简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is T4Trade Legit or a Scam? — Full Regulation & Safety Check

Abstract:Is T4Trade legit and regulated? We verify its Seychelles FSA license (SD029), client fund safeguards, risks, and red flags to judge legit vs scam.

Is T4Trade Safe and Legit? Our Focused Verdict

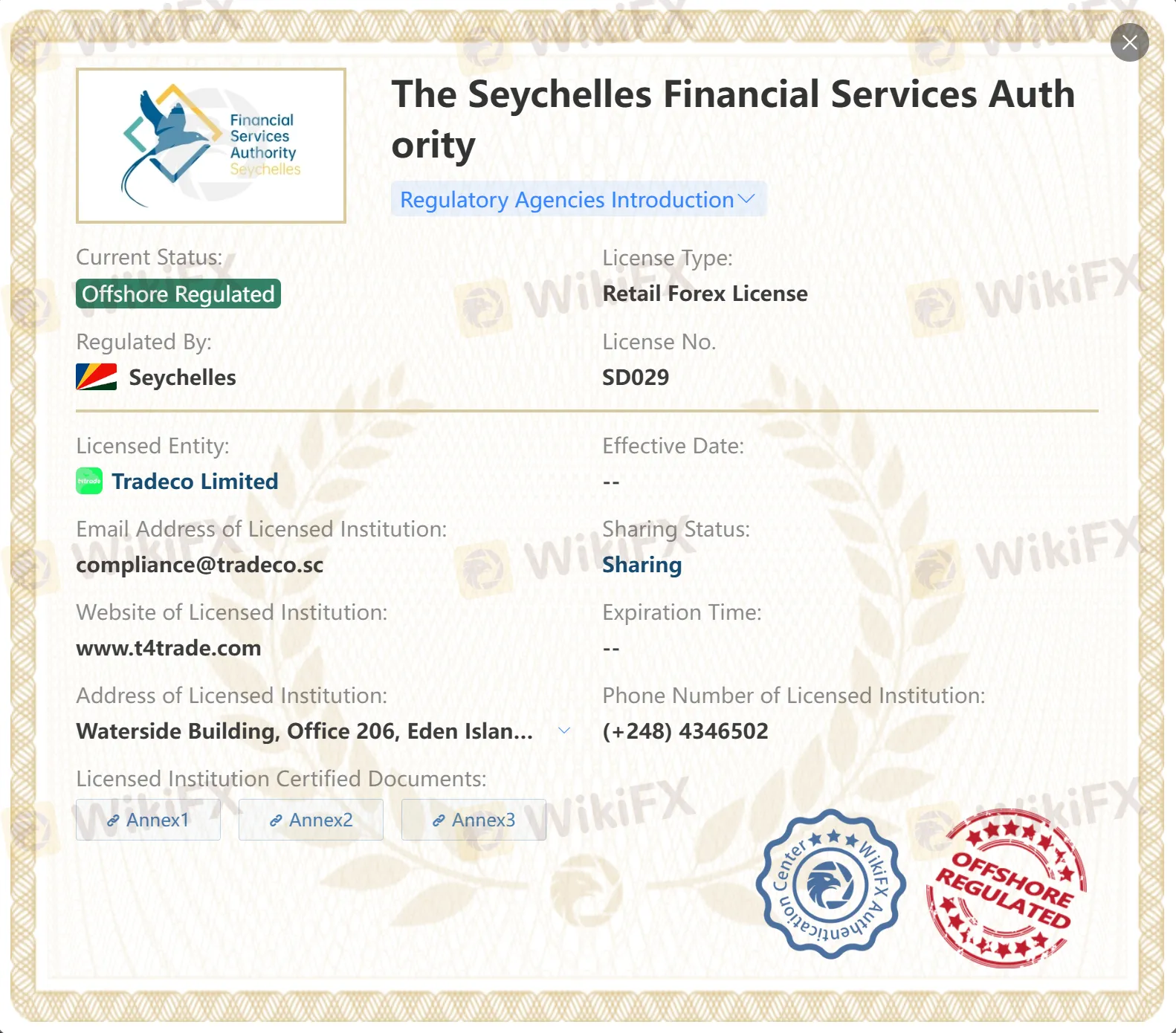

T4Trade operates as a trade name of Tradeco Limited, which states authorisation by the Seychelles Financial Services Authority (FSA) under license SD029. On the official site, T4Trade highlights risk warnings, leverage up to 1:1000, and 300+ CFDs across six asset classes on MT4, with region restrictions for EU/UK and some countries. These are consistent with a typical offshore (non-EU/UK) CFD setup: licensed locally, high leverage, and no promise of EU/UK-style protections. We verify the regulatory body via the FSA website and the brokers legal pages.

T4Trades security page claims segregated client funds at “top-tier institutions,” SSL data protection, and negative balance protection appears in its risk disclosures (losses limited to account balance). These controls are positive, but they are firm-level and jurisdiction-specific rather than EU-style statutory compensation schemes. We treat the broker as licensed offshore, not unregulated, and we recommend conservative risk sizing and rigorous testing before committing larger capital.

What Do Traders Ask Most about Safety & Legitimacy?

Q1. Is T4Trade regulated and by whom?

A. Yes—Tradeco Limited lists authorisation by the Seychelles FSA (SD029); we corroborate with the firms legal pages and the FSA portal.

Q2. Does Seychelles offer an investor compensation scheme like the UKs FSCS?

A. No statutory FSCS/ICF-style scheme applies to Seychelles securities dealers; several Seychelles-licensed firms explicitly disclose no compensation scheme, illustrating the regimes lighter protections versus EU/UK.

Q3. Are client funds kept separate from company money?

A. T4Trade says client funds are held in segregated accounts and personal data is protected under SSL. Segregation is important, but it is not a guarantee against loss if a firm fails.

Q4. Is there negative balance protection?

A. T4Trades risk disclosure indicates losses are limited to your account balance (negative balance protection per account applies).

Q5. How long do withdrawals take?

A. Third-party testing and reviews show internal processing within ~24h with final times depending on payment method and geography (bank wires can take longer). Always verify in your client portal.

How Is T4Trade Regulated and What Does It Mean for Traders?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Seychelles | Seychelles Financial Services Authority (FSA) | Tradeco Limited | Retail Forex License | SD029 | Offshore Regulated |

What this means: We treat T4Trade as licensed in an offshore jurisdiction. That supports legal operation and basic oversight, but does not equate to UK/EU investor compensation. Trading remains high-risk; use tight risk limits, verify operations (KYC, funding, withdrawals), and keep meticulous records.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Easy Forex Trading Basics: Learn to Profit in 1 Hour

“Ho Chi Minh City Elite Night” Successfully Held, Focusing on Building a Sustainable Forex Ecosystem

Currency Calculator