简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Price Latest: Negative Sentiment Pushing Prices Lower

요약:EURUSD took a dip lower after the latest ZEW release showed German current conditions data falling sharply, the latest in a line of weak data

IMF Warns of Risks to Global Growth, Advanced Economies to Fall Sharply

EURUSD Touches a Two-Week Low

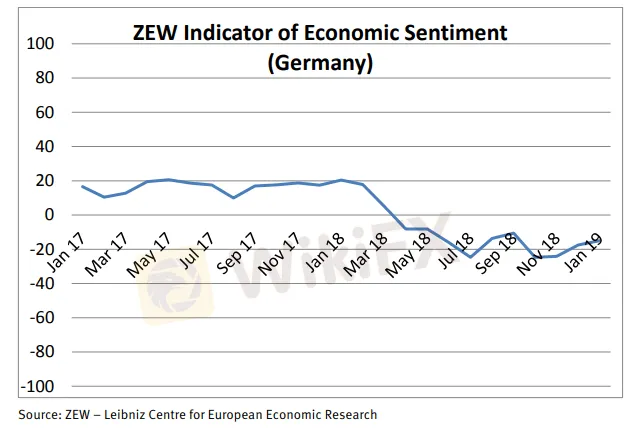

The latest ZEW readings confirmed that German, and the single-block, sentiment remains negative, confirming recent data. The German economic sentiment reading ticked 2.5 points higher to -15.0 and despite this increase the reading remains well below the long-term average of 22.4 points. The current situation assessment fell sharply, down 17.7 points to 27.6, the lowest reading since January 2015.

The Euro-Zone economic assessment rose a mere 0.1 points to -20.9, while the current economic situation in the Euro-Zone fell by 6.8 points to 5.3.

German BDI Warns of Serious Growth Problem

The Euro fell further against the US dollar and hit a two week+ low and is likely to fall further with 1.1300 the next target. A break below here opens the 1.1265 area ahead of the November 12 low at 1.1215. The pair remain all three moving averages and continue the bear move off the January 10, 1.1570 high.

EURUSD Daily Price Chart (August 2018 – January 22, 2019)

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

제1회 모의 투자 대회 수상자 발표

벚꽃 앱테크 이벤트 당첨자 발표

[4월 2일 거래 팁] 美 관세 발표 임박,‘불확실성 장세’에서 살아남는 법은?

환율 계산기