简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A South African Trader Claimed That SWIFT EARNERS Blocks His Withdrawal Request

Abstract:SWIFT EARNERS has emerged as a controversial and highly dubious player. Despite its claims of being a reliable broker with a base in the United States and additional operations in Thailand, the experiences of numerous victims tell a different story. A particularly harrowing account comes from a South African victim who has found himself ensnared in what appears to be a well-orchestrated scam.

SWIFT EARNERS has emerged as a controversial and highly dubious player. Despite its claims of being a reliable broker with a base in the United States and additional operations in Thailand, the experiences of numerous victims tell a different story. A particularly harrowing account comes from a South African victim who has found himself ensnared in what appears to be a well-orchestrated scam.

Case Description

The South African victim, whose identity we are protecting for privacy reasons, recounts their ordeal with SWIFT EARNERS:

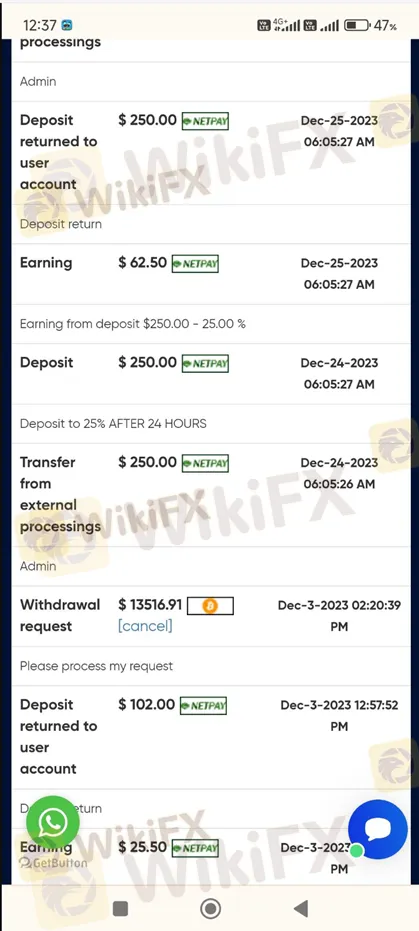

“These people (SWIFT EARNERS) take deposits from people and then dont payout when you want to withdraw. I have spent more than 20 thousand ZAR in withdrawal fees only to be told they have to charge again.”

This statement highlights a common tactic used by fraudulent brokers: imposing exorbitant and repeated withdrawal fees, effectively preventing clients from accessing their own money. Such practices not only erode trust but also highlight the malicious intent behind the operations of SWIFT EARNERS.

About SWIFT EARNERS

SWIFT EARNERS markets itself as a registered broker with trading experience spanning 1-2 years. However, this relatively short operational history combined with several red flags raises serious concerns:

Is it Legit?

SWIFT EARNERS operates without regulation, meaning any financial authority does not oversee it. This absence of regulatory oversight significantly increases the risk to investors, as there is no recourse for those who fall victim to its unscrupulous practices.

Physical Addresses

The broker lists two physical addresses: one in San Dimas, California, USA, and another in Bangkok, Thailand. These addresses do little to reassure potential clients, especially considering the international nature of financial fraud and the difficulties in pursuing legal action across borders.

Poor Reputation

Independent review platforms like WikiFX have given SWIFT EARNERS a dismal score of 1.22/10. Such a low rating is indicative of widespread dissatisfaction and multiple reports of unethical behavior.

Suspicious Business Practices

The story of our South African victim is not an isolated incident. SWIFT EARNERS has been reported to engage in several dubious practices:

Unresponsive Customer Service

The victim has reported that once he deposits their money, customer service becomes unresponsive or outright hostile, further complicating any attempts to recover funds.

Conclusion

The case against SWIFT EARNERS is compelling and deeply concerning.

Investors are strongly advised to conduct thorough research and opt for brokers with verifiable regulatory oversight. The allure of high returns should never overshadow the fundamental importance of security and trustworthiness in financial dealings.

In light of these findings, raising awareness and protecting potential investors from falling prey to such schemes is imperative. When choosing a trading partner, always prioritize transparency, regulation, and a solid reputation. If you want more information about certain brokers' reliability, you can open our website. Or you can download the WikiFX App to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Rise of Algorithmic Trading in Forex Markets: Opportunities and Risks

Over the past decade, the integration of technology into financial markets has revolutionized forex trading. Algorithmic trading, driven by complex mathematical models and real-time data, has become a cornerstone of modern trading strategies. This article explores the transformative impact of algorithmic trading on forex markets, as well as the opportunities and risks it presents.

Central Bank Policies,Forex Markets and Gold Prices

Central banks play a pivotal role in shaping global economic landscapes. Their policies—ranging from interest rate adjustments to quantitative easing—directly influence both forex markets and the price of gold. As major players, central banks not only aim to stabilize their economies but also inadvertently set off a chain reaction in the trading world.

SkyLine Spotlight: XM, Leading the Future with Excellence

As the global multi-assets investment market flourishes, the localized differences within the forex market have become increasingly pronounced. WikiFX, serving as a forex broker information service platform across over 180 countries and regions, has developed a brand-new local broker guide, WikiFX SkyLine Guide, for users. This guide is founded on extensive data analysis and incorporates authoritative evaluations from local experts. It employs a rigorous multi-dimensional scoring system to enhance transparency and credibility within the foreign exchange industry. The primary objective is to assist investors in identifying the most reputable local brokers.

A Must-To-Watch Top Trading Pairs This 2025

Discover the top trading pairs to watch this week, including Bitcoin, Euro, USD, and more. Market trends, key resistance levels, and price movements analyzed.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

Will Trump's Trade Policies Fuel Inflation? BlackRock Warns of Economic Risks

Will a Stablecoin Bill Shape the Future of Crypto Regulation?

Bybit Launches Zero-Fee Trading for MT5 Index CFDs Until April 12

The Rise of Algorithmic Trading in Forex Markets: Opportunities and Risks

WikiFX "3·15 Forex Rights Protection Day" – Official Release of the Blacklist

Why Scammers Let You Win Before Taking It All

A Must-To-Watch Top Trading Pairs This 2025

Currency Calculator