简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Overnight, Negative News Dissipates Entirely, Risk Assets Stage a Massive Rally

Abstract:Trump has begun to transform from a stubborn child into a Mr. Nice Guy, admitting that he believes the 145% tariff imposition is excessively high, suggesting a potential U-turn with a significant redu

Trump has begun to transform from a stubborn child into a Mr. Nice Guy, admitting that he believes the 145% tariff imposition is excessively high, suggesting a potential U-turn with a significant reduction in the future. U.S. Treasury Secretary Mnuchin stated at a public event that a resolution to the U.S.-China trade negotiations is possible, but the talks will be challenging and protracted.

Market movements often unfold unexpectedly and conclude when least prepared. Gold's volatility has intensified in the past two days. We maintain our previous view that the explosive surge in gold prices is now part of history. We believe gold has reached a bubble phase, drawing parallels to the South Sea Bubble and Tulip Mania. While historical events differ, the underlying sentiment is quite similar.

The recent final surge in gold prices peaked near $3500 per ounce. Both retail investors and investment banks heavily invested in gold. However, the order book depth in the gold trading market is relatively small compared to other markets, leading to a faster pace of price increases. Crowded trading has become a reality, constantly reminding us to avoid where the crowd goes.

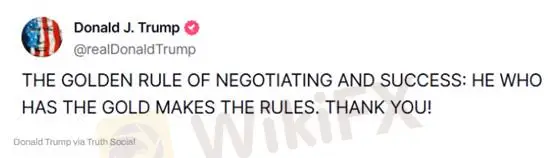

We previously pointed out that the logic behind Trump's social media post causing a significant gap up in gold prices was flawed, as the tweet did not specifically refer to gold. Trump stated: “Negotiating and the Golden Rule of success is simple: Whoever has the gold makes the rules. Thank you!” The correct interpretation is: Those who possess money (resources) are the ones who make the rules. He was essentially saying that power, money, and influence are closely intertwined, and in negotiations, whoever has stronger capital calls the shots.

The tweet was merely an allegory, not a direct message saying that having gold guarantees victory or being king of the hill!

(Figure 1: Gold's All-Time High Resulted from a Misinterpretation; Source: Truth Social)

Returning to risk assets, the market is gradually regaining rationality, leading to a narrowing of stock index losses. Coupled with rising stock prices and falling gold prices, observing market logic, we believe that funds from the crowded gold trade are gradually exiting and moving into more attractive equities and bonds.

Following positive earnings reports from Boeing and Enphase Energy yesterday, investors are no longer focusing on the tariff turmoil created by Trump. Instead, they are turning their attention back to earnings reports and future outlooks. Alphabet, Intel, and PepsiCo are scheduled to release their quarterly earnings reports early Thursday morning, with durable goods orders and initial/continuing jobless claims on the economic data front. We still anticipate significant upward revisions to future corporate earnings estimates by market analysts, with a retaliatory rebound extending into the end of the second quarter.

Of course, we still consider risk assets to be in a rebound phase. When all four major tailwinds are fully priced into the market, the manufacturing inventory cycle will be nearing its end. This economic vacuum will prompt us to adopt a more conservative trading strategy. However, now is the time to seize opportunities for quick gains, and investors should not miss out – limited availability is indeed harsh!

The Four Major Future Tailwinds:

Powell cuts rates and ends QT (Quantitative Tightening)

Tariffs are raised high but then lowered gently

Corporate tax cuts are passed

The Russia-Ukraine war ends

Gold Technical Analysis

Gold's price has fallen by nearly $240 during this swing, and the short-term trend structure has shifted from bullish to bearish control. Today's Asian session rebound is not a signal to go long but rather an opportunity to look for short positions. The resistance level to watch is around 3380. If it holds, consider establishing short positions. The suggested stop-loss is $25.

Support: [Blanks in original text] Resistance: [Blanks in original text]

Risk Warning: The above views, analyses, research, prices, or other information are provided for general market commentary only and do not represent the position of this platform. Any individuals viewing this information should bear all risks themselves and trade cautiously.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ZFX: A Closer Look at Its Licences

XM Rolls Out New Forex Trading Competition Platform for 2025

Should you buy or sell US dollars in the next three to six months?

Tradehall Broker Review 2025: Read Before Trade

Inside MBI: The Billion-Dollar Ponzi Scheme That Shook Malaysia

Danske Bank expects the European Central Bank to make its final interest rate cut in September.

Retirement Dreams Shattered: Don't Do This To Yourself!

EU Regulators Imposed Over €71M in Sanctions in 2024, ESMA Calls for Enforcement Convergence

No Regulation, Revoked Licence: Is Tradehall Safe to Use?

Philippines Sets Southeast Asia’s First Crypto Regulatory Framework

Currency Calculator