简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Leverage on Forex Trades: Risks, Strategies, and More

Abstract:Imagine walking into a casino where you’re handed 100,000 to bet—but you only need to risk 1,000 of your own money. That’s essentially how leverage works in forex trading. It’s a tool that lets you control large positions with a small upfront investment, turning modest market moves into significant gains… or losses.

What is Leverage in Forex?

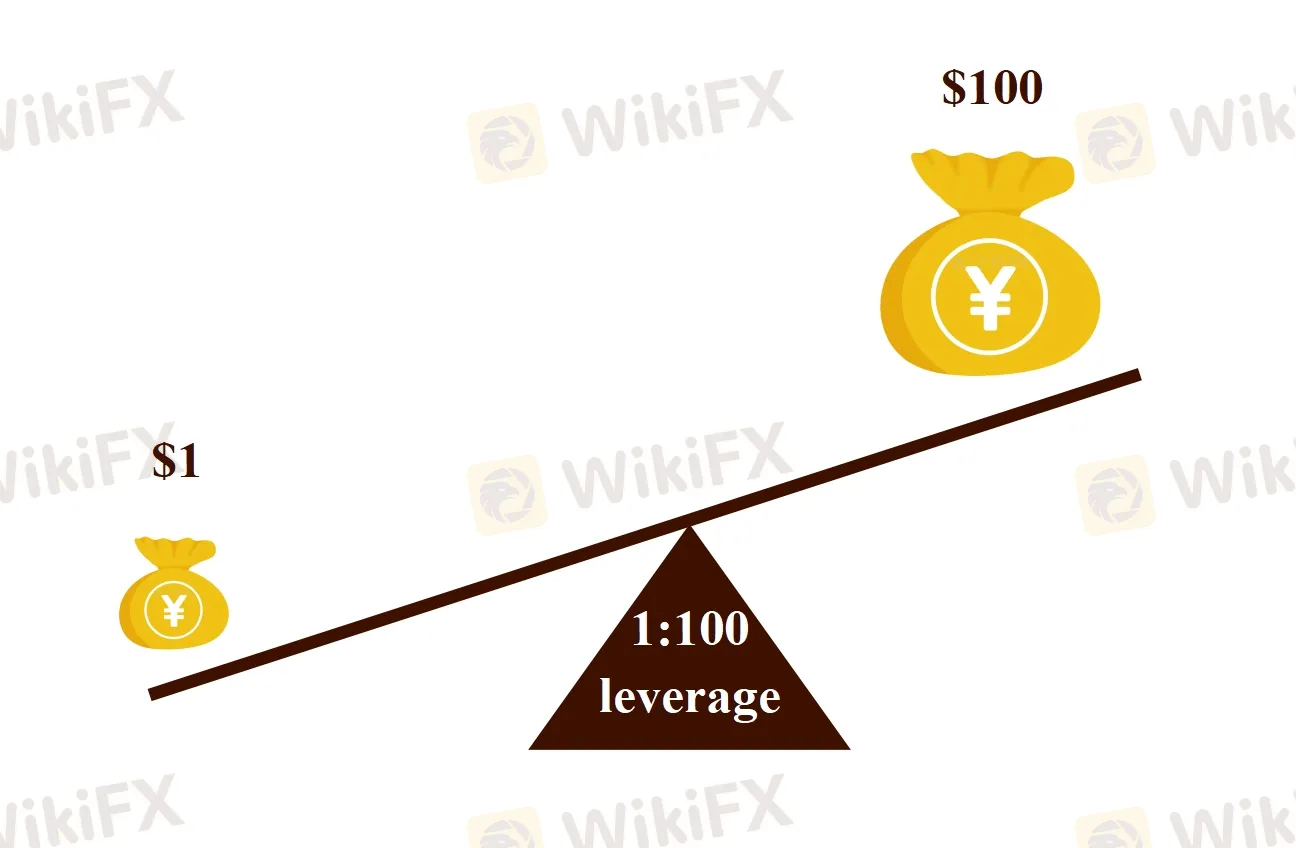

Leverage is borrowed capital provided by your broker, magnifying your trading capacity. For example, with 1:100 leverage, every 1 in your account controls 100 in the market. This opens doors to opportunities far beyond your initial deposit, making forex accessible to traders with limited funds. However, it also amplifies risks, turning even small price swings into double-edged outcomes.

