简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exness Secures FSCA ODP License in South Africa

Abstract:Recently, Exness has announced a significant milestone in its operational journey, as the Financial Sector Conduct Authority (FSCA) of South Africa has granted the company an ‘Over-the-Counter Derivative Provider’ (ODP) license.

Recently, Exness has announced a significant milestone in its operational journey, as the Financial Sector Conduct Authority (FSCA) of South Africa has granted the company an ‘Over-the-Counter Derivative Provider’ (ODP) license. This prestigious license not only broadens Exness regulatory portfolio but also reinforces its dedication to maintaining the highest standards of client security, regulatory compliance, and market transparency within the South African financial landscape.

Strengthening Client Protection and Trust

The ODP license is a testament to Exness unwavering commitment to client protection. It mandates rigorous risk management protocols and stringent reporting standards, offering clients an additional layer of security in their trading activities. By adhering to these elevated regulatory requirements, Exness continues to solidify its reputation as a trusted broker for local traders, ensuring a secure and reliable trading environment.

Paul Margarites, Exness Regional Commercial Director, highlighted the significance of this achievement:

“The ODP license acquisition signifies a significant stepping stone for Exness in South Africa. Our promise to provide a frictionless trading experience doesn‘t stop at trading conditions and a seamless client journey. Still, it extends to robust safety and security measures that put our clients first. In today’s online trading landscape adherence to the FSCAs stringent standards ensures that our South African clients have an extra layer of peace of mind when trading with Exness.”

Elevating Industry Standards Through Technology and Ethics

Exness is known for leveraging advanced technology and ethical practices to set new benchmarks in the trading industry. The company‘s proprietary platform, renowned for its superior performance and unique market protections, offers clients a seamless and frictionless trading experience. This latest regulatory achievement is a reflection of Exness’ ongoing efforts to create favorable conditions for traders, ensuring that their market interactions are secure, efficient, and transparent.

With the FSCA ODP license, Exness not only enhances its regulatory stature but also reaffirms its dedication to providing top-tier trading services in South Africa. This development is poised to instill greater confidence among traders, further establishing Exness as a leading force in the global financial markets.

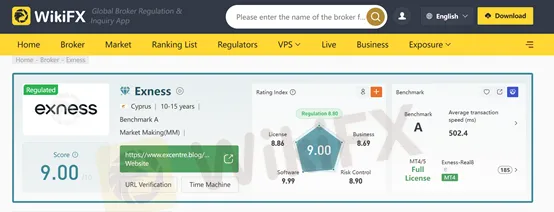

Exness on WikiFX

Exness is a globally recognized forex broker, operating in over 170 countries, offering a diverse range of tradable assets, including currencies, commodities, and cryptocurrencies. With a daily execution of over 300,000 trades and monthly trading volumes exceeding $1 trillion, Exness is a high-volume broker known for its transparency. Regulated by CySEC , FCA FSCA, and FSA in different jurisdictions, Exness adheres to strict financial standards. In this Exness review, we'll explore the broker's offerings in detail to reveal the real exness.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

Webull and SK Growth complete their business combination, with Webull now trading under the ticker “BULL.” App hits 50 million downloads worldwide.

UN Warns Asian Scam Operations are Spreading Worldwide

UN report reveals Asian scam operations expanding globally, targeting Africa, Latin America with cyberfraud, generating billions amid crackdowns.

PrimeXBT Expands with Stock CFDs for Major Global Companies

PrimeXBT introduces stock CFDs, allowing trading of major US stocks like Amazon, Tesla, and MicroStrategy with crypto or fiat margin options.

TRADE.com UK Sold to NAGA Group Amid 2024 Revenue Drop

TRADE.com UK sold to NAGA Group for £1.24M after a 65% revenue drop and £346K loss in 2024, marking NAGA's UK return.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

StoneX Subsidiary, Gain Global Markets Bermuda, Penalized for Trading Misconduct

The Crypto Shift: Challenges and Opportunities for Traditional Brokers

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

How is AI Transforming Scams and Making Them Harder to Detect?

Coinbase Cuts Fees on PayPal Stablecoin to Boost PYUSD Use

Singapore’s Web of Investment Scams: Mounting Debts Are Breaking Victims

Currency Calculator