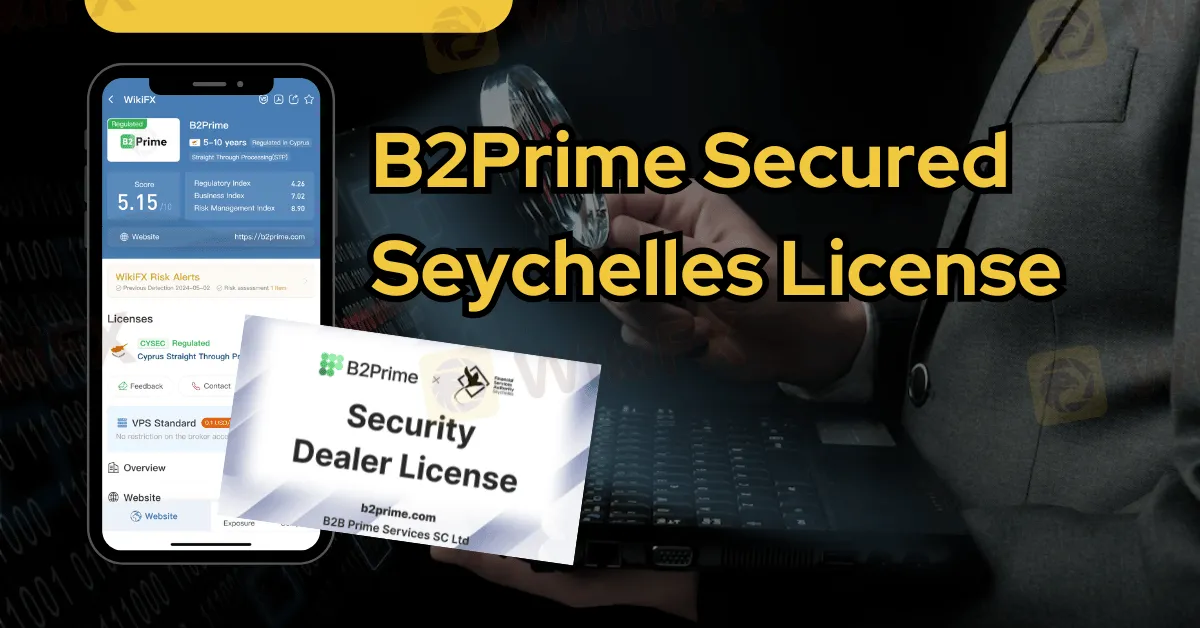

B2Prime Secured Seychelles License

Abstract:B2Prime, a liquidity provider offering services across multiple asset classes, has recently obtained a security dealer license in Seychelles, adding to its existing licenses in Cyprus and Mauritius.

B2Prime, a liquidity provider offering services across multiple asset classes, has recently obtained a security dealer license in Seychelles, adding to its existing licenses in Cyprus and Mauritius. This regulatory milestone signifies B2Prime's expansion into new jurisdictions and its commitment to providing compliant services to its global clientele. The company also received initial approval for a Dubai VARA crypto license.

Seychelles, recognized as an offshore hub for brokers, provides B2Prime with a strategic platform to distribute liquidity locally to regulated entities. With the newly acquired security dealer license, B2Prime is authorized to engage in essential financial activities, including securities negotiation, portfolio management, and transaction handling on behalf of clients.

B2Prime offers over 225 instruments across six asset classes, including Forex, Cryptos, Spot Indices, Precious Metals, Commodities, and NDFs, accessible through a single margin account. Clients benefit from deep liquidity pools sourced from Tier-1 providers, ensuring competitive spreads and efficient execution. The platform also provides seamless connectivity options through various integration channels like oneZero, PXM, Centroid, T4B, FIX API, and cTrader.

Eugenia Mykulyak, Founder & Executive Director of B2Prime, stated the company's aim to provide financial services to local brokers, hedge funds, money managers, institutional clients, and liquidity providers. This move aligns with B2Prime's global growth strategy and enhances its ability to capitalize on opportunities in the global financial markets.

B2Prime recently disclosed financial results for its parent company, demonstrating growth in the first quarter of 2024. Total assets in Cyprus increased significantly, reflecting a 40.32% rise from the previous year. Client assets held for trading also experienced substantial growth, rising by 47.6% to €26,840,460.11.

Shareholders' equity increased by 8%, indicating growth across various financial metrics. Regulatory capital adequacy showed improvement, with B2Prime's own funds increasing nearly 600% to €2,728,000, exceeding regulatory requirements.

These financial results highlight B2Prime's commitment to financial stability and growth, positioning the company as a player in the global financial landscape. With plans to disclose the fiscal report for B2Prime Mauritius soon, the company continues to strengthen its presence as a service provider for clients worldwide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

On August 1, 2025, the SkyLine Judge Appreciation Dinner was successfully held in Kuala Lumpur, Malaysia. As the first WikiFX SkyLine event in Malaysia this year, the dinner not only aimed to express sincere gratitude to expert judges, partners, and industry representatives who have long supported the development of the SkyLine Judge Community but also facilitated in-depth discussions on the future direction of forex trading safety, financial education, and industry transparency.

AssetsFX Scam Alert: 5 Troubling Signs

Forex trading has become a critical game now because of advancements in technology. Due to this Unfortunately, scam brokers have also entered in the Forex market. Therefore, you need to stay alert. This article aims to warn all traders and investors. Read carefully and stay aware.

Forex4Money: Where Your Money Goes In, But Never Comes Out!

Discover how Forex4Money traps investors with fake profit promises and blocked withdrawals. Read real complaints and protect yourself from this unregulated forex scam.

Forex Success Stories: Lessons You Can Use to Win

There can be many ups and downs even for the world’s best forex traders. However, they remain undeterred in their vision to overcome the challenges that come their way. That’s why they form part of forex success stories that continue to inspire generations. One can inherit some lessons to be among successful currency traders. In this article, we will be sharing the lessons you can use to be successful in forex trading.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Interactive Brokers Expands Forecast Contracts to Europe

Robinhood Gains 2.3M New Accounts, Platform Assets Close to $280B

CVS shares pop on earnings beat and outlook, as retail pharmacy and insurance units improve

CNBC's Inside India newsletter: Why an India-U.K. trade deal does not make U.S.-India agreement any easier

Currency Calculator