简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

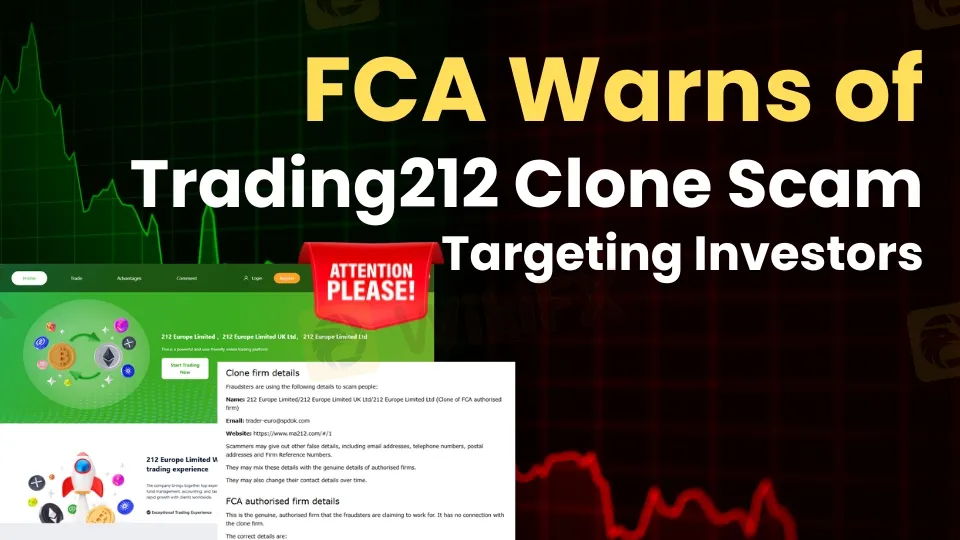

FCA Warns of Trading212 Clone Scam Targeting Investors

Abstract:FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

The UK Financial Conduct Authority (FCA) has issued a warning against a fraudulent clone firm impersonating Trading212 to scam unsuspecting investors. Fraudsters often create fake companies using the details of regulated firms, including their name, address, website, and branding, to appear legitimate and deceive victims into depositing funds.

Clone Firm Details

The FCA has identified the fraudulent company using the following details:

- Name: 212 Europe Limited/212 Europe Limited UK Ltd/212 Europe Limited Ltd

- Email: trader-euro@spdok.com

- Website: https://www.ma212.com/#/1

Official Trading 212 UK Details

The genuine Trading212 UK Limited is fully authorized and has no connection with the fraudulent clone. Below are the verified details:

- Firm Name: Trading212 UK Limited

- FCA Reference Number: 609146

- Address: Aldermary House, 10-15 Queen Street, London, EC4N 1TX, UNITED KINGDOM

- Telephone: +44 020 3857 1320

- Email: info@trading212.com

- Website: www.trading212.com

Why This Matters

If you unknowingly engage with a clone firm, you wont be eligible for financial protections such as the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS). If the fraudulent firm collapses, your money is likely unrecoverable.

WikiFX database has found several clones of Trading212 that need your attention:

How to Stay Safe

To avoid scams like this, always:

✔ Verify broker details on the FCAs official register.

✔ Be cautious of unsolicited emails or investment offers.

✔ Use the WikiFX app, a trusted platform to verify broker legitimacy and detect fraudulent firms before investing.

About the FCA

The Financial Conduct Authority (FCA) is the UKs regulatory body overseeing financial markets. It ensures firms operate fairly and transparently, protecting investors from fraud and misconduct.

Stay informed, verify brokers, and secure your investments.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Trading Challenges in India

Explore this guide to understand the challenges that deter India's forex market from unleashing its true potential.

The Deepening Roots of Forex Scams in India

Check out how forex scams in India have expanded beyond banks and unregistered brokers to include the informal gang racket duping investors every day.

Trade Nation vs. HYCM: Which Broker Should You Choose?

When it comes to online forex trading, picking the right broker can make a big difference. Two popular choices, Trade Nation and HYCM, that offer different features, rules, and trading conditions. Both are regulated by financial authorities, but they follow different approaches in areas like fees, trading tools, and customer support. This comparison helps traders understand which platform might suit their needs better.

Eightcap Secures Dubai License to Expand in MENA Operation

Eightcap gains Dubai SCA Category 5 license, enabling financial consultation and introducing broker services in the UAE. Learn about its MENA expansion plans.

WikiFX Broker

Latest News

Advantages of Using EA VPS for Trading - Detailed Guide

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

MetaQuotes Rolls Out MT5 Build 5120 with Enhanced Features and Stability Fixes

Indian "Finfluencer" Asmita Patel Banned: SEBI Slaps Charges on Her Company, AGSTPL

HDFC Bank's Green Push: Empowering 1,000 Villages with Solar Energy

Safe-Haven Surge: Gold Shines Amid Market Turmoil

Why Your Stop Loss Keeps Getting Hit & How to Fix It

How Money Moves the World | Why Finance Matters for Everyone

IG Japan Issues Trading Alert as Israel‑Iran Tensions Escalate

Investor Alert: SEBI Introduces New UPI Safety Net Against Scam Brokers

Currency Calculator