简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Two Victims Lose Over RM660K in Investment Scams

Abstract:Two individuals recently fell victim to fraudulent investment schemes in Malaysia, losing a combined total of RM660,000. Both cases highlight the persistent threat of online financial scams and the need for caution when engaging with unverified platforms.

Two individuals recently fell victim to fraudulent investment schemes in Malaysia, losing a combined total of RM660,000.

In the first case, a 53-year-old account manager from Johor lost RM444,000 in a stock investment scam. According to Johor Bahru South district police chief ACP Raub Selamat, the victim was approached in July by someone posing as a stock investment consultant. The consultant introduced him to an app called Arcadia Equity, which allegedly promised substantial profits.

Between 31 October and 22 November, the victim made 16 transactions, transferring RM444,000 to seven different accounts linked to the scheme. His account on the app later showed a profit of over RM3.1 million. When he attempted to withdraw the funds, he was informed that a 10% commission of RM289,000 was required. Realising he had been deceived, the man reported the scam to the police.

In a separate incident, a 61-year-old New Zealand national residing in Malaysia lost RM216,000 to another fraudulent investment scheme. Johor Bahru North district police chief ACP Balveer Singh Mahindar Singh revealed that the victim was contacted on 2 October by an individual promoting an investment opportunity through the website https://m.worldcoinkk.com.

The victim was promised monthly returns of 3% to 5% on his investment, which he was instructed to deposit into a Hong Leong Bank account under the name SPB International Sdn Bhd. Between 3 and 25 October, he made 27 transactions totalling RM216,000. After receiving no returns, he realised the scheme was a scam and filed a police report.

Both cases are being investigated under Section 420 of the Penal Code, which addresses offences related to cheating. Convictions under this section can result in imprisonment of up to ten years, whipping, and fines.

