简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Equiti Forex Trading Guide: Platforms, Markets, Tools, and Risk-first Tips

Abstract:Equiti forex trading guide covering MT4/MT5/WebTrader, copy trading, supported markets (forex, indices, commodities, stocks, ETFs, crypto), leverage up to 1:2000, and risk-first best practices.

Where Can I Trade and Which Platforms Does Equiti Offer?

Equiti focuses on trading CFDs across major forex pairs and multi-asset markets via MT4, MT5, and WebTrader, with Copy Trading and an always-on Demo Account. From our teams checks, leverage can reach 1:2000 on certain account types. We put risk first: we open on demo, review symbol specifications (contract size, margin, spreads, swaps), then go live with small size.

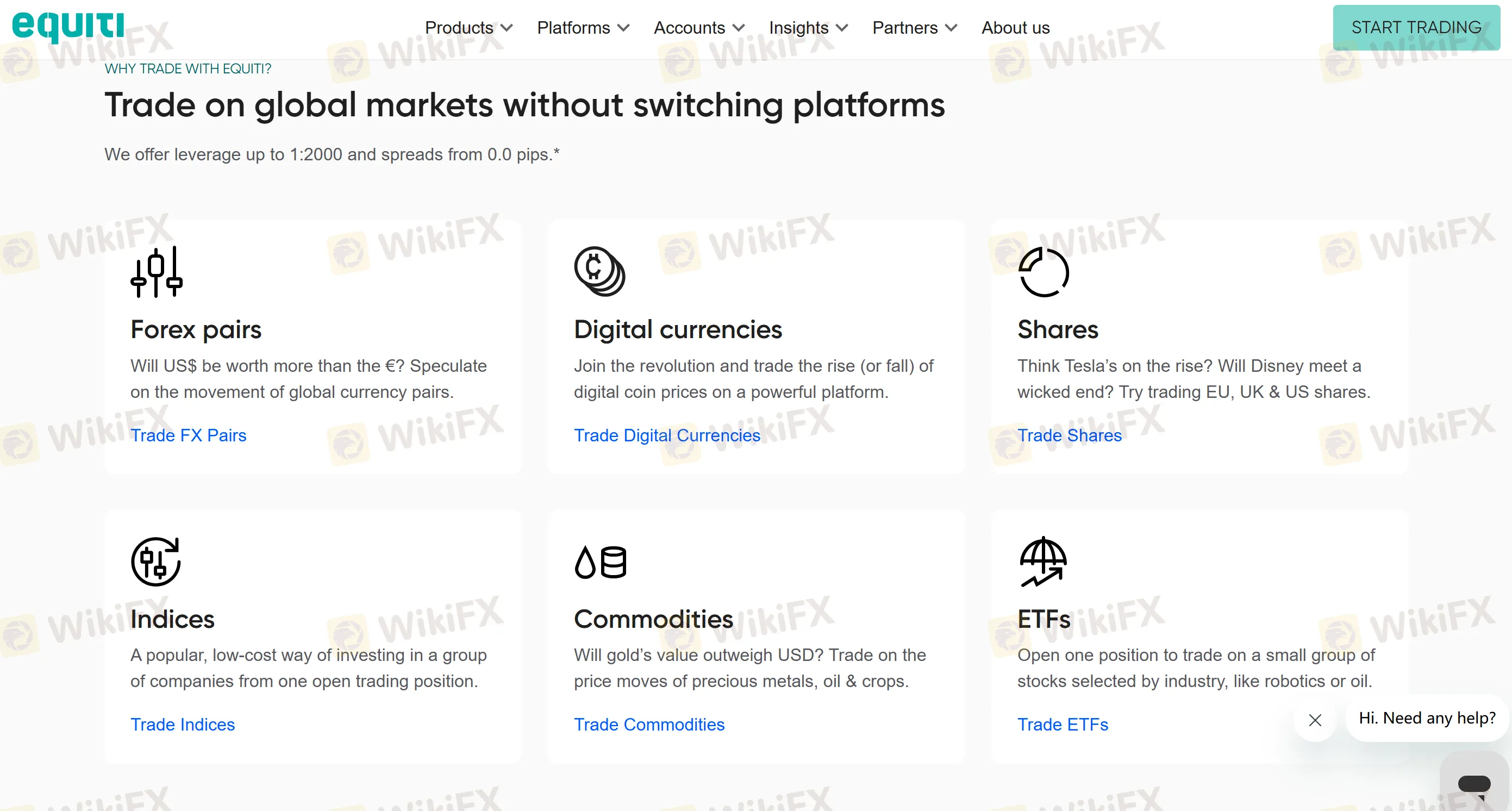

What Trading Instruments And Assets Does Equiti Offer?

Below is how we map the available markets. Availability can depend on region, account type, and trading hours. We verify each symbol in Market Watch → Specification and double-check the swap before holding overnight.

| Trading Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✔ |

Our field notes

- Stocks / ETFs / Crypto are CFDs. There is no underlying ownership. Corporate actions and dividends follow CFD rules.

- Trading hours & margin vary by instrument and can change on holidays/rollovers.

- Swaps (financing) apply to overnight positions. We always check long/short swap for the trading day.

- Leverage awareness: 1:2000 magnifies risk. We stress test on demo before real funds.

