简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar May Rise as Data Shows Consumers Mood Has Darkened

요약:The US Dollar may rise, finding support in haven demand as data from the University of Michigan shows consumers mood darkened in January.

- US Dollar may rise on soggy UofM consumer confidence data

- Yen lower as trade war de-escalation hopes lift APAC bourses

- Norwegian Krone gains as Prime Minister shores up coalition

The University of Michigan measure of US consumer confidence stands out on an otherwise dull economic calendar through the end of the trading week. The US government shutdown has dramatically slowed incoming news-flow, leaving investors pining for timely indicators offering a view of near-term economic conditions. That might make this release more market-moving than usual.

The headline sentiment index is seen ticking lower to 96.8. While that would be a five-month low, it would not amount to a dramatic departure from the prevailing upward trend. A disappointing outcome reflecting a raft of worries – like fiscal headwinds from the shutdown as well as disruption and uncertainty linked to the US-China trade war – may translate into broad-based risk aversion.

Perhaps counter-intuitively, the US Dollar might fare relatively well against such a backdrop. The benchmark currency has proven to be remarkably resilient despite the collapse of priced-in Fed rate hike expectations over the past two months. In fact, it rose to a 20-month high amid a vicious late-year market rout before pulling back as risk appetite steadied. That speaks to strong haven appeal waiting to entice anew.

YEN DOWN AS APAC STOCKS RISE, NOK UP AS PM SHORES UP COALITIONThe Japanese Yen narrowly underperformed in otherwise quiet Asia Pacific trade. The perennially anti-risk unit tracked lower as local stock markets followed Wall Street higher. The newswires chalked optimism to rumors that US Treasury Secretary Steven Mnuchin is pushing to scale back tariffs on China, despite a forceful official denial of any such effort.

Meanwhile, the Norwegian Krone traded broadly higher after Prime Minister Erna Solberg reached a deal with the Christian Democratic Party to broaden her ruling coalition. The move secures a legislative majority aimed at pushing through a raft of market-friendly policies, including tax cuts.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

ASIA PACIFIC TRADING SESSION

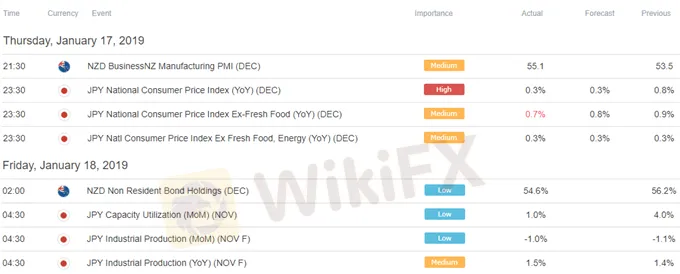

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES- Just getting started? See our beginners‘ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

제1회 모의 투자 대회 수상자 발표

벚꽃 앱테크 이벤트 당첨자 발표

[4월 2일 거래 팁] 美 관세 발표 임박,‘불확실성 장세’에서 살아남는 법은?

환율 계산기