Why should you care? Because leverage is the backbone of forex trading—its why the $7.5-trillion-a-day market thrives on participation from individuals worldwide. But without understanding how to manage it, leverage can quickly turn a calculated strategy into a financial rollercoaster.

How does Forex Leverage Work?

Think of forex leverage as a “financial magnifying glass.” It allows you to control a large amount of money in the market with only a fraction of your capital—this fraction is called margin.

Leverage is expressed as a ratio, such as 1:50, 1:100, or even 1:500. With 1:100 leverage, every 1 in your trading account lets you control 100 in the market. A 1,000 deposit could command a 100,000 position.

Margin is the collateral you need to open and maintain a leveraged position.

Example:

Trade Size: $100,000 (1 standard lot)

Leverage: 1:100

Margin Required: 100,000/100=1,000

This means you only need 1,000 to control 100,000 trade. But remember: Your margin is at risk if the market moves against you.

Let's understand the relationship between leverage and margin more easily:

Imagine buying a 500,000 house with a 500,000. Here, your leverage' is 1:10. Similarly, in forex:

· Your “down payment” = margin

· The “house price” = total trade value

· The bank (or broker) lends you the rest

Brokers provide leverage but enforce margin requirements. If losses eat into your margin (e.g., your account drops below a certain threshold), youll face a margin call—a demand to add more funds or close positions. For example, if your account balance is $1,000 and losses reach $900, then your remaining margin is only $100. In this case, your broker may automatically close trades to prevent a negative balance.

Double-Edged Sword: Risk vs. Reward

Think of leverage in forex as a high-powered amplifier: it can supercharge your gains to exciting new levels, but it also has the potential to magnify losses into dangerous territory.

With leverage, even tiny market movements can generate significant returns.

Reward Example:

Trade: Buy 1 standard lot of EUR/USD (€100,000)

Leverage: 1:100 → Margin required: $1,000 (assuming USD account)

Price Movement: EUR/USD rises 1% (from 1.1000 to 1.1100)

Profit: €100,000 × 1% = $1,000 → 100% return on margin

Without leverage, that same 1% move would require a 100,000 investment to earn 1,000—a mere 1% return.

The flip side? Losses hit just as hard.

Same Example, Downward Move:

EUR/USD drops 1% (to 1.0900)

Loss: €100,000 × 1% = $1,000 → 100% loss of margin

Result: Margin call—your position is liquidated, and you lose your entire deposit

Worse yet, in volatile markets (e.g., during news events), prices can swing 2–3% in minutes. With 1:100 leverage, thats a 200–300% loss relative to your margin—even if you 'only' risked 1% of your account.

The Balancing Act: Risk vs. Reward in Practice

Compare two traders with the same $10,000 account:

| Trader A (1:10 Leverage) | Trader B (1:100 Leverage) |

| Controls $100,000 per trade | Controls $1,000,000 per trade |

| 1% market move = ±$1,000 (10% account risk) | 1% move = ±$10,000 (100% account risk!) |

| Survives 10 consecutive 1% losses | Wiped out in one bad trade |

The math doesnt lie: Higher leverage reduces your margin for error.

Common Leverage Misconceptions

Leverage is also one of the most misunderstood tools in forex trading. While it can turbocharge your trades, myths about its use often lure beginners into reckless decisions. Lets debunk five dangerous misconceptions—and replace them with reality.

Myth 1: Higher Leverage = Better Trading

'If 1:100 leverage is good, 1:500 must be amazing!' This is a trap! The reality is that higher leverage doesnt improve your strategy, instead, it amplifies your risk. With 1:500 leverage, a 0.2% price move against you wipes out 100% of your margin. In reality, there are rare professional traders with leverage exceeding 1:10. They focus on precision, not leverage ratios.

Myth 2: Leverage is Free Money

'It‘s the broker’s money—why not gamble big?' is another trap. Leverage is a loan, not a gift. Youre responsible for losses. Swap fees (overnight interest) and margin calls will erode profits. e.g. A 10,000 trade with 1:100 leverage costs 100 in margin and daily swap fees.

