简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Rebounds with Stability Expected at High

요약:From the start of the week, gold price is little changed compared with last week as it has quickly rallied from the fresh monthly low of $1,907.

WikiFX News (12 Sept) - From the start of the week, gold price is little changed compared with last week as it has quickly rallied from the fresh monthly low of $1,907; while current market trends may keep gold afloat as the crowding behavior in the US dollar persists in September.

Gold price may continue to consolidate as global stock markets are under pressure with the Nasdaq and S&P 500 sitting at a precarious position. However, the crowding behavior in the greenback may continue to coincide with the bullish behavior in gold as a bear-flag formation emerges in the DXY.

The FED seems to persist with the plan of “achieving an inflation that averages 2% over time”, which may not be changed before the US election. Gold price is expected to be lifted once the Chairman Powell raises the FEDs balance sheet back above $7 trillion.

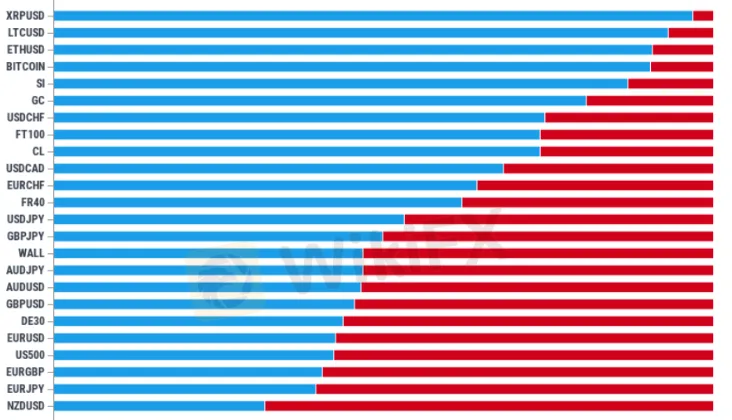

According to the IG Client Sentiment report, retail investors all hold net-long USD/CHF, USD/CAD and USD/JPY while remaining net-short AUD/USD, GBP/USD, EUR/USD and NZD/USD.

Gold price may continue to consolidate before a successful attempt of closing below $1,907-1,920. Only when a break/close above $2,016-2,025 appears can the record high price ($2075) finds its way. The next area of focus comes around $2,064 followed by $2,092.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

Chart: IG Client Sentiment Report

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

환율 계산기