简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

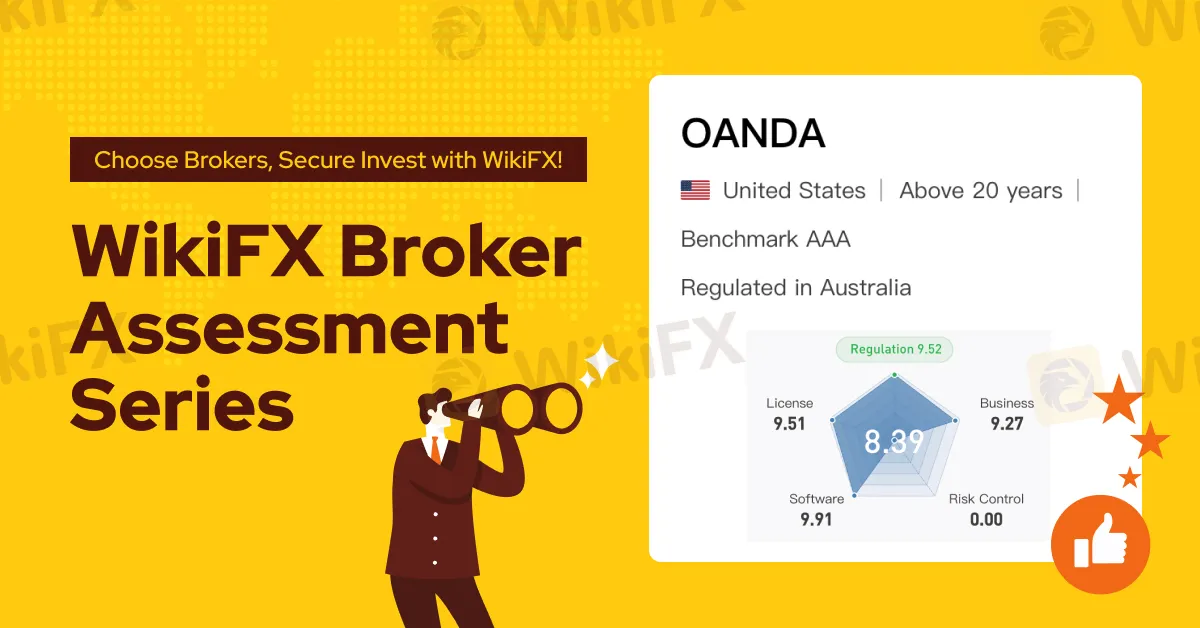

OANDA 2025 Most Comprehensive Review

Abstract:This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

OANDA is a well-known brokerage established in the United States, primarily offering forex trading services. It also allows EU clients to trade U.S. stocks, expanding its global reach. OANDA is renowned for its user-friendly trading platforms and powerful research tools, making it particularly suitable for beginner investors. The account opening process is straightforward and fast, making it an ideal choice for those entering the market.

OANDA's trading platforms perform excellently, offering useful features like chart customization and price alerts. Both the mobile and web platforms share the same functionalities, providing a highly user-friendly experience. The desktop platform excels in customizability, order types, and portfolio reporting.

OANDA also offers an extensive range of research tools, including various technical indicators and a robust API, to help investors conduct in-depth market analysis.

Fee Structure

OANDA sets a low-cost fee structure with competitive spreads for forex and CFD trading. The minimum deposit is $0, and withdrawal fees are also $0. Additionally, the first card withdrawal each month is free, providing convenience for users in managing their funds. All trading fees are included in the spread, so no separate commissions are charged. For example, the spread for EUR/USD is 1.0.

Product Range

OANDA offers a wide range of products, including forex, CFDs, and cryptocurrencies. These products meet the needs of various investors, from beginners to experienced traders, with tools suitable for all types of market participants. Its diverse product offerings make it a preferred platform for global investors.

Overall, OANDA is a reliable brokerage with its low trading costs, user-friendly platforms, rich research tools, and diversified product offerings. For investors seeking a trustworthy trading platform, OANDA is undoubtedly a solid choice.

To learn more about the reliability of specific brokers, feel free to visit our website (https://www.WikiFX.com/en) or download the WikiFX App, helping you find the most trusted brokers to ensure your trading is safer and more reliable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IronFX Review 2025: Is This Broker Trustworthy or a Scam?

Discover our comprehensive 2025 IronFX review. Explore account types, trading performance, regulation, and user feedback to determine if this broker is trustworthy or a potential scam. Updated June 13, 2025.

Forex Trading Challenges in India

Explore this guide to understand the challenges that deter India's forex market from unleashing its true potential.

The Deepening Roots of Forex Scams in India

Check out how forex scams in India have expanded beyond banks and unregistered brokers to include the informal gang racket duping investors every day.

Trade Nation vs. HYCM: Which Broker Should You Choose?

When it comes to online forex trading, picking the right broker can make a big difference. Two popular choices, Trade Nation and HYCM, that offer different features, rules, and trading conditions. Both are regulated by financial authorities, but they follow different approaches in areas like fees, trading tools, and customer support. This comparison helps traders understand which platform might suit their needs better.

WikiFX Broker

Latest News

Advantages of Using EA VPS for Trading - Detailed Guide

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

MetaQuotes Rolls Out MT5 Build 5120 with Enhanced Features and Stability Fixes

Indian "Finfluencer" Asmita Patel Banned: SEBI Slaps Charges on Her Company, AGSTPL

HDFC Bank's Green Push: Empowering 1,000 Villages with Solar Energy

Safe-Haven Surge: Gold Shines Amid Market Turmoil

Why Your Stop Loss Keeps Getting Hit & How to Fix It

Eightcap Secures Dubai License to Expand in MENA Operation

Important Statement on the Authenticity of WikiFX Score and Broker Reviews

The Deepening Roots of Forex Scams in India

Currency Calculator