简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RoboForex Account Types — Compare Accounts, Specs & Fees

Abstract:Compare RoboForex account types (Pro, ProCent, ECN, Prime): minimum deposits, spreads, leverage and typical commissions. Understand costs before you trade.

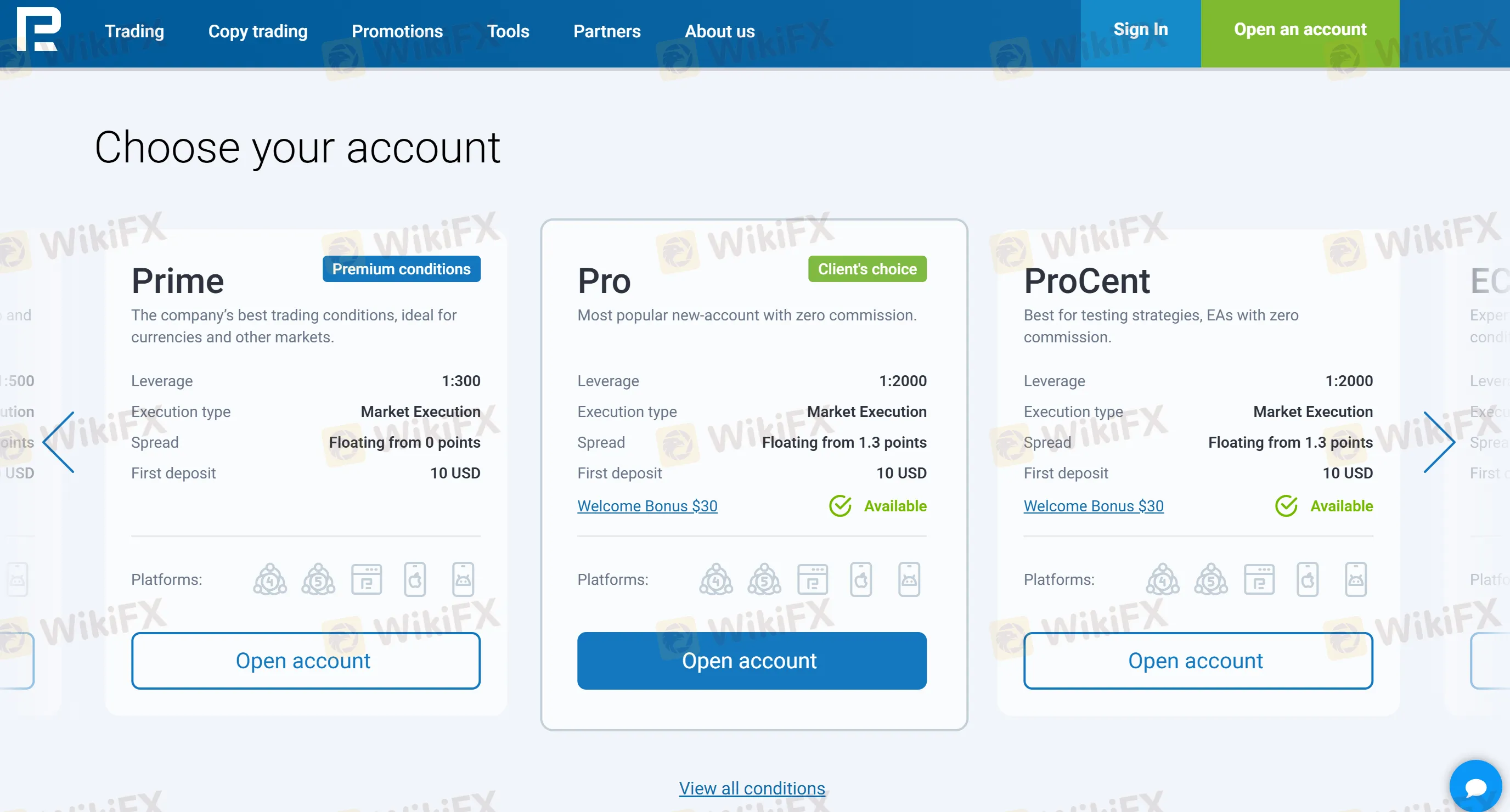

Which Account Types Does RoboForex Offer?

You can open Pro, ProCent, ECN, and Prime accounts on MT4/MT5. Each starts from $10 initial deposit per the platform pages, with floating spreads differing by type and leverage policies that can reach up to 1:2000 on Pro/ProCent under RoboForexs leverage program. ECN/Prime target tighter spreads, often from 0.0 with commission.

What Are the Differences Between Accounts?

Rule of thumb: Pro/ProCent for general use and strategy testing; ECN/Prime for raw spreads + commission and faster execution.

| Account | Typical Spread | Commission | Initial Deposit | Max Leverage | Best for |

| Pro | Floating from ~1.3 pips | None | 10 USD/EUR | Up to 1:2000 (program rules apply) | All-round trading on MT4/MT5 |

| ProCent | Floating from ~1.3 pips | None | 10 USD/EUR | Up to 1:2000 | EA testing and micro-lot practice |

| ECN | From 0.0 pips | Yes (about $20 per $1M traded; reference ECN update) | 10 USD/EUR | Up to ~1:500 | Low-spread strategies |

| Prime | From 0.0 pips | Yes | 10 USD/EUR | Commonly up to ~1:300 | Tight spread + quality execution |

Fees also include swaps/financing (where applicable) and, for stocks/ETFs, exchange-style financing rates in R StocksTrader. Check contract specifications per instrument.

FAQs about RoboForex Account Types & Fees

Q1: Which account is best for beginners?

We usually start on Pro for balanced conditions; use ProCent to test EAs with micro-exposure.

Q2: How do ECN/Prime fees compare to Pro?

ECN/Prime use tight spreads plus a commission (e.g., ~$20 per $1M traded per ECN update), while Pro/ProCent bake costs into the spread.

Q3: Can I use 1:2000 leverage on every account?

No—RoboForexs “Leverage up to 1:2000” program applies to MT4/MT5 Pro/ProCent (including CopyFX) and depends on equity thresholds.

Q4: Are swaps charged on stock/ETF positions?

R StocksTrader shows financing details (e.g., 0% at 1:1 and negative rates when leveraged). Always check each instruments specs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Easy Forex Trading Basics: Learn to Profit in 1 Hour

“Ho Chi Minh City Elite Night” Successfully Held, Focusing on Building a Sustainable Forex Ecosystem

Currency Calculator