简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Octa fx Trading Platforms & Markets Guide

Abstract:Explore Octa fx trading coverage: platforms (MT4, MT5, OctaTrader), instruments (forex, indices, commodities, crypto, stocks), core specs, risks, and practical FAQs.

Where Can I Trade with Octa and On Which Platforms?

I keep this page laser-focused on what you can trade and where youll trade it. Octa covers the headline markets most fx, trading users expect—Forex, Indices, Commodities (incl. gold/silver & energy), Cryptocurrencies, and Stocks/stock-CFDs—delivered on MT4, MT5, and OctaTrader. Spreads are floating, swap-free (Islamic) accounts are available, and Negative Balance Protection is standard.

Risk first: instrument availability, leverage, and promotions vary by region and account. In the EU, Octa Markets Cyprus Ltd is regulated by CySEC (License 372/18) and capped at lower leverage (e.g., 1:30); non-EU entities may offer higher leverage. We treat these regional differences as a hard constraint when we evaluate conditions.

Which Markets and Instruments Can You Trade at Octa?

From our hands-on checks of the product menus, we group the offering like this. If your country‘s live account shows fewer lines than below, that’s a regional restriction—not a platform bug.

Quick intro: We saw full coverage for forex majors/minors/exotics, index CFDs, metals and other commodities, major crypto pairs, and a selection of stocks/stock-CFDs. Bonds, options, ETFs are not part of the standard lineup.

| Trading Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks / Stock-CFDs | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

What this means for you: forex and index traders get the broadest depth; crypto and single-stock exposure is available where permitted. We confirm final availability after login because regional catalogs differ.