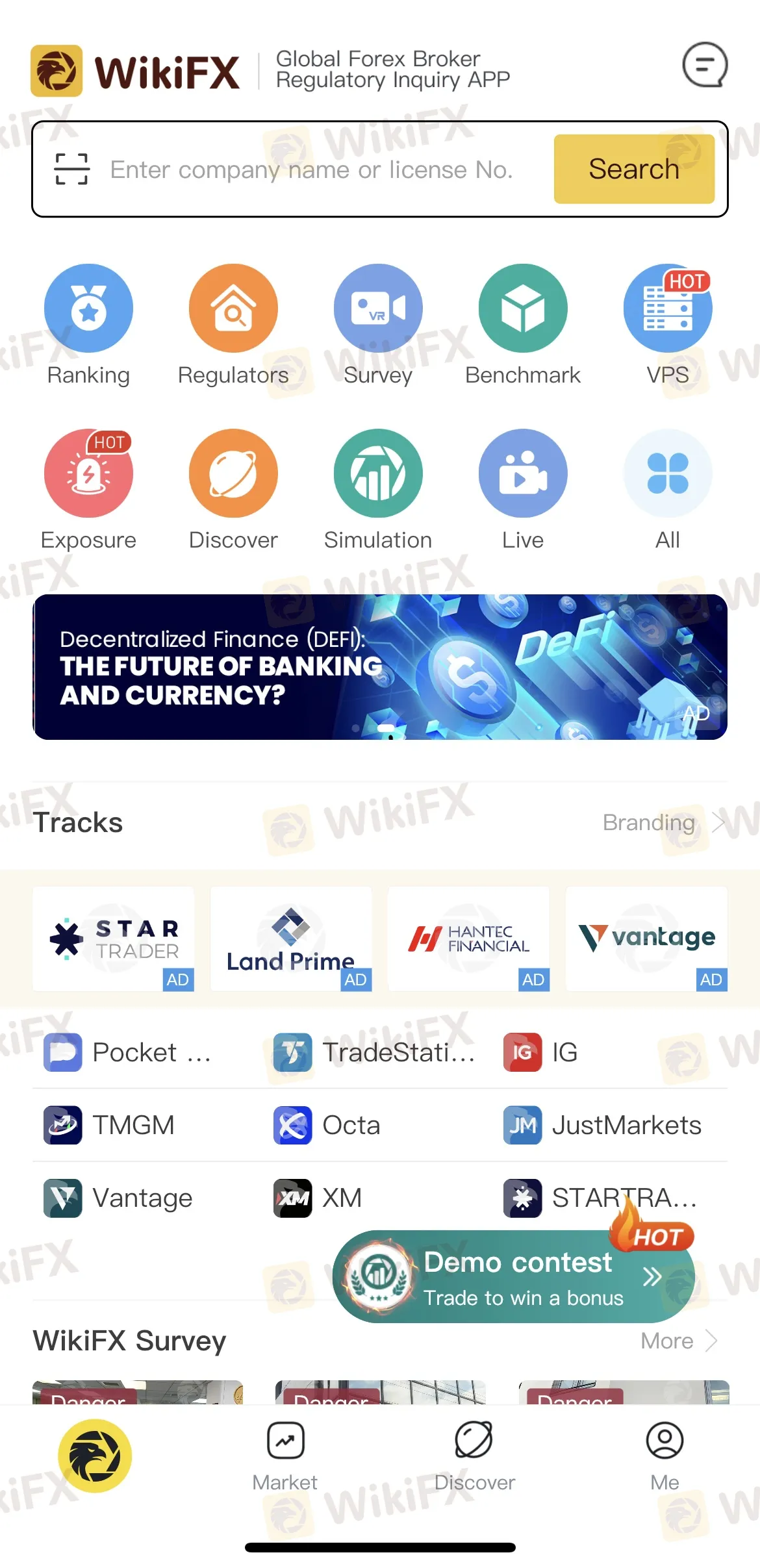

To help investors avoid similar scams, platforms like WikiFX provide essential resources for verifying the legitimacy of brokers and financial services. WikiFX offers a comprehensive database that includes global broker profiles, regulatory information, and user reviews. Its risk ratings and alerts help users identify unlicensed or suspicious entities. By using WikiFX, investors can make more informed decisions and protect their savings from fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

No Regulation, Revoked Licence: Is Tradehall Safe to Use?

In the fast-growing world of online trading, safety and regulation must always come first. Traders need to choose brokers that are properly licensed and follow the rules. Sadly, not all brokers meet these standards, and Tradehall is a clear example of this.

Retirement Dreams Shattered: Don't Do This To Yourself!

Two retired Malaysian men have collectively lost more than RM1.14 million to fraudulent investment schemes promoted on social media platforms.

Markets4you vs. IronFX: Which Broker Offers a Safer, Smarter Trading Experience?

Choosing the right forex broker is more than just finding low spreads or high leverage. Traders must consider regulation, platform quality, account types, and overall trustworthiness. In this comparison, we look at Markets4you and IronFX, which are two brokers with very different strengths and risks.

Markets4you Adds Global Stocks with New PAMM Program

Markets4you adds 20+ new global stocks and introduces the PAMM Partner Program, marking key milestones for 2025 with enhanced Forex trading opportunities.

WikiFX Broker

Latest News

Inside MBI: The Billion-Dollar Ponzi Scheme That Shook Malaysia

ZFX: A Closer Look at Its Licences

Should you buy or sell US dollars in the next three to six months?

Tradehall Broker Review 2025: Read Before Trade

XM Rolls Out New Forex Trading Competition Platform for 2025

Tether Freezes $12.3 Million in USDT Over Money Laundering Concerns

No Regulation, Revoked Licence: Is Tradehall Safe to Use?

Danske Bank expects the European Central Bank to make its final interest rate cut in September.

EU Regulators Imposed Over €71M in Sanctions in 2024, ESMA Calls for Enforcement Convergence

MiCA Unlocks EU Crypto Market, but National Tensions Rise as Gemini and Coinbase Near Approval

Currency Calculator