Myth 3: Leverage Only Affects Short-Time Trades

'I‘ll hold this trade for weeks—leverage doesn’t matter.' No! It's wrong! Leverage impacts margin requirements for all trade durations. If you hold a leveraged position during a weekend or news event, sudden gaps can liquidate you. e.g. A 2% weekend gap against your 1:50 leveraged trade = 100% loss.

Smart Leverage Strategies for Beginners

Leverage is a tool—not a magic wand. For new traders, the key to success isn‘t maximizing leverage but minimizing recklessness. Here’s how to wield leverage wisely, even as a beginner:

Rule 1: Start Low to Limit Risk Exposure

Begin with conservative leverage (1:10–1:30). Lower leverage = Lower risk per trade = More room to learn from mistakes. e.g. Suppose your account has $1,000 and you choose the leverage of 1:30, then you can control $30,000 per trade. The risk is 1% ($10) per trade, so you can withstand 100 losing trades. Never let FOMO ('Fear of Missing Out') push you into 1:100+ leverage prematurely.

Rule 2: 1–2% Risk Rule

Never risk more than 1–2% of your account on a single trade. e.g. Suppose your account has $5,000, then the maximum risk is 2% ($100) per trade. With 1:50 leverage, the trade size is $50,000 and you can set a stop-loss to cap losses at $100 (e.g., 20 pips on EUR/USD).

Rule 3: Use Stop-Loss Orders

Always use stop-loss (SL) orders to define your risk upfront. Place SLs based on technical levels (support/resistance), not arbitrary numbers. Adjust SLs as the trade moves in your favor (trailing stops). e.g. Buy GBP/USD at 1.2500 with a 50-pip SL (1.2450), with 1:50 leverage, a 50-pip loss = 2% of a $5,000 account.

Rule 4: Match Leverage to Your Trading Style

If you are a scalper and target a tiny gain (5–10 pips), you can choose a high leverage of 1:50-1:100, but the risk per trade is still capped at 1-2%. If you are a swing trader, you had better use a lower leverage of 1:10-1:30 to survive overnight gaps and volatility. If you are a position trader, the leverage advised is not more than 1:10, avoid margin calls during drawn-out trends.

| Trading Style | Leverage |

| Scalping (Short-Term) | 1:50-1:100 |

| Swing Trading (Medium-Term) | 1:10-1:30 |

| Position Trading (Long-Term) | 1:5-1:10 |

Regulatory Limits and Broker Comparisons

Regulatory bodies worldwide impose leverage caps to protect retail traders from excessive risk. These limits vary by jurisdiction:

·EU/UK: Major currency pairs capped at 1:30

· US: Maximum 1:50 for forex trades

· Offshore Brokers: Offer 1:500+ leverage

When choosing a broker to trade, the first thing you need to consider is regulation. Prioritize broker's top-tier regulatory licenses, such as FCA, FSA, and ASIC. Besides, avoid 'too-good-to-be-true' leverage offers (brokers promoting 1:3000 may hide high fees or slippage risks) and test leverage flexibility in demo accounts.

Here, we compare three brokers with flexible leverage ratios. Find details in the table below:

| Broker |  |  |  |

| FxPro | XM | FXTM | |

| Leverage | 1:1 - 1:500⭐ | 1:1 - 1:1000⭐ | 1:25, 1:30, 1:50, 1:100, 1:200, 1:300, 1:400, 1:500, 1:1000, 1:3000 |

| Regulation | CySEC, FCA | ASIC, CySEC, DFSA, FSC (Offshore) | FCA, FSC (Offshore) |

| Negative Balance Protection | - | ✔ | - |

| Segregated Account | - | ✔ | ✔ |

| Demo Account | ✔ | ✔ | ✔ |

| Islamic Account | - | ✔ | - |

| Minimum Deposit | $/€/£100 | $5⭐ | $/€/£/₦200 |

| Trading Cost | Spread average of 1.3 pips on EUR/USD | Spread from 0.8 pips | Spread from 0.0 pips & $3.5 per lot traded on FX (Advantage account) |

| Trading Platform | FxPro Mobile App, FxPro WebTrader, MT4/5, cTrader⭐ | MT4/MT5, XM App | MT4/MT5, mobile trading |

Case Study: Leverage in Action

To illustrate how leverage impacts trading outcomes, lets compare two hypothetical traders—Trader A (cautious) and Trader B (aggressive)—executing the same EUR/USD trade with different leverage levels.