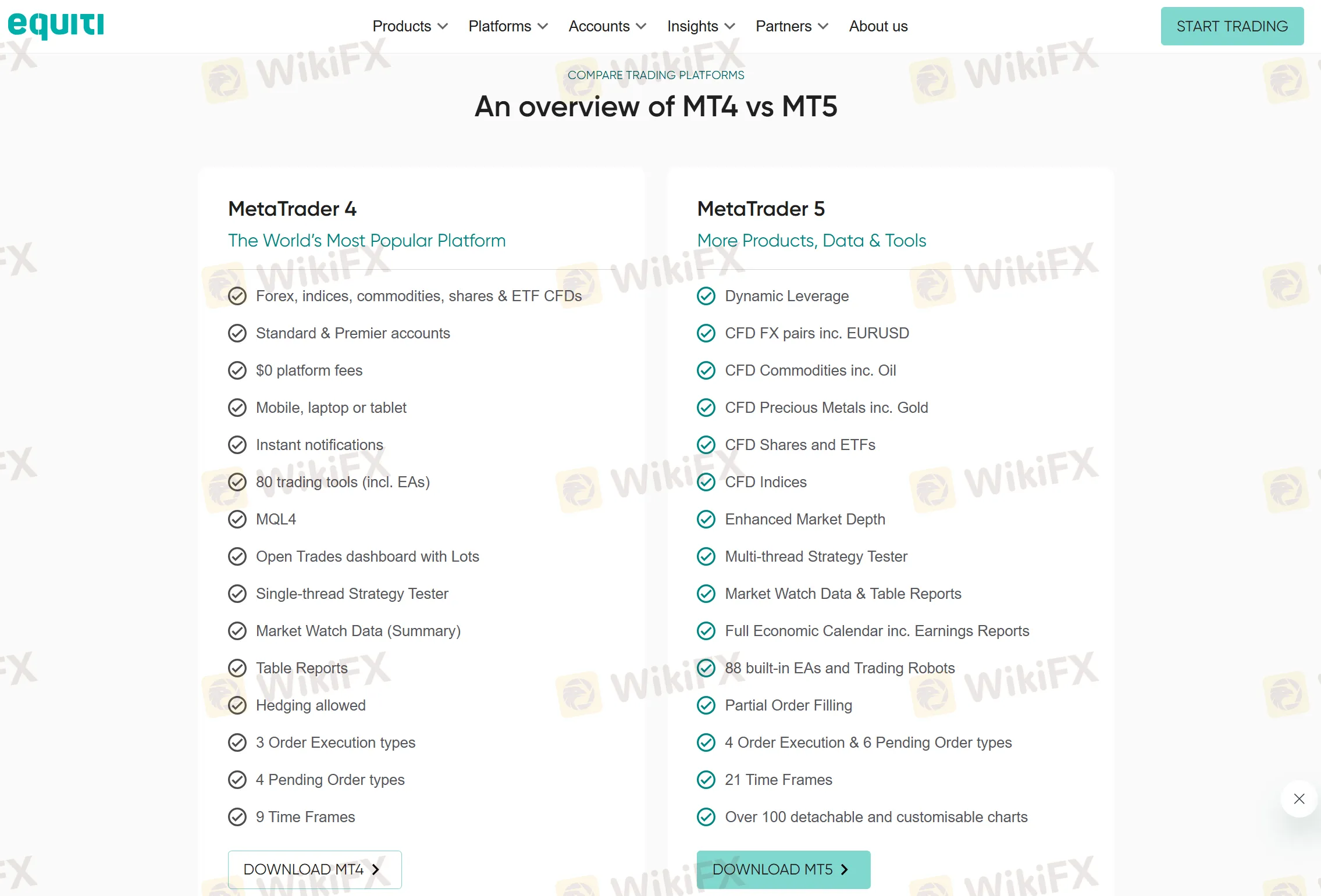

Which Trading Platforms Does Equiti Provide and How Do They Cater to Different Trader Needs?

We pick platforms by workflow. MT4 is lightweight and EA-friendly. MT5 adds more timeframes, depth of market, and faster architecture. WebTrader is convenient on shared devices. Copy Trading serves followers who still want strict risk controls. Our rollout is demo → tiny live → full live, measuring execution and slippage at each step.

| Platform / Tool | Access | Typical Use | Key Notes |

| MetaTrader 4 (MT4) | Desktop, iOS/Android, Web | forex/CFD basics, EAs | Huge ecosystem, quick to learn; solid for discretionary or automated trading. |

| MetaTrader 5 (MT5) | Desktop, iOS/Android, Web | Multi-asset, advanced | More order types/timeframes, improved tester; better for portfolio-style trading. |

| WebTrader (MQ Web) | Browser | Lightweight access | No installs; ideal for quick checks and simple order management. |

| Copy Trading | Web/App | Strategy following | Choose providers, set risk multipliers; we still cap max drawdown. |

| Demo Account | MT4/MT5/Web | Practice & testing | Free, ongoing; we validate spreads, swaps, and slippage before funding. |

FAQs about Equiti Trading Platform & Instruments

Q1. Whats the maximum leverage I can use for forex trading?

Our tests and docs show leverage can be as high as 1:2000 on some accounts. We treat it cautiously—scaling from micro lots and enforcing hard stop-outs.

Q2. Does Equiti charge commissions?

On the Standard account we saw $0 commission with wider spreads; on Premier we saw raw spreads (from 0.0) plus $3.5 per lot per side. We match account choice to strategy.

Q3. How do swaps/financing work on MT4/MT5?

Swaps apply to overnight holdings. We right-click the symbol → Specification to see long/short swap and factor it into our expectancy before carrying positions.

Q4. Are stocks and ETFs real or CFDs?

They‘re CFDs. We don’t own the underlying; we gain exposure to price movements. We read each instruments spec for trading hours and corporate action handling.

Q5. Can I copy trade and still control risk?

Yes. We follow providers but set strict multipliers, equity stops, and max open trades. We also pause copying around major events to avoid gap risk.

Q6. Is demo access time-limited?

Our usage indicates the demo account is free and ongoing. We keep a permanent demo to validate changes in spread and swap before live deployment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Easy Forex Trading Basics: Learn to Profit in 1 Hour

“Ho Chi Minh City Elite Night” Successfully Held, Focusing on Building a Sustainable Forex Ecosystem

Currency Calculator