简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

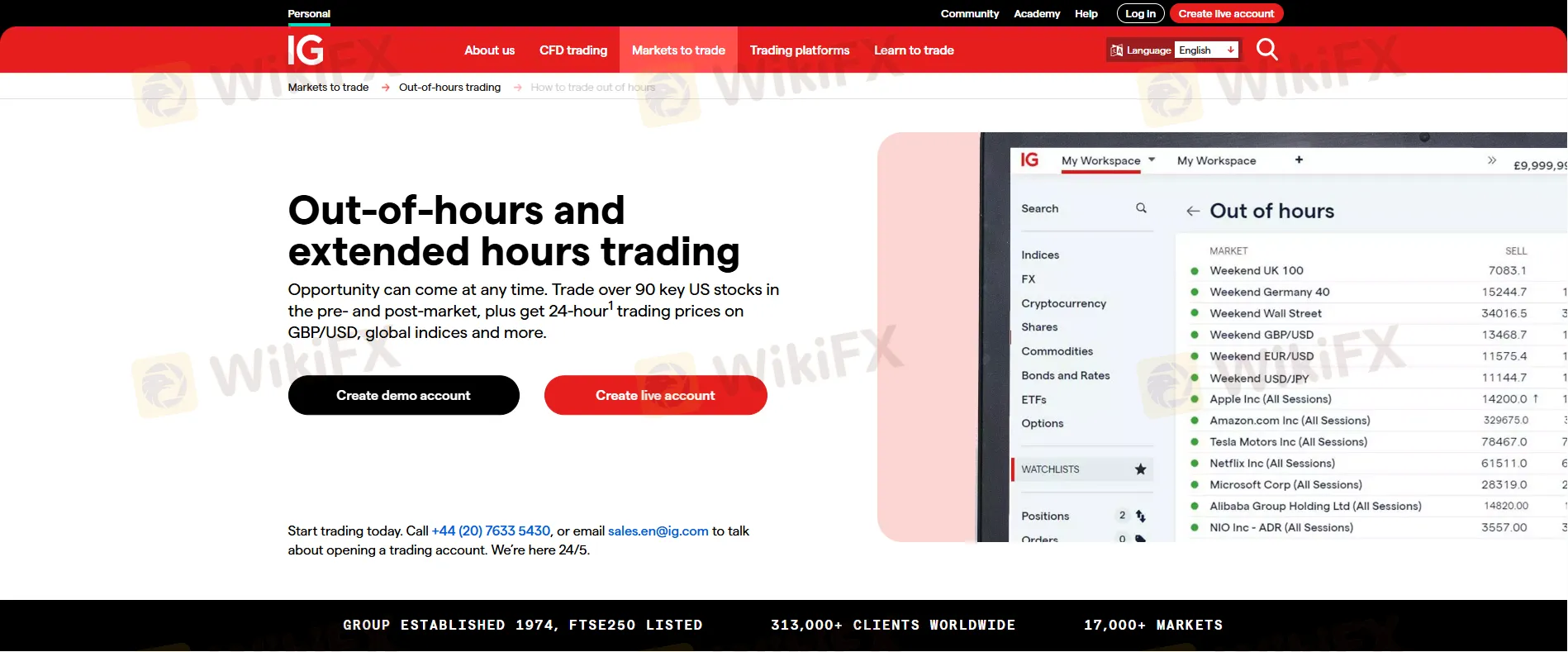

IG Adds 25 Stocks for Extended Hours Trading

Abstract:IG adds 25 new stocks for extended hours trading, available to UK clients from 9 am to 1 am Monday-Thursday, and 9 am to 10 pm on Fridays.

IG, the global leader in electronic trading, has added 25 more equities to its extended-hours trading platform.

UK customers may now trade these new equities Monday through Thursday from 9 a.m. to 1 a.m., and Friday from 9 a.m. to 10 p.m. This increase enables traders to have access to a greater choice of equities outside of typical market hours, improving their ability to react to market moves quickly.

IG is noted for continually increasing its trading instruments. The firm just launched US-listed options and futures trading for UK customers. This new tool gives users access to over 7,000 underlying options and futures, providing complete depth and liquidity to the US market.

Furthermore, IG's platform allows rapid financing and currency conversion, allowing traders to capitalize on opportunities as soon as they arise. This extensive offering demonstrates IG's dedication to providing customers with a varied and responsive trading experience.

Access IG page at WikiFX to route to the official website.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fall Instead of Rising, Hitting a Two-Week Low

Despite geopolitical tensions, gold prices have dropped sharply, reaching a two-week low. Markets refocus on Fed policy and broader macro trends.

Nigeria to Launch Sweeping Cybersecurity Reforms Amid Rising Digital Threats

With cyber threats escalating and economic losses exceeding ₦250 billion annually, Nigeria is launching comprehensive reforms to safeguard its digital future and build a more resilient cybersecurity infrastructure.

Overlooking Broker Spreads? It’s Costing You More Than You Think

In the ever-competitive world of online trading, where margins are slim and timing is everything, traders often obsess over entry strategies, risk management, and technical setups. Yet one critical element is routinely underestimated, if not outright ignored, especially by retail and novice traders alike, is the broker’s spread.

Reviewing CFreserve - Regulation Status, Operation Period & More

Has CFreserve deceived you financially? Did you face problems regarding forex investment withdrawals with this broker? You’re not alone! Read this exposure story to know how it's duping investors.

WikiFX Broker

Latest News

HYCM Broker Review 2025: A Comprehensive Overview

WikiFX’s Complimentary Protection Services Aim to Safeguard Investors' Legal Rights and Interests

Exness Acquires €75 Million Property in Cyprus for Future Growth

CMCMarkets vs J.P. Morgan: Which One is Suitable for You?

Broker Review: EightCap VS iFOREX ! Which Trading Platform Should You Choose?

TradeHall vs. HYCM: Which Broker Should You Choose?

Is SDStarFX a Legal Broker? Read This to Find Out

Is Your Money Safe with Libra Markets? Check Out Fast!

FCA Issues New Warnings Against Clone and Unauthorised Firms

Important Statement on the Authenticity of WikiFX Score and Broker Reviews

Currency Calculator