| Trader A | Trader B | |

| Account Balance | $10,000 | $10,000 |

| Leverage | 1:10 | 1:100 |

| Position Size | $100,000 (1 standard lot) | $1,000,000 (10 standard lots) |

| Margin Required | 10,000 (100,000 ÷ 10) | 10,000 (1,000,000 ÷ 100) |

| Risk per Trade | 1% ($100) | 1% ($100) |

| Stop-Loss | 50 pips (≈ $500 risk) | 5 pips (≈ $500 risk) |

Trade: Buy EUR/USD at 1.1000

Outcome 1: EUR/USD Rises 1% (1.1100)

| Trader A | Trader B | |

| Profit | 100,000×11,000 | 1,000,000×110,000 |

| Return on Margin | +10% | +100% |

| Account Balance | $11,000 | $20,000 |

Takeaway: Trader Bs high leverage amplifies gains—but this success can breed overconfidence.

Outcome 2: EUR/USD Drops 1% (1.0900)

| Trader A | Trader B | |

| Loss | 100,000×11,000 | 1,000,000×110,000 |

| Return on Margin | -10% | -100% |

| Account Balance | $9,000 | $0 (Margin Call) |

Trader Bs Downfall:

· Loses entire account in one trade.

· If the broker allows negative balances, Trader B might owe money (e.g., -$2,000 on a 1.2% drop).

Outcome 3: Weekend Gap Risk (EUR/USD Opens 2% Lower)

| Trader A | Trader B | |

| Loss | 100,000×22,000 | 1,000,000×220,000 |

| Account Balance | $8,000 | -$10,000 (Debt) |

Key Lesson: Market gaps (common during news events) can obliterate high-leverage traders.

Psychological Impact

·Trader A: Mild stress but survives to trade another day.

· Trader B: Emotional spiral—blown account, potential debt, loss of confidence.

The Role of Risk Management

Both traders risked 1% of their account ($100), but Trader Bs leverage made their stop-loss impossibly tight (5 pips vs. 50 pips).

· Trader Bs Mistake: High leverage forced an unrealistic stop-loss, vulnerable to normal market noise.

· Better Approach: Use lower leverage (e.g., 1:10-1:30) to set wider, technically logical stop-losses.

Final Takeaway

- Leverage ≠ Skill: Its a tool, not a strategy.

- Risk First: Focus on capital preservation, not shortcuts.

- Education > Emotion: Master risk management before scaling up.

- Start Small: Gradually increase leverage as you gain experience.

Forex Leverage FAQs

Can I lose more than my initial deposit?

Yes, if your broker doesnt offer negative balance protection.

What is the best leverage ratio for beginners?

1:10-1:30. Lower leverage reduces risk per trade and gives you room to learn.

Do professional traders use high leverage?

Most pros use ≤10:1 leverage. They prioritize capital preservation over reckless gains. Hedge funds might use higher leverage for arbitrage but with sophisticated risk controls.

Can I change my leverage settings mid-trade?

No. Leverage is set per account, not per trade. You can adjust position sizes or open a new account with different leverage. Always test leverage settings in a demo account first.

What is a margin call?

Margin call is a brokers warning that your account equity is too low to hold open positions.

Does leverage affect swap/rollover fees?

Yes. Swap fees are calculated based on your total position size, not just your margin.

Can I trade forex without leverage?

Yes. But youll need a large account. e.g. Trading 1 standard lot (100,000 units) of EUR/USD without leverage requires $100,000. Most retail traders use leverage to participate.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Safe-Haven Surge: Gold Shines Amid Market Turmoil

Why Your Stop Loss Keeps Getting Hit & How to Fix It

Indian "Finfluencer" Asmita Patel Banned: SEBI Slaps Charges on Her Company, AGSTPL

HDFC Bank's Green Push: Empowering 1,000 Villages with Solar Energy

MetaQuotes Rolls Out MT5 Build 5120 with Enhanced Features and Stability Fixes

Boosted by U.S. CPI, Yen May Rise Again

Global oil prices soar after Israel attacks Iran

Advantages of Using EA VPS for Trading - Detailed Guide

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

U.S. consumer prices rose 2.4% in May, below expectations

Currency Calculator