简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TMGM Regulation: Licenses, Oversight, and Real Safety Checks

Abstract:Is TMGM legit or a scam? We verify ASIC AFSL 436416 and VFSC 40356, explain protections like NAB segregation & PI insurance, and show how to self-check licenses.

Is TMGM Legit and Safe? Our Deep-Dive Verdict

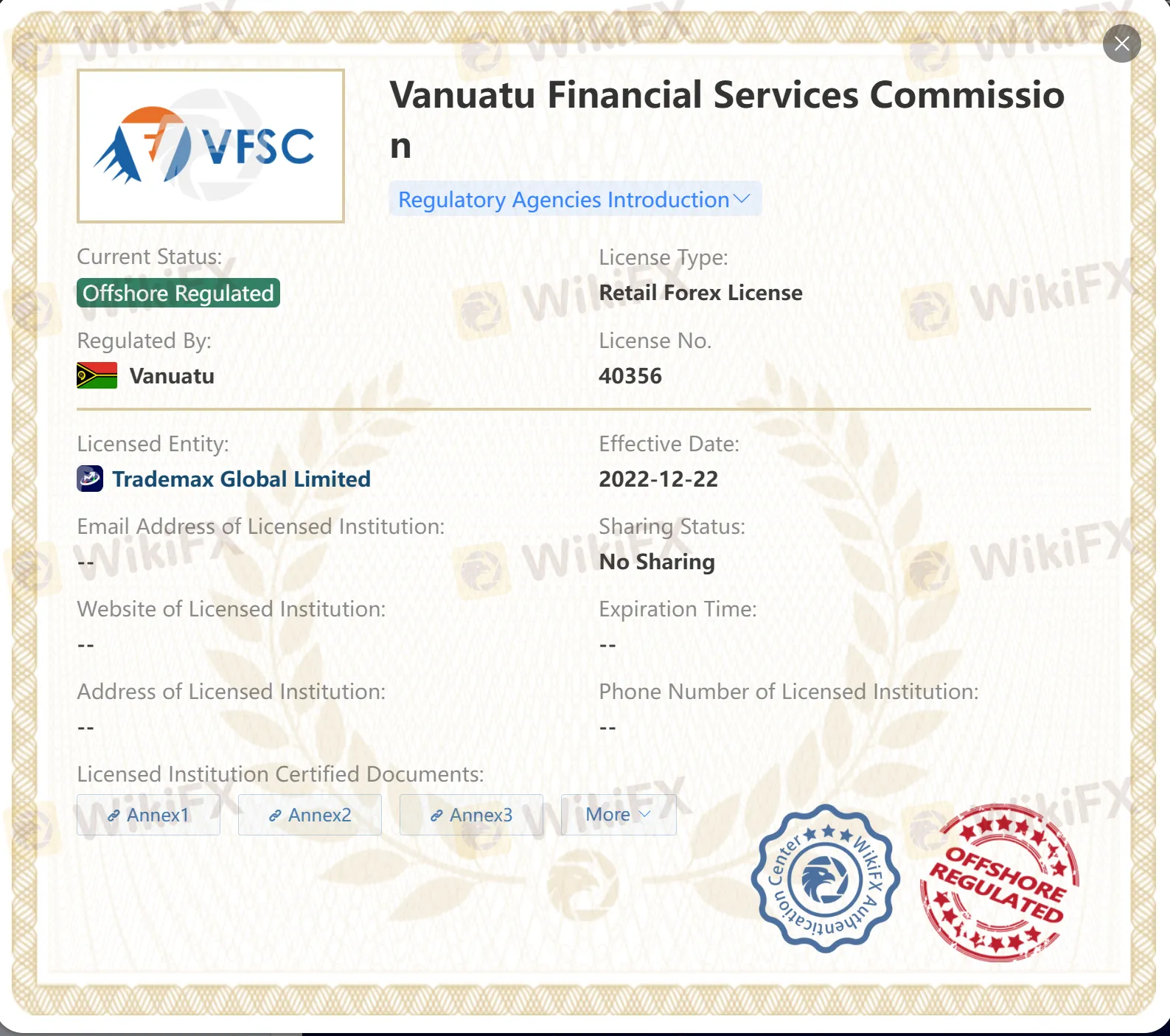

We separate “is it legit?” into three verifiable pillars: licenses, money safeguards, and regulatory track record. TMGM operates multiple entities; the Australian arm (Trademax Australia Limited) holds AFSL 436416 under ASIC, and the Vanuatu arm (Trademax Global Limited) holds 40356 under VFSC. Both IDs are published on TMGM‘s regulatory page and can be verified via ASIC’s registers and VFSCs lists.

On safeguards, TMGM states client funds are kept in segregated trust accounts at National Australia Bank (an Australian ADI) and highlights professional indemnity insurance up to AUD 10 million; these reduce operational risk but dont remove trading risk.

For track record, ASIC issued two interim stop orders against Trademax Australia on May 23, 2024 under Design & Distribution Obligations; ASICs later report notes such interim orders were revoked after entities made changes. We flag this transparently so retail traders appreciate both the licensing status and real-world supervision.

In our judgment, TMGM is regulated, not a “scam”. Still, CFDs remain high risk—size positions conservatively and verify which TMGM entity youre actually signing with.

What Do Traders Commonly Ask about TMGM‘s Safety?

Q1. How do I verify TMGM’s licenses myself?

Search TMGM‘s “Regulatory Supervision” page for AFSL 436416 (ASIC) and VFSC 40356, then cross-check on ASIC Connect and VFSC’s public info.

Q2. Are client funds segregated and where?

TMGM states client funds are held in segregated trust accounts with National Australia Bank (NAB), an Australian ADI.

Q3. Do I have negative balance protection?

TMGM markets “advanced risk tools” and references negative balance protection in account materials; policy may vary by entity. If your balance goes negative, Help Center guidance is to contact support—always confirm protections for your specific entity.

Q4. Is there additional insurance?

TMGM discloses professional indemnity insurance up to AUD 10 million; this is the firms liability cover, not a guarantee of client reimbursement.

Q5. Can UK clients rely on FCA protections?

No—TMGM warns it isn‘t authorised by the UK FCA; UK-specific protections (FSCS, FOS, CASS) don’t apply.

How Is TMGM Regulated and What Does It Mean for Traders?

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| Australia | ASIC | Regulated | Trademax Australia Limited | Market Making (MM) | 436416 |

| Vanuatu | VFSC | Offshore Regulation | Trademax Global Limited | Retail Forex License | 40356 |

These two jurisdictions offer very different regimes: ASIC is a stricter, on-shore regulator; VFSC is more flexible but lighter-touch. Choose the entity that matches your risk tolerance and product needs. TMGMs site also lists other group entities (e.g., Mauritius FSC, Kenya CMA); always check the exact entity on your application form.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Easy Forex Trading Basics: Learn to Profit in 1 Hour

“Ho Chi Minh City Elite Night” Successfully Held, Focusing on Building a Sustainable Forex Ecosystem

Currency Calculator