Trump Imposes 25% Tariffs On Japan, South Korea After Failing To Reach Deal

요약:Update (1246ET):U.S. main equity indexes, the S&P 500 and Nasdaq, fell to session lows after the Tru

U.S. main equity indexes, the S&P 500 and Nasdaq, fell to session lows after the Trump administration released tariff letters to a handful of countries, citing “persistent trade imbalances” and the failure to reach trade deals before the July 9 deadline. The tariffs are expected to take effect on August 1.

The first two trade letters were sent to South Korea and Japan, imposing a 25% tariff on all goods, effective August 1.

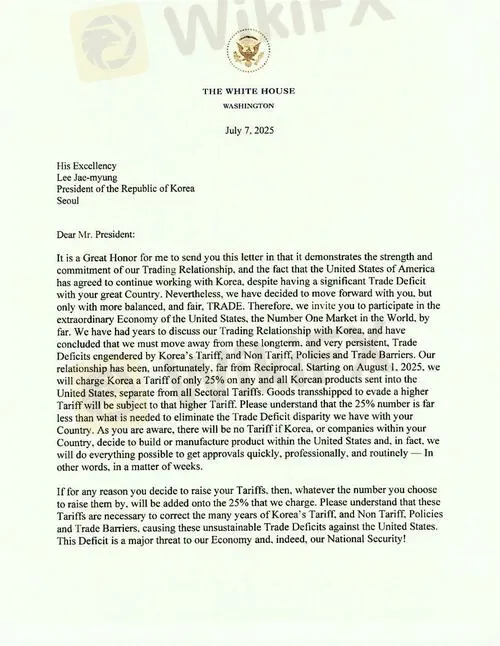

Here are the key points from the letter addressed to South Koreathat was posted on President Trump's Truth Social page:

Full Letter US Sent South Korea

Here are the key points from the letter addressed to Japanthat that was posted on Trump's Truth Social page:

Full Letter US Sent To Japan

The instant reaction in U.S. markets was traders hitting the 'sell button,' with the S&P 500 and Nasdaq sliding to session lows.

Both yen and won tumbled on the news...

All in all, this is a trade ultimatum from the Trump administration to South Korea, Japan, and other countries, pressuring them to reduce trade barriers and tariffs and to reshore manufacturing in the U.S. The letter signals a broader 'America First' agenda and tariff diplomacy, aimed at reducing trade deficits by penalizing countries with perceived unfair trade practices. We suspect the other letters will be sent out shortly.

Related:

Vietnam has become the benchmark—both the ceiling for countries striking deals with the U.S. Trump is giving Japan and South Korea a final three-week deadline to reach a deal—failure to do so could mean severe consequences.

* * *

Trade tensions are back in view as the 90-day deadline to reciprocal tariffs (which sparked a painful but extremely short market correction) approaches on July 9, with Trump pledging to start issuing unilateral rates to dozens of countries in the coming days. Stocks retreated at the start of a potentially volatile week as US trading partners rushed to finalize trade deals with the Trump administration ahead of the Wednesday deadline. However, one potential offset is that there are increasingly suggestions that August 1st might be the new July 9th (more below).

As a benchmark, DB's economists believe the current effective tariff rate is around 15% (same as Morgan Stanley, see chart below), which is obviously a good deal below the implied rate from Liberation Day, but well above the low single figures before Trump returned to office. It is good news for markets that Section 899 (the revenge tax) has been consigned to the history books after not making it into the tax bill. It's also good news that Bessent has recently sounded more positive on the direction of travel in recent talks.

However, with financial conditions easy again and with the S&P 500 back at all-time highs, it wouldn't be a surprise to see the Trump Administration take a tough stance with those who they don't think negotiations are going in the right direction .

President Trump said at the end of last week that by the July 9 deadline, tariffs would be “fully covered and they‘ll range in value from maybe 60 or 70% tariffs to 10 and 20%.” Then over the weekend he said that he'd “signed some letters and they’ll go out on Monday – probably 12”.Overnight this was firmed up to noon Washington time today, so expect a flurry of headlines at noon!

On Thursday Trump mentioned that the letters could go out on the Friday holiday and apply from August 1st if no deal can be made. This gave some comfort that there could be yet another extension and time to do deals. Bessent has also reiterated over the weekend that some countries would be able to negotiate a three-week extension to August 1st. So maybe we'll just be here again in three weeks when everyone is on the beach apart from the trade negotiators.

Bessent also said Trump will send letters to trading partners notifying them if no deal is reached, they will revert to April 2nd tariff levels while also adding that they are close to several deals and expect to see some big announcements in the next days. Furthermore, Bessent said 100 smaller countries will get set a tariff rate and many never even contacted the US.

For Europe, Bloomberg reported that the union is willing to accept a 10% universal tariff if exemptions for areas such as autos (25%) and steel and aluminum (50%) are provided. For Japan, the mood turned negative last week as President Trump said that they should “pay 30%, 35%, or whatever the number is that we determine, because we also have a very big trade deficit with Japan.” On the bright side, Treasury Secretary Bessent said they were “very close” to a deal with India, and on Thursday the US reached a trade deal with Vietnam.

Then overnight Trump posted on social media that Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff

This follows a BRICs summit in Rio over the weekend where the group leaders, including China and India, condemned and called for a “just and lasting” resolution to conflicts across the Middle East.

- Trump said trade letters are signed and are going out on Monday addressed to 12 countries but declined to say which countries or the different tariff levels involved. Trump later commented that they will have a deal or letter with most nations done by July 9th and could send out 12 or 15 letters on tariffs on Monday.

- Trump posted “I am pleased to announce that the UNITED STATES TARIFF Letters, and/or Deals, with various Countries from around the World, will be delivered starting 12:00 P.M. (Eastern), Monday, July 7th”

- Trump posted “Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.”

- Bessent said Trump will send letters to trading partners notifying them if no deal is reached, they will revert to April 2nd tariff levels with the tariffs to take effect on August 1st, while Bessent added that they are close to several deals and expect to see some big announcements in the next days. Furthermore, Bessent said 100 smaller countries will get set a tariff rate and many never even contacted the US.

- Russian President Putin told BRICS through a video link that it is important to enhance cooperation at BRICS and the usage of national currencies, while he commented that the liberal globalisation model is becoming obsolete.

- White House Economic Adviser Hassett said it is possible that some trade negotiations will push past the deadline, while he added that trade deals with the UK and Vietnam provide guidelines for additional agreements with other countries, according to a CBS interview.

- EU diplomats said on Friday that EU negotiators failed to achieve a breakthrough in US trade talks and negotiations to continue into the weekend, while EU negotiators were looking to secure a US tariff pause extension if no wider trade deal is agreed. It was also separately reported that the US threatened the EU with a 17% tariff on food exports, according to FT.

- Japan‘s tariff negotiator Akazawa held in-depth phone talks with US Commerce Secretary Lutnick on Thursday and Saturday, according to Japan’s government.

- Japanese automakers are reportedly exploring all options to help reduce trade imbalances with the US, via Nikkei; one idea is Toyota Motor (7203 JT) importing cars made in the US back to Japan.

- China retaliated against the EU ban regarding public tenders for medical devices by imposing import restrictions on medical devices. Chinas Finance Ministry said it is to exclude imports of medical devices exceeding CNY 45mln from the European Union from July 6th, while imports of medical devices from non-EU countries should not contain EU-made components worth more than 50% of the contract value.

- India and the US are likely to take the final decision on a mini trade deal in the next 24-48 hours (reported on Sunday), with an average tariff under the mini trade deal likely to be 10%, while talks have currently only been completed on a mini-trade deal and negotiations on a larger bilateral trade agreement will begin after July 9th, according to CNBC-TV18.

- Thailand is to offer the US more trade concessions to avert a 36% tariff with Thailands Finance Minister expected to submit the revised orders before July 9th with a proposal to boost bilateral trade volume and reduce Thailands USD 46bln trade surplus with the US by 70% within 5 years, according to Bloomberg.

- South African Trade Department spokesperson says it remains committed to a trade deal with the US; conversations are constructive and fruitful.

- US-Indonesia trade deal includes buying US soybean, corn and energy products, according to an official.

- German government spokesperson says time is money when it comes to tariff negotiations; adds, Chancellor Merz is coordinating with EU President von der Leyen, Italy PM Meloni, and French PM Macron on tariff talks.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기