Durable Goods Orders (Ex-Transports) Beat Expectations In June

Lời nói đầu:After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders wer

After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data... and they did.

Durable Goods Orders plunged 9.3% MoM (slightly better than the -10.7% MoM expected) - the biggest drop since the COVID lockdowns. But as the chart below shows, it is a wildly noisy time series, almost entirely due to the lumpiness of aircraft orders...

Source: Bloomberg

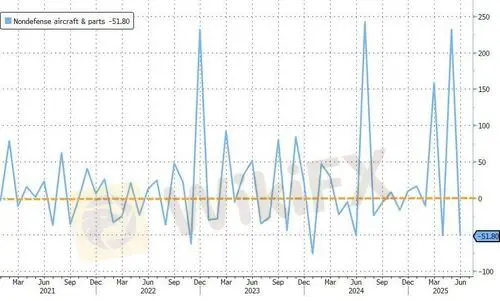

Thanks to a swing from a 230% MoM rise to a 50% MoM decline in non-defense aircraft orders...

Source: Bloomberg

Excluding the noise of Boeing orders, the data was actually solid with a 0.25% MoM increase (better than the 0.1% rise expected) in durable goods orders (ex-Transports),pushing YoY orders uo 2.23%

Source: Bloomberg

Adding to the confusion, the value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, decreased 0.7% last month after an upwardly revised 2% gain in May

Capital goods shipments rose 0.4%, excluding defense and commercial aircraft, better than the +0.2% expected, adding to Q2 GDP growth hopes.

A very mixed picture from a generally considered 'secondary' economic indicator... and this the market reaction is muted to say the least.

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

IC Markets Global

KVB

GTCFX

Exness

IronFX

ATFX

IC Markets Global

KVB

GTCFX

Exness

IronFX

ATFX

Sàn môi giới

IC Markets Global

KVB

GTCFX

Exness

IronFX

ATFX

IC Markets Global

KVB

GTCFX

Exness

IronFX

ATFX

Tin HOT

Doo Prime vs KVB 2025: Sàn Forex nào tối ưu chi phí cho trader Việt?

WikiFX cảnh báo sàn Forex Monaxa có dấu hiệu lừa đảo và ăn cắp tiền

Tính tỷ giá hối đoái