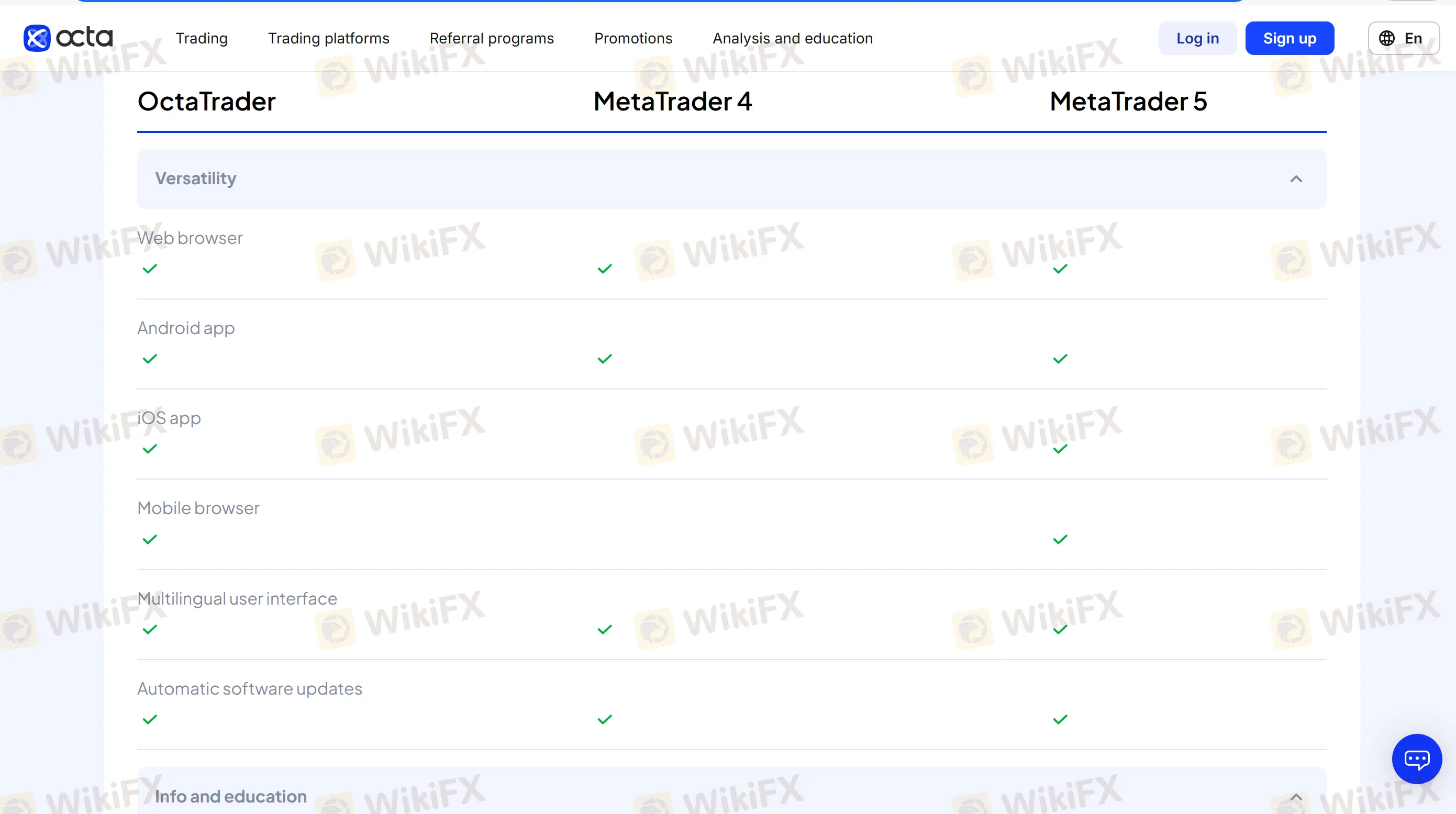

Which Trading Platforms Does Octa Provide, and Who Are They Best for?

Octa supports three environments. We mapped them to trader needs after walking through the terminals and docs.

Short take:

- MT4—the “classic” fx terminal, wide EA ecosystem, simple analytics.

- MT5—multi-asset, improved tester, more order types than MT4.

- OctaTrader—Octas own platform (web/mobile) focused on usability and fast onboarding.

| Platform | Best for | Highlights |

| OctaTrader (web & mobile) | New to intermediate traders who want a clean UI | In-app account management, quick order entry, streamlined deposits/withdrawals, negative balance protection shown clearly |

| MetaTrader 4 (MT4) | EA/robot users and fx-first traders | Massive indicator/EA library, hedging, proven workflow |

| MetaTrader 5 (MT5) | Multi-asset users who need deeper tools | More order types than MT4, improved strategy tester, depth of market |

Notes we work with: floating spreads; swap-free option; demo accounts for practice; leverage and product access depend on your jurisdiction and account.

FAQs about Octa Trading Platform & Instruments

- Does Octa charge commissions or only spreads?

We saw floating spreads as the pricing baseline. Some account/platform combos are commission-free; check your live account specs after login for your region.

- How does leverage work across regions?

Non-EU entities may list higher leverage for fx, trading; EU clients under CySEC (Octa Markets Cyprus Ltd, 372/18) face lower caps (e.g., 1:30). Your profile determines the actual limit.

- Is there a swap-free (Islamic) account?

Yes. Octa offers Islamic (swap-free) conditions. Always read the exact terms in your account cabinet.

- Can I use EAs/algos? MT4 vs MT5?

Yes. MT4/MT5 both support EAs; MT5 adds more order types and a stronger tester. OctaTrader targets speed and simplicity rather than third-party automation.

- Which instruments are missing?

We did not see bonds, options, ETFs in the standard catalog. If you need those, this isnt the right venue.

- Do I get Negative Balance Protection?

Yes—Octa describes NBP across accounts, resetting a negative balance to zero after a loss event. Still, risk controls (position sizing, stops) remain your responsibility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Easy Forex Trading Basics: Learn to Profit in 1 Hour

“Ho Chi Minh City Elite Night” Successfully Held, Focusing on Building a Sustainable Forex Ecosystem

Currency